As we enter a new decade, rife with a global pandemic, the most violent bear market in history, and unprecedented uncertainty, alternative investments continue to be a polarizing topic. Yet, further growth in alternatives is expected. Our report covers three important topics: the meteoric rise, current state, and outlook of alternative investments; a deep dive into the growth drivers of the underlying industries and asset classes; and a four-point call to action for the industry that will become our rallying cry in the coming years.

Here are some of the highlights:

From Then to Now: A 15-Year Lookback

Highlights:

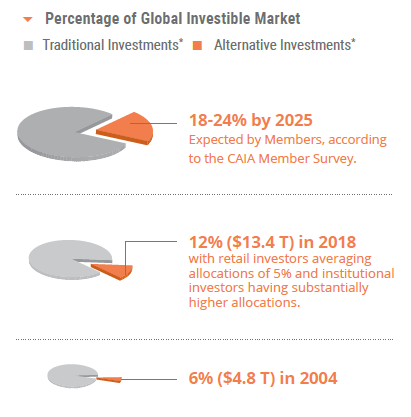

- How alternative investments doubled their global market share between 2003 and 2018.

- Why record lows in global interest rates have driven pensions toward alternative investments.

Why Alternative Investments?

Highlights:

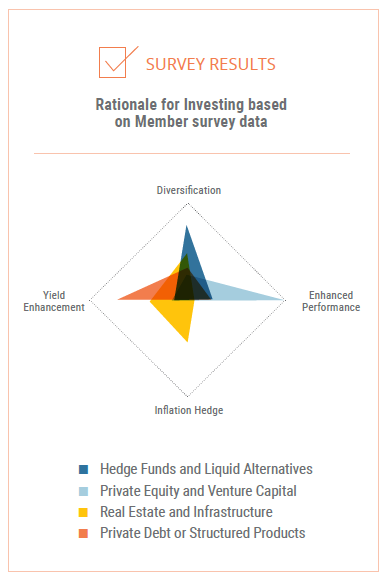

- CAIA Member rationales for investing in alternative asset classes.

- How alternative assets classes can help responsible investors reap the long-term benefits of both risk mitigation and return enhancement.

- Why value creation continues to shift from public markets to private markets.

The Future of Institutional Alternatives

Highlights:

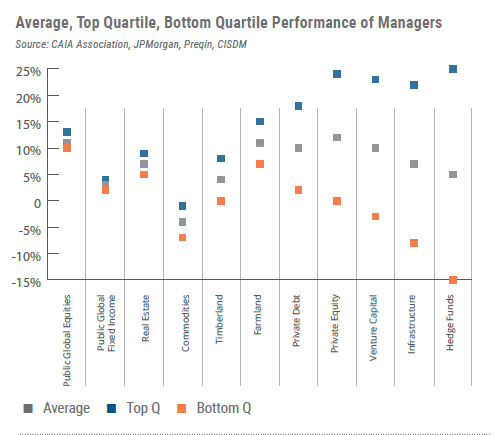

- Why performance dispersion among managers of alts will make manager due diligence increasingly important.

- The growing popularity of co-investments and the accumulation of dry powder in private equity.

- Major trends in private debt stemming from regulatory changes and an ongoing low-interest rate environment.

- Expectations for hedge fund outperformance during times of weakening stock prices and the anticipated growth of liquid alts.

- The impact of ESG integration on real assets investing.

Our Call to Action

CAIA Association is taking the lead with a call to action for our Members and the broader industry. With our four-point agenda below, we hope to change our industry to benefit future generations of workers and savers.

- Commit to Education.

- Embrace Transparency.

- Advocate for Diversification.

- Democratize but Protect.