Hyung Jin Lee, portfolio manager at The Asia Pacific Fund Inc. (NYSE: APB), a, equity-oriented fund, presented APB’s views on the outlook for East Asia, and took questions, in a webcast May 23. APB’s environment, like that of most of the rest of the world, is low growth and features low interest rates. Under these circumstances, portfolio construction involves the selection of long-term growth companies trading at low prices. Fortunately, valuations are not as high in their region as they are in many other parts of the globe. According to one of the slides displayed during the call (sourced from JP Morgan), the global price/earnings ratio is now 14.1. In the United States it is 15.1. But in emerging Asia it is just 12.4, and in China it is considerably lower than that, 10.1. Also, APB’s portfolio construction involves looking for dividend growth opportunities with steady earnings outlooks. “Dividend yields of stock have become an increasingly important part of their attraction as an investment vehicle” as against the capital gain, Jin said. Wages The wage story in Asia varies markedly from one nation to another and even, within China, from one province to another.

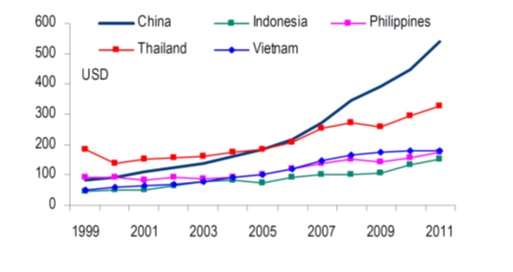

Hyung Jin Lee, portfolio manager at The Asia Pacific Fund Inc. (NYSE: APB), a, equity-oriented fund, presented APB’s views on the outlook for East Asia, and took questions, in a webcast May 23. APB’s environment, like that of most of the rest of the world, is low growth and features low interest rates. Under these circumstances, portfolio construction involves the selection of long-term growth companies trading at low prices. Fortunately, valuations are not as high in their region as they are in many other parts of the globe. According to one of the slides displayed during the call (sourced from JP Morgan), the global price/earnings ratio is now 14.1. In the United States it is 15.1. But in emerging Asia it is just 12.4, and in China it is considerably lower than that, 10.1. Also, APB’s portfolio construction involves looking for dividend growth opportunities with steady earnings outlooks. “Dividend yields of stock have become an increasingly important part of their attraction as an investment vehicle” as against the capital gain, Jin said. Wages The wage story in Asia varies markedly from one nation to another and even, within China, from one province to another.  Source: The Asia Pacific Fund, Inc. According to the above slide, which was part of the webcast, the average wage rate in China and to a lesser extent in Thailand has been surging, especially in the second half of the period covered in the above graph. In other countries in the region it has remained more-or-less constant. In 1999, the average wage rate in China was about US $100 on a monthly basis. It is now more than five times that. Thailand’s wages started form a higher base, about US$200 per month. It stayed there until about 2006, around the time when Chinese wages caught up with and surpassed Thailand’s. Thai wages since have increased by half, to about US$300. On the one hand, and most obviously, this negatively affects manufacturing costs, with an impact that varies across regions, and that also varies from one product category to another. On the other hand, and just as important, this trend has a positive impact on the consumer-demand side of the microeconomic equation in the countries where it is underway. Questions Jin took a question about the Japanese yen and its likely consequences. The webcast guest asked, “What is the impact of the weakness of the Japanese yen on the equities in Korea and other countries that have export firms in competition with Japanese exporters?” The aggressive policies of the Bank of Japan certainly have assisted Japanese exporters, and thus Japanese equity indices. At the time of this webcast, the Nikkei had just experienced a sharp down day, largely due (it seems likely) to inconsistent signals from the U.S. central bank about quantitative easing (or otherwise) in the near future. Still, the Nikkei 225 has spent the month of May straddling the 15,000 mark. It has only been half a year since it crossed the 10,000 line. Jin answered the question by agreeing that “in the short run” one should expect “negative impact on the equities in Korea and other exporting countries” from Japan’s moves. Longer term, he doesn’t see this as a deal killer. “There are too many other factors” to justify putting the yen at the center of one’s frame. Another question asked about the future of the Southeast Asian EM nations generally, the nations beneath the belly of the Chinese dragon. Jin said this has been “a very strong area of growth. This will continue to be the case” although a correction or consolidation is of course possible it “will be not out of the ordinary” in its proportions.

Source: The Asia Pacific Fund, Inc. According to the above slide, which was part of the webcast, the average wage rate in China and to a lesser extent in Thailand has been surging, especially in the second half of the period covered in the above graph. In other countries in the region it has remained more-or-less constant. In 1999, the average wage rate in China was about US $100 on a monthly basis. It is now more than five times that. Thailand’s wages started form a higher base, about US$200 per month. It stayed there until about 2006, around the time when Chinese wages caught up with and surpassed Thailand’s. Thai wages since have increased by half, to about US$300. On the one hand, and most obviously, this negatively affects manufacturing costs, with an impact that varies across regions, and that also varies from one product category to another. On the other hand, and just as important, this trend has a positive impact on the consumer-demand side of the microeconomic equation in the countries where it is underway. Questions Jin took a question about the Japanese yen and its likely consequences. The webcast guest asked, “What is the impact of the weakness of the Japanese yen on the equities in Korea and other countries that have export firms in competition with Japanese exporters?” The aggressive policies of the Bank of Japan certainly have assisted Japanese exporters, and thus Japanese equity indices. At the time of this webcast, the Nikkei had just experienced a sharp down day, largely due (it seems likely) to inconsistent signals from the U.S. central bank about quantitative easing (or otherwise) in the near future. Still, the Nikkei 225 has spent the month of May straddling the 15,000 mark. It has only been half a year since it crossed the 10,000 line. Jin answered the question by agreeing that “in the short run” one should expect “negative impact on the equities in Korea and other exporting countries” from Japan’s moves. Longer term, he doesn’t see this as a deal killer. “There are too many other factors” to justify putting the yen at the center of one’s frame. Another question asked about the future of the Southeast Asian EM nations generally, the nations beneath the belly of the Chinese dragon. Jin said this has been “a very strong area of growth. This will continue to be the case” although a correction or consolidation is of course possible it “will be not out of the ordinary” in its proportions.