When I think of a “road map” I have a very old-school image in mind, one of those fold-up things drivers used to keep in the glove compartment before new-fangled talking-dashboard computers came into our world to give us turn-by-turn directions. It is with that older image in my head that I read what John T. Hailer, chief executive officer of Natixis Global Asset Management, said in a release. “The old roadmap no longer guides investors and the new one is being drawn every day.” Hailer was summarizing the results of a Natixis survey, indicating that institutional investors are optimistic about their own cartography/performance in at least the near future, in part because they are confident about their use of global equities in their portfolios. To reach that conclusion and others Natixis questioned more than 500 institutional investors. The respondents, collectively, manage more than $11.5 trillion in assets. Institutions are confident Eighty-nine percent of respondents said they expect they will be able to meet their future obligations. But they aren’t so sanguine about the fate of individuals in their own country now trying to save for retirement.

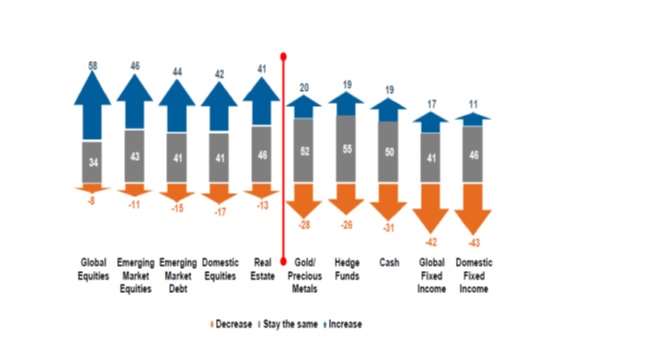

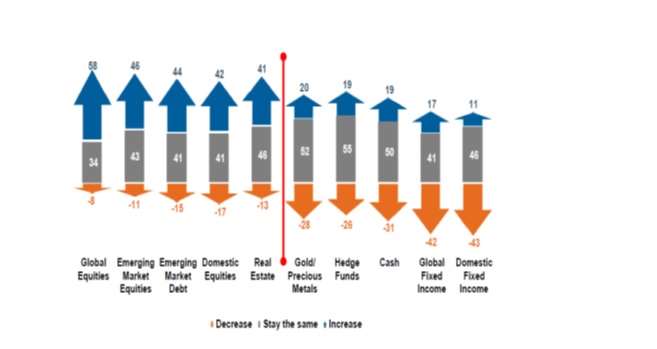

When I think of a “road map” I have a very old-school image in mind, one of those fold-up things drivers used to keep in the glove compartment before new-fangled talking-dashboard computers came into our world to give us turn-by-turn directions. It is with that older image in my head that I read what John T. Hailer, chief executive officer of Natixis Global Asset Management, said in a release. “The old roadmap no longer guides investors and the new one is being drawn every day.” Hailer was summarizing the results of a Natixis survey, indicating that institutional investors are optimistic about their own cartography/performance in at least the near future, in part because they are confident about their use of global equities in their portfolios. To reach that conclusion and others Natixis questioned more than 500 institutional investors. The respondents, collectively, manage more than $11.5 trillion in assets. Institutions are confident Eighty-nine percent of respondents said they expect they will be able to meet their future obligations. But they aren’t so sanguine about the fate of individuals in their own country now trying to save for retirement.  Source: Natixis Only 19% of investors questioned in the U.S. said that they are confident “the average person in your country will have enough assets including personal savings and government benefits to meet their financial obligations when they retire”. Only 16% of the respondents in the U.K. expressed that confidence and only 12% in Latin America (the red portion of the above figure). Optimism in this respect was a good deal higher on the continent of Europe (36%) and quite high in the Middle East (59%). Global Equities The institution’s confidence about their own fate, though, is tied to confidence in the future performance of equities. More than three in five of the respondents (61%) listed either global, domestic, or emerging market equities as the number one asset class to perform over the next 12 months. Of those three classifications of equities, “global” is seen more favorably than the other two – and more favorably than any other asset class. Nearly 60% (to be precise, 58%) of respondents expect to increase their allocation to global equities over the next twelve months. A healthy 46% say the same about emerging market stocks, 42% about domestic stocks. As Hailer put it, institutions “are mindful that they need to meet both short- and long-term objectives, and they see stocks – particularly those beyond their own borders – as the best way to achieve that balance.” There are very low levels of confidence, on the other hand, in global or domestic fixed income, hedge funds, and precious metals.

Source: Natixis Only 19% of investors questioned in the U.S. said that they are confident “the average person in your country will have enough assets including personal savings and government benefits to meet their financial obligations when they retire”. Only 16% of the respondents in the U.K. expressed that confidence and only 12% in Latin America (the red portion of the above figure). Optimism in this respect was a good deal higher on the continent of Europe (36%) and quite high in the Middle East (59%). Global Equities The institution’s confidence about their own fate, though, is tied to confidence in the future performance of equities. More than three in five of the respondents (61%) listed either global, domestic, or emerging market equities as the number one asset class to perform over the next 12 months. Of those three classifications of equities, “global” is seen more favorably than the other two – and more favorably than any other asset class. Nearly 60% (to be precise, 58%) of respondents expect to increase their allocation to global equities over the next twelve months. A healthy 46% say the same about emerging market stocks, 42% about domestic stocks. As Hailer put it, institutions “are mindful that they need to meet both short- and long-term objectives, and they see stocks – particularly those beyond their own borders – as the best way to achieve that balance.” There are very low levels of confidence, on the other hand, in global or domestic fixed income, hedge funds, and precious metals.  Source: Natixis Global Asset Management As the above graphic indicates, 43% of respondents expect to decrease their exposure to domestic fixed income in the year ahead. With hedge funds, too, the numbers who expect to decrease their exposure exceeds the numbers who expect to increase it: 26% to 19%. Challenges When institutions were asked to rate how “challenging” they considered various issues, their responses indicate that the greatest challenge is what one might call the bottom line: generating stable returns. This was deemed either “challenging” or “very challenging” by more than four-fifths of those who were asked (43.1% and 38.7% respectively, totaling 81.8 %.) Other challenges ranking very high: taking tactical advantage of market movements, setting a strategic asset allocation, and selecting managers. Lower on the list of challenges, apparently not keeping institutional investors awake in their institutional beds at night, one finds: ensuring good governance, striking a balance between active and passive mandates, or mitigating the impacts of changes in accounting standards. Other highlights: Natixis notes that “despite concerns about meeting liabilities,” fewer than half of the respondents have incorporated asset liability management into their portfolio strategy. A majority of respondents (57%) believe that traditional assets are too highly correlated to allow for proper diversification. Consistent with that, 58% say investors need to replace traditional diversification and portfolio construction techniques with new approaches, and 71% predicted alternatives would perform better in 2013 than they did in 2012. Method The survey was founded upon fieldwork in 19 countries and six geographical regions. More than 500 senior decision makers in their institutions involved submitted to interviews in January and February 2013. Natixis categorizes its respondents this way: Private pension funds: 189 Public pension funds: 109 Sovereign wealth funds: 43 Insurance companies: 35 Endowments/foundations: 18 Funds of funds: 11 Asset consultants: 97.

Source: Natixis Global Asset Management As the above graphic indicates, 43% of respondents expect to decrease their exposure to domestic fixed income in the year ahead. With hedge funds, too, the numbers who expect to decrease their exposure exceeds the numbers who expect to increase it: 26% to 19%. Challenges When institutions were asked to rate how “challenging” they considered various issues, their responses indicate that the greatest challenge is what one might call the bottom line: generating stable returns. This was deemed either “challenging” or “very challenging” by more than four-fifths of those who were asked (43.1% and 38.7% respectively, totaling 81.8 %.) Other challenges ranking very high: taking tactical advantage of market movements, setting a strategic asset allocation, and selecting managers. Lower on the list of challenges, apparently not keeping institutional investors awake in their institutional beds at night, one finds: ensuring good governance, striking a balance between active and passive mandates, or mitigating the impacts of changes in accounting standards. Other highlights: Natixis notes that “despite concerns about meeting liabilities,” fewer than half of the respondents have incorporated asset liability management into their portfolio strategy. A majority of respondents (57%) believe that traditional assets are too highly correlated to allow for proper diversification. Consistent with that, 58% say investors need to replace traditional diversification and portfolio construction techniques with new approaches, and 71% predicted alternatives would perform better in 2013 than they did in 2012. Method The survey was founded upon fieldwork in 19 countries and six geographical regions. More than 500 senior decision makers in their institutions involved submitted to interviews in January and February 2013. Natixis categorizes its respondents this way: Private pension funds: 189 Public pension funds: 109 Sovereign wealth funds: 43 Insurance companies: 35 Endowments/foundations: 18 Funds of funds: 11 Asset consultants: 97.

←

Back to Portfolio for the Future™

Natixis on Investing by ‘Road Maps:’ Institutional Cartographic Confidence

June 16, 2013