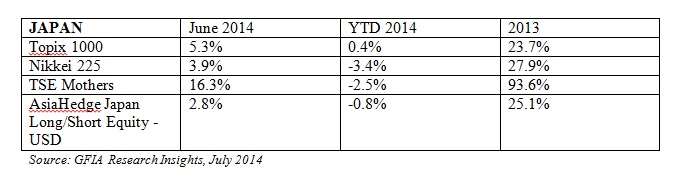

GFIA’s latest Research Insights tells us that in the month of June, MSCI Asian Pacific ex Japan was up, 1.3%. Japan itself, meanwhile, experienced something of a stock price surge – Topix 1000 gained 5.3%, Nikkei 225, 3.9%.

GFIA’s latest Research Insights tells us that in the month of June, MSCI Asian Pacific ex Japan was up, 1.3%. Japan itself, meanwhile, experienced something of a stock price surge – Topix 1000 gained 5.3%, Nikkei 225, 3.9%.

Japanese outperformers “included city and regional banks, consumer electronics and steel companies,” while the underperforming side of the market included telecomm, retail operations, and utilities. Given Japan’s upbeat numbers, the MSCI Asia Pacific [inc. Japan] finished up 2.8%.

As the line for TSE Mothers on the above table indicates, small and mid-cap stocks in general outperformed the large cap indexes.

Unsurprisingly, then, Japan-centric managers “with a small and mid-cap focus strategy reported good returns” for June “despite underperforming the general market.” It was a case of the tide floating the boats. But, since some of the boats were designed not to be correlated with the tide, they didn’t float as high as investors may have hoped.

The Good, the Bad, and the Bankers

UMJ Kotoshiro Fund, which has small and mid-cap positions, had a good June run (4.7%). Akamatsu Fund has the same bottom line as Kotoshiro, 4.7%. Also noteworthy about Akamatsu, though, is that it is bringing its net exposure down, from 60% at the start of the month to 27% at the end, using Topix futures for this purpose.

Japanese banks in particular are, GFIA says, an appealing proposition now: their valuations remain deeply discounted, yet their balance sheets are sound and they possess “interesting prospects for earnings growth.” Arcus Japan Long/Short Fund has done well with its bank holdings of late.

Within the ASEAN region, Thailand stands out. The new government, appointed by the military, enacted a series of stimulus measures, including infrastructure investment.

For many fund managers working in Southeast Asia, though, June was “listless,” with numbers that suggest a flat tire. The booms on the ASEAN bourses are concentrated where the fund managers aren’t, in “high beta cyclical sectors.” Cheyne Malacca dropped -0.8%, while Counterpoint Asian Macro – with bond and currency books -- fell a bit further (-1.1%). Albiza, though reporting in blank ink, was reporting nothing to write home about (0.9%).

Dalton Asia Fund did somewhat better (1.3%), but it is still underperforming the MSCI Asia Index year to date.

There is good news for event-driven strategies: there are more events in Asia than their used to be. Well … events of the sort you have in mind. Athos Asia Event Driven Fundand Pengana Asia Special Eventsboth produced positive returns in June, 1.0% and 0.9% respectively: mainly as a consequence of deal making in Australia and Singapore.

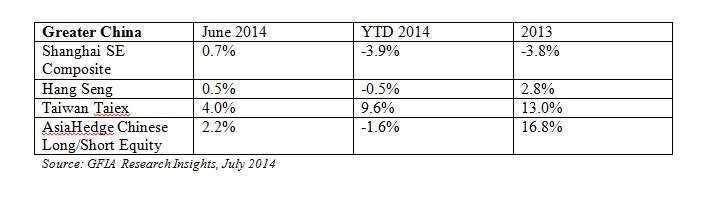

Reserve Ratios and the PMI

In China, the government continues to rely on what GFIA calls “mini-stimulus measures such as the loosening of reserve requirement ratios at certain banks.” The prefix “mini” is key there. The Shanghai and Hang Seng results are both themselves lackluster – or listless, if you prefer. See the table below.

Taiwan’s stock market numbers are much superior to those across the Strait, both for the month of June and for the year to date.

Given these facts, managers with a China focus are picking their investments selectively and conservatively these days, while China works through its macroeconomic difficulties.

Speaking of which … not all news is listless, even on the mainland of China. For example, the final paragraph of this report on June observes that the HSBC flash PMI for the month of July is in at 52. This is the best number in a year and a half, beating forecasts soundly. So perhaps they are working through those difficulties toward the point at which managers will become more aggressive.

To the west, returns in the India market for June were more impressive, both for the underlying economy and for the relevant funds/managers. Not so listless here. The BSE Sensex 30 was up 2.8% for the month, and 23.7% YTD.

Most of the India-centric managers that GFIA tracks outperformed the index.