The factors driving hedge fund returns in the various regions of the world are, roughly, what you might guess they are, if you’ve simply been reading the headlines of any mainstream news periodical. That’s the conclusion one reaches reading Eurekahedge’s latest report, on hedge fund performance around the world in May 2015 and in this year to date.

The factors driving hedge fund returns in the various regions of the world are, roughly, what you might guess they are, if you’ve simply been reading the headlines of any mainstream news periodical. That’s the conclusion one reaches reading Eurekahedge’s latest report, on hedge fund performance around the world in May 2015 and in this year to date.

The report refers for example to Bank of Japan’s “strong commitment to achieve its inflation rate target;” to good news from India by way of its year-on-year GDP growth; and to improved expectations regarding the Eurozone.

Some Numbers

Hedge fund assets under management increased in the first five months of the year by $92 billion, to a total of $2.23 trillion, a record high. One third of the increase came from new allocations.

Meanwhile European hedge funds, assisted presumably by the above-mentioned improved expectations, are up 5.54% YTD. This comes very close to their gain for the whole of the dismal year 2014, which was 0.56%. Total AUM is up by $20.1 billion YTD, and 36.9% of that has come from new allocations.

How did these improved expectations come about? The drama over Greece hasn’t abated this year: quite the contrary. Still, that drama has been a constant for years now. In February 2012, John Brynjolfsson wrote in this blog that the EU had “no choice but to paper over a Greek default.” The big news since then has simply amounted to this: the default has become more explicit, the papering is falling off. Perhaps that is no longer enough to spook markets, and the improved expectations arise from elsewhere on the continent.

In February of this year, for example, the Bank of America Merrill Lynch monthly fund manager survey showed that 81% of surveyed fund managers expected the Eurozone’s economy to improve over the following 12 months. That figure was widely discussed at the time: it was the highest reading for optimism since 2009. That optimism was down considerably by May, but … even in May the same survey showed that Europe was the geographical market that fund managers were most likely to overweight from a 12-month perspective.

A Table and a Graph

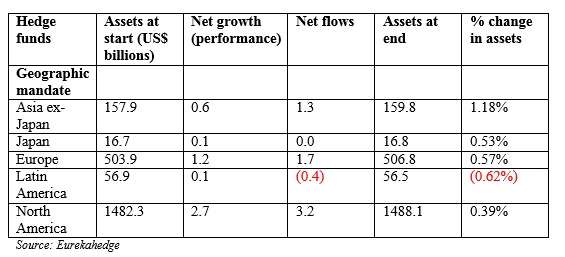

The table below, excerpted from Table 1 of the Eurekahedge report, shows the performance based changes in assets and asset flows in the Month of May by geographic mandate.

Meanwhile, in North America, hedge funds have seen new allocations of $17.5 billion YTD. The bad news is that this is only half the same statistic from a year ago.

Looking to Asia

When Eurekahedge looks to Japan it sees that its Japan Hedge Fund Index is up 5.22% for this year. May saw strong performance by the constituents of the Nikkei 225, (up 5.34%) and long/.short equity fund managers had the benefit of that strength.

Asset inflows into Japan were flat in May, though.

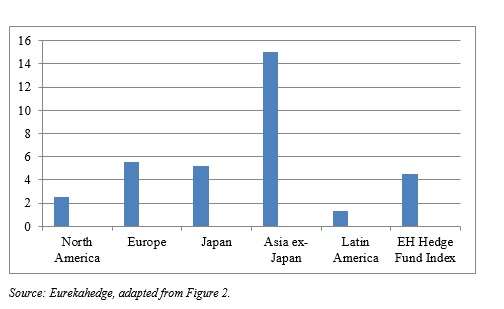

Every geographic mandate showed positive results for performance-based growth for 2015 YTD through May, though the results vary greatly, as this figure indicates.

Asia ex-Japan’s performance owns its dominance in that figure especially to the results of funds with a Greater China mandate, which posted gains of 25.91%

Eurekahedge also observes that India mandated hedge funds have performed well in 2015, with a 3.24% gain in May and a YTD figure of 5.66% . The authors of this report “expect the rally in Indian equity markets to continue to provide support to the country’s long-biased equity hedge funds.”

Latin America

In a special section of the report devoted to “Key Trends in Latin American Hedge Funds,” Eurekahedge observes that since 2008, investors interested in Latin America have “increasingly opted for onshore funds over offshore funds.” The onshore funds are mostly located in Brazil. That country requires that they provide regular net asset values and a transparent pricing policy. It also mandates extensive monthly investment reports and centralized counterparty risk.