MFS, an active global asset manager that’s been around for nearly a century, has put out a white paper on active management.

MFS, an active global asset manager that’s been around for nearly a century, has put out a white paper on active management.

The authors of the paper argue that the trend of passive investment has gone too far. It is a meta-trend, that is, a trend that consists of following other trends: but the skilled active manager seeks to get ahead of trends.

The paper lists three “signs of skill,” thus: demonstrated conviction; the addition of value in volatile markets; and the integration of “multiple perspectives” through collaborative research. The point of the list is to delineate the authors’ view that the success of certain managers “relies on their expert research and repeatable processes, rather than on short term phenomena such as market momentum.” The significance of the demonstration of convictions in particular is that the maintenance and development of convictions about how the markets work encourages differentiation from any favored benchmark and lower portfolio turnover.

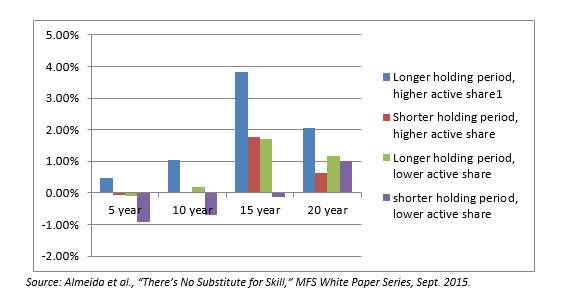

A study by Martin Cremers and Ankur Pareek indicates those managers with a high active share and who held positions for longer than average time periods outperformed their own self-declared benchmark by, on average, 1.9% per year.

Some managers have benefited from the recent shrinkage in the investment world’s time horizons by becoming time arbitrageurs, that is, by using a longer horizon to find abundant investment prospects where there is a greater return dispersion among securities in a market as represented by the MSCI World Index. “Dispersion” in this context refers to the performance spread over a given period between the best and worst companies. How this time arb works is illustrated by the graph below, an adaptation of Exhibit 1B from the white paper.

Benefits of a long-term active approach

The figures represented on this graph are net of all fees (including 12b-1) but they exclude sales charges.

As a concrete example of the significance of dispersion for time arb, the authors reference the S&P Index in 2009. Auto Nation, one of the best performers, was up 94%, and one of the worse (AIG) was down 4%. This gives a spread of 98%. Those are good fishing grounds for active managers. This was of course the year following the great Wall Street debacle of 2008.

In contrast, consider 2014. One of the best performers, Apple, was up 40% while one of the worst (General Motors) was down 12%. This gave a spread of only 52% or just over half the spread in 2009. Dispersion has a significant impact on active returns. In years of the most dispersed markets, the top quartile of active managers produced excess returns of 11.99%, while in the years of the least dispersed markets that number was down to 2%.

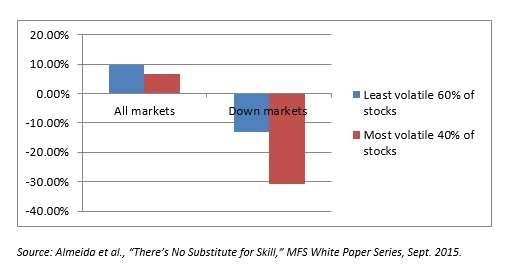

One helpful characteristic of active managers for their investors is that, in the words of this paper, they can “avoid taking full market risk, intentionally avoiding companies and segments of the markets where risk is overpriced.”

The graph below, an adaptation of Exhibit 6 of the White Paper, illustrates this by comparing the most and the least volatile stocks in the period 1990 to 2014. In all markets the most risky/volatile stocks did somewhat less well than the more volatile, because in down markets in particular the riskier did far worse.

Investors are not always rewarded for risk

If investors take on risk expecting that they’ll be compensated for it, they may well be disappointed, unless they have skilled active managers who can steer their risk to where it will do them the most good.

A Final Thought

But to return for a final thought to the third of the symptoms of skill mentioned above, the integration of research and the reward for collaborative thinking: these authors contend that the complexity of the contemporary marketplace, the sheer volume of available data and the need to understand the global entanglements of issuers, all mean that there is no substitute for “an integrated research platform with teams of experts collaborating on investment decision making and risk assessment and a philosophy of foregoing short term performance in pursuit of longer-term value.”

The paper is credited to Robert M. Almeida Jr., institutional portfolio manager, Michael T. Cantara, senior managing director of the global client group, Joseph C. Flaherty, Jr., chief investment risk officer.