A global survey by PwC and the Alternative Investment Management Association looks at the expansion of the hedge fund industry and the evolution of its distribution model.

The most eye-catching statistic from the survey us that 44% of fund managers responding said that they will launch a new fund by the end of 2016. The headline of the accompanying press release rounds that up a bit to “almost 50%.” That is probably an over-eager bit of rounding. It is closer to 2/5, after all, than to ½.

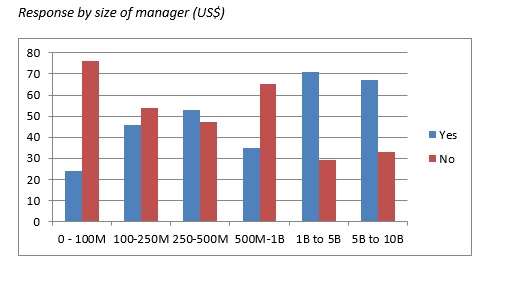

Roughly speaking, the more assets a manager has under management, the more likely it is to say “yes” in answer to the question about an expected launch. Among managers with less than $100 million AUM, only 24% anticipate a new launch by the new years’ end. Among those with between $1 and $5 billion AUM, the number is 71%. The more complete breakdown is shown in the graph below.

Do You Anticipate Launching a New Fund in 2015/2016?

Adapted from Fig. 14, Global Hedge Fund Distribution Survey 2015, PwC and AIMA.

Geography and Liquidity

Looked at geographically, this presumption of expansion is most prevalent among the hedge fund managers of North America and Great Britain, and is quite rare in Australia.

In terms of fund domicile, nearly half of the new funds will be established in the Caymans, nearly a quarter in Ireland, 12% in Luxembourg and just 10% in the United States.

Expansion is underway in other respects as well. The survey asked respondents about the likelihood that they would launch a new liquid alternatives fund before the end of the year. This time the question wasn’t just “yes’ or “no.” Respondents were allowed to choose among five answers: No way, not likely, more likely than not, very likely, and extremely likely. Considering the first two of those answers as “negative” and the latter three as “positive,” the break-down was: 67% negative, 33% positive.

The “first wave of liquid alternatives have focused largely on institutions,” the report says, but “the second wave will target the retail and mass affluent markets, including the rapidly expanding defined contribution pensions fund market.” PwC estimates that as a consequence of this broadened market, the demand for liquids, which stood at $260 billion worldwide at the end of 2013, will be $664 billion by 2020.

Thoughts on Asia

One theme of the report is that regulations are having a pushme/pullyou effect on distribution channels: impeding some and encouraging others. This is true in all the regions of the world, Asia not less so than elsewhere. In Korea, for example, the minimum investment required for hedge funds has been lowered; the profile of eligible investors has become more permissive. Thailand has just undertaken a public consultation on the regulation of alternative investment funds.

One Asian hedge fund manager told the survey takers, “Japan is one of the biggest allocators to hedge funds in Asia and there is significant potential as the Japanese shrink their allocation to Japanese Government Bonds … and increase allocations to alternatives, long-only products and offshore bonds.”

Meanwhile the People’s Republic of China continues to hold its fascination for the rest of the world. The internationalization of its currency combined with what the report calls “Beijing’s ongoing reduction of investment barriers” constitute the good news for an industry always looking for opportunities. The establishment of the Shanghai-Hong Kong Stock Connect is an example of this changing climate, as is the launch of duty-free zones in two of China’s provinces.

China also has seen what the report calls an “explosion” in the quantities of high-net worth individuals looking for places to invest. Although in 2012, HNW individuals based in the Asia-Pacific region in general accounted for assets of less than $13 trillion under the management of the hedge fund industry; by 2020 that number will have increased to $22.6 trillion, and China will have accounted for much of that increase.

Meanwhile, Europe’s AIFMD

The EU’s Alternative Investment Fund Managers Directive has been a game-changer for firms in Europe, of course, as well as for firms from outside of Europe that market to its investors. The report describes it as a “catalyst” that has caused firms to re-work their distribution strategies

The AIFMD, like regulatory initiatives everywhere, can be a stumbling-block. But it can also be an opportunity. As the report observes, “Some non-EU managers have decided not to wait for the outcome of the third-party passporting debate and have gone down the EU/AIGM route early. Fund managers in this category may have been persuaded by clients and/or consultants that they need to have a presence on the ground in Europe.”

In the words of Jack Inglis, the CXEO of AIMA, “The industry, having begun the process of institutionalization prior to the global financial crisis, is now maturing rapidly in order to manage a variety of distribution opportunities.”