According to a new Spectrem Group whitepaper, most investors questioned believed (usually erroneously) that their advisors have a fiduciary responsibility in caring for their money.

Eighty percent of ultra-high-net-worth investors believe that their advisor is a fiduciary. So do 85 percent of millionaire families, and 83 percent of the mass affluent.

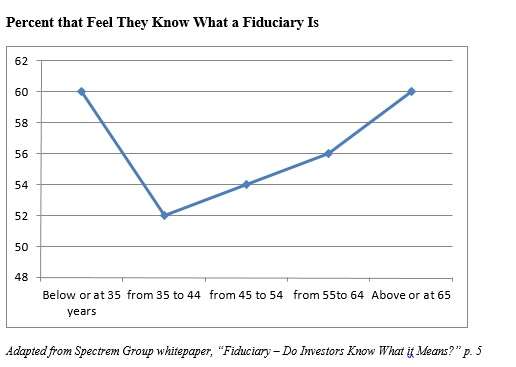

What may be worse, they think they know what that means. They don’t have the Socratic virtue of knowing that they do not know. Among the “mass affluent,” that is, among individuals in households with a net worth above $100,000 though no higher than $1 million, 57 percent believe that they know what a fiduciary is. The breakdown of the mass affluent by age is as follows.

That’s a fascinating curve, in that it is consistent with hat is sometimes grandly known as the Dunning-Kruger effect, that is, the hypothesis that the many of the young investors, the most ignorant, learn something about the state of their ignorance at around age 35. Then perhaps from 45 on they acquire some real knowledge of what “fiduciary” means. By the time they are 65 they know as much as they thought they knew decades before.

Back in April of last year, the Department of Labor proposed new regulations that would impose fiduciary standards on advisors involved in the disposition of retirement plan assets. This drew some attention to the real distinction between fiduciary responsibility on the one hand and the actual standard of most investment advisors, the “suitability” standard, on the other.

The IRA rollover, which is the part of many family’s portfolios that would fall directly within the scope of the DoL proposal, represents nearly one-third of the portfolios of both mass affluent and millionaire households (32 percent and 31 percent, respectively). It is understandably a smaller portion of the portfolio of UHNW households, at 22 percent. But 22 percent is nothing to sneeze at, either!

Fees

Spectrem also asked investors about fees. About three-quarters of the respondents believe that they have a solid grasp of the fee structure of their advisors. This breaks down to 82.99 percent of the EHNW respondents, 74.35 percent of the millionaires, and 66.45 percent of the mass affluent.

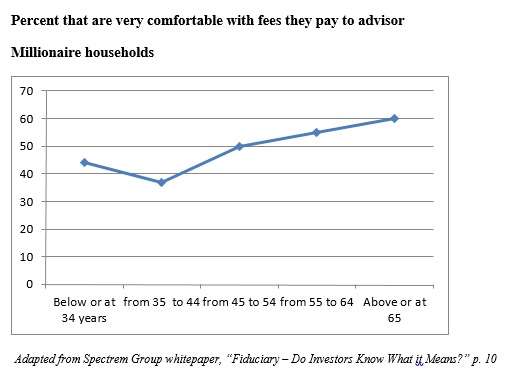

More than half of investors say they are comfortable with the fees they pay their advisor. This comfort, though, changes with age. Looking again at the mass affluent to fix ideas: 54 percent are comfortable. The comfort level is lowest among the youngest group, those at or less than 35 years. The figure there is 46 percent. It rises gradually to 61 percent among those at or above 65.

The millionaire’s group shows a similar pattern.

Spectrem expresses some concern in this connection that “the skepticism of the younger generation and their comfort in seeking out information may ultimately depress fees, making the balance of risk and reward harder to achieve.” Some potential advisors may decide it is no longer rational to work on building a practice in this field, given the greater liability to lawsuits as well as the lower fees, and discouraging advisors in such a way will limit choices.

Advice for Advisors

Spectrem concludes its white paper with some advice for advisers. They should write an “elevator” speech to give to their clients. Pointing out that they will be hearing the word “fiduciary” and related terms used more frequently and they should understand what it means. An adviser should make it clear to what standard he or she is held by existing laws and regulations, “while assuring them about how you care about their best interests, no matter to which standard you are officially held.”

Advisers should also review their fee disclosure documents. Relevant disclosures will exist within a number of existing documents generated by an advisory concern, but it is important to “see if those documents can merely act as backdrop to one really clear document that sets out the fees that will be charged” to investors’ accounts.

Further, there should be a quarterly committee meeting to review client accounts.