Andrea Consiglio and two of his colleagues have developed models for the management of risk in the sovereign credit swaps market, and they have successfully back tested these models against recent European history. Consiglio is a professor at the University of Palermo, in Italy.

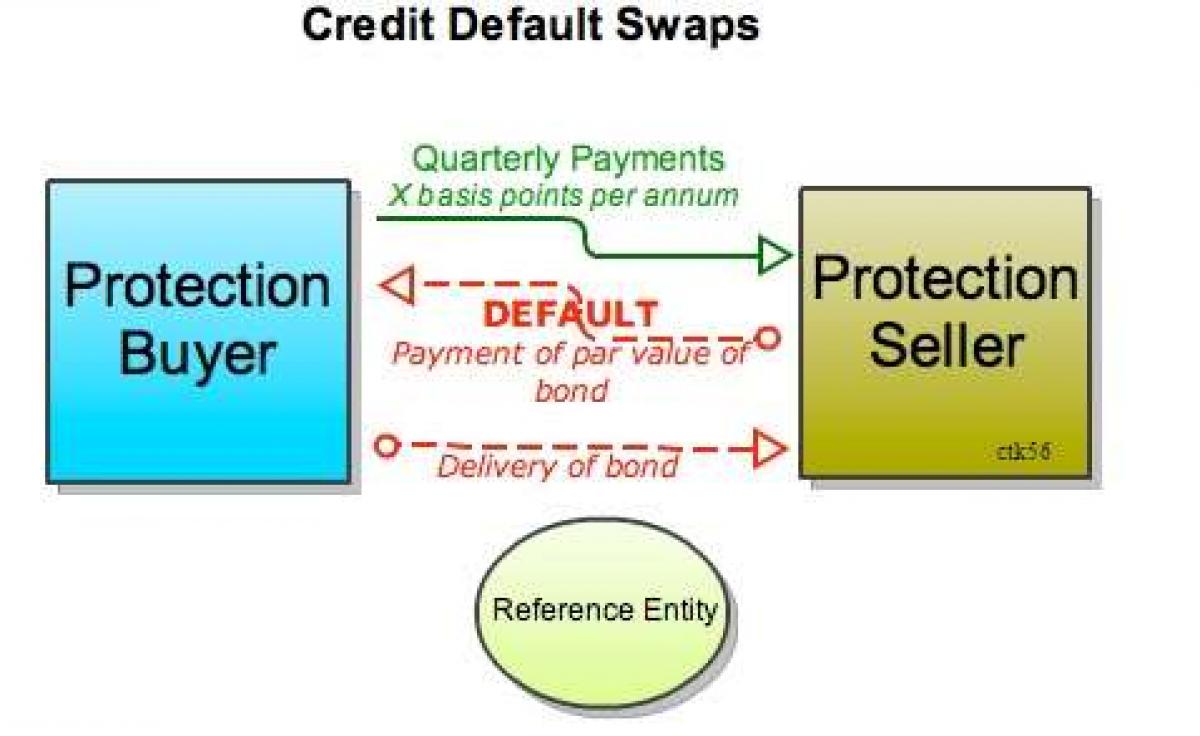

Sovereign CDS’ are contracts that offer protection against the default of the referenced government. As is typically the case with swaps, one may use them either to hedge or to speculate. In particular, a speculator may take a naked position on the CDS’, without having any exposure to the referenced sovereign’s bonds.

Further, one can of course seek alpha by arbitraging in this market, exploiting price differences between the derivatives market and that of the underlying obligations.

The relevant contracts were standardized by the end of the 20th century and they passed an early test created by the Republic of Argentina in the final days of 2001. Thereafter, the market grew swiftly. The Bank for International Settlements began reporting data on the size of the sovereign CDS market in 2005, and the market grew steadily from that time until 2013. There has been some pullback on that growth since 2013, in part at least due to the ban on naked trading of such CDS’ by the European Union in November 2012.

Is someone wearing a fishnet naked? The distinction between speculation and hedging is here, as in many other contexts, a porous one. Properly understood, hedging need not be one bond, or one sovereign, at a time, that is, it need not be (and should not be) dominated by a “silo” approach. Hedging for a portfolio manager can well involve the ownership of some naked positions, if the (unowned) underlyings are highly correlated with other instruments that are within the portfolio. The EU rules allow for such a transaction.

As the authors note, there have been a lot of scholarly studies of sovereign CDS’, and even more so of their corporate-issued cousins. There has been something of a dearth of studies, though, of the specific role of sovereign CDS’ within portfolio management, and here is where Consiglio and the others believe they are making a distinctive contribution, in their paper, “Portfolio diversification in the sovereign credit swap markets.”

Three Strategies

Accordingly, they have used a conditional value at risk metric (CVaR) to model three portfolio strategies insofar as they involve such CDS’: long positions; long and short positions; covered short positions. They tested their models against data from a very volatile period from October 2008 until March 2016. They divided the data by sovereign into three classes: Europe’s core, Europe’s periphery, and the Central, Eastern, and Southeastern Europe (CESEE) region.

They establish that their models do select portfolios that yield results superior to those of the broad market index.

For simplicity, they modeled CDS-only portfolios, but they left to further research the “interesting extension” of incorporating the underlyings within the same models. That is, they say, an extension with “great practical significance.”

Continue and Extend

Likewise, if the authors’ work is to be continued and extended it will be natural to include “regime switching.” That is, a CDS portfolio manager might want to diversify among turbulent, crisis, and post-crisis regimes.

The article contends that the relative efficiency of the different country groups changes with regime. In turbulent/pre-crisis circumstances it paid to diversify from the core to CESEE and/or periphery countries. Post-crisis the CESEE countries dominated.

The authors’ “most encouraging finding” as they say, “is that the covered long and short strategy performs uniformly well. It … rides smoothly past the big market up- and down-swings.”

Along with Consiglio, the authors of this study were: Somayyeh Lotfi, of the Department of Applied Mathematics, University of Guilan Iran, and Stavros A. Zenios, of the Department of Accounting and Finance, University of Cyprus.