Hong Kong Exchanges and Clearing (HKEx), the company that bought the London Metal Exchange four years ago, has further expansion plans. At a recent event on the commodity markets of East Asia, Charles Li, the CEO of HKEx, spoke on this point.

Li wants to create a physical metals trading platform in mainland China in 2017, tying it to a warehouse system on the LME model.

There’s likely a market for this because Chinese investors (and officialdom) have become wary of speculation in futures, something they see as unmoored to the underlying physicals. They’ve also become wary of representations as to those underlying physicals. Fresh memories of the Qingdao imbroglio are part of the problem.

Memories of a Disappearance

As a refresher: in 2014 the government of the People’s Republic announced that it was investigating the discrepancy in the amount of metal that was supposed to be in a warehouse in Qingdao, a northeastern city and China’s fourth largest port, versus the amount of metal that was actually there. Eighty thousand tons of aluminum and 20 thousand of copper had reportedly gone missing.

Metal had become a key form of collateral in China by 2014, and the suspicion was widespread that the metal that had gone missing had never really existed, that it had been fraudulently pledged as collateral by traders.

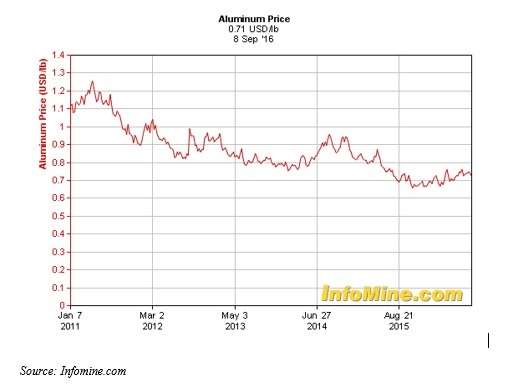

As the above chart indicates, there has been a long-term trend downward in aluminum prices, from $1.10 per lb. in early 2011 to close to $0.70 in September 2016. But the year 2014 saw an interruption of this trend, a strong upward move that only slowly thereafter eroded. This may have a lot to do with the market’s discovery that the available supply in those Qingdao warehouses wasn’t in fact what it had appeared to be.

Cognitive Dissonance

There is room, then, for an expanding HKEx to play against the mainland-Chinese suspicion of the non-LME warehouses. Li’s company plans to locate the warehouses near consumer locations, while creating a unified, central, system for the warehouse receipts.

“We want to do everything short of trading futures,” he said. “We don’t believe we will get a license for that.”

Some observers, including Craig Pirrong, on his Streetwise Professor blog, have observed that there was some internal tension (Pirrong calls it a “cognitive dissonance”) in Li’s remarks. There was on the one hand the notion that the new system will allow traders in the metals markets to do most of what traders want to do anywhere; and on the other hand the notion that the physical presence of the metals would provide an important restraint on their usual shenanigans.

If Li gets these plans off the ground, the result might well be, again in Pirrong’s words, “another speculative venue [although] one masquerading as a staid market for physical players.”

Indeed, there is nothing foolproof about the LME record in these matters. LME rules seek to limit hoarding and/or price manipulation by requiring that specified amounts of metal be moved out of a warehouse each day. But … as certain Wall Street banks have infamously demonstrated, moving the metal “out” doesn’t necessarily mean moving it out of the warehouse system as a whole. Shuffling a truckload of metal from one warehouse to another moves it “out” of the first. Then shuffling it back moves it “out” of the second.

There is no obvious reason why this prevents either hoarding or price manipulation (though it gives work to truckers).

Last year HKEx and its subsidiary, LME, settled their part in a class action lawsuit over aluminum price manipulation claims, focusing on the LME’s presumed collusion in just such behavior.

At any rate … good luck to the HKEx in the pursuit of its plans.