By Diane Harrison

Jonathan Swift, one of the great satirists of all time, published a disturbing and provocative essay, ‘A Modest Proposal,’ in 1729 suggesting a unique and terrible solution to Ireland’s famine crisis. In his piece, Swift recommended cannibalism as a wholesale solution to Ireland’s struggles with overpopulation, starvation, and a stagnant economy. Swift’s rationale for ‘A Modest Proposal’ was based largely upon the following:

- He suggested that unwanted and orphan babies could be “repurposed” as a food supply.

- His rationale included statistics of his time on overpopulation, lack of adequate food supply, and the cost of meat.

- He summarized that, while uncomfortable, the benefits of his proposal outweighed the downside.

If one takes a comparative view on the current state of the hedge fund society, it might jumpstart a conversation about difficult changes needed for a healthier investment sector.

DEBUNKING THE LAW OF AVERAGES

Much has been written over the past several years dissecting reasons for the disappointing results of the hedge fund industry overall. Critics decry mediocre returns, the tendency to lag the overall market, and steep fees. What most critics fail to point out, however, is the lack of usefulness in focusing on aggregate hedge fund performance. With hedge funds currently numbering somewhere north of 14,000, the array of investment choices a buyer of such funds might make is staggering. But the vast majority of these hedge funds have, for reasons good or bad, failed to live up to their hype.

Probability theory, which the ‘law of averages’ is based upon, is often misused as a statistic in drawing conclusions about hedge fund performance. With such a bloated universe, one must take a closer look at the individual fund components of this mix. For contained within these thousands of funds are hundreds of bright stars worthy of discovery and investor capital. A statistical tool more suited to assess hedge funds and their relative value is the ‘power curve.’

THE POWER PLAYERS OF THE POWER CURVE

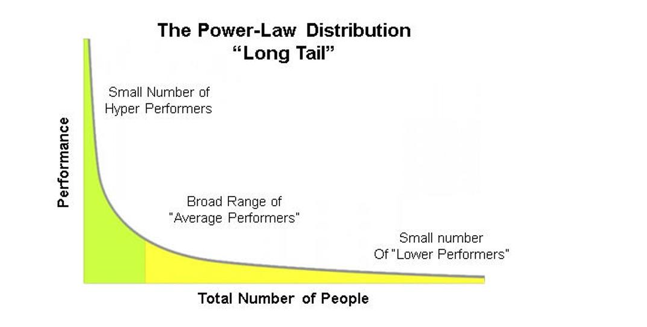

Josh Bersin wrote an interesting article in Forbes several years ago called ‘The Myth of the Bell Curve: Look for the Hyper-Performers,’ in which he suggested that, when analyzing performers, the ‘power curve’ might be a more accurate tool. In this article, Bersin offered that the majority of results are created by the minority of performers, creating a ‘long tail’ distribution pattern:

A “Power Law” distribution is also known as a “long tail.” It indicates that people are not normally distributed. In this statistical model there are a small number of people who are “hyper high performers,” a broad swath of people who are “good performers” and a smaller number of people who are “low performers.” It essentially accounts for a much wider variation in performance among the sample. It has very different characteristics than the Bell Curve. In the Power Curve, most people fall below the mean (slightly). Roughly 10-15% of the population are above the average (often far above the average), a large population are slightly below average, and a small group are far below average. So the concept of “average” becomes meaningless.

FOCUSING ON THE FEW

If we return to our earlier assumption that the overpopulated hedge fund industry has been an aggregate lackluster performer, and that this universe comprises approximately 14,000 funds, then roughly 250 or so funds existing today are providing substantial benefits to their partners. This ‘power group’ generates performance regardless of what fees are being charged, what segments of the market they exploit, and what current regulations are burdening them.

It’s likely that these exceptional results are due to a broad array of factors, some of which include:

- A distinctive strategy that can capitalize on its market environment

- Great analysis and execution

- A balance of upside capture and containment of downside risks that allow profitable activity to run and minimize episodes of loss

- An ability to replicate solid results over time and with varying amounts of assets under management.

A WHOLESALE FIRE COULD CLEAR THE HEDGE FUND WOODS…

If we further agree that the 250 ‘stars’ are the hedge funds worth focusing on, and we return to the initial comparison to Jonathan Swift’s ‘A Modest Proposal,’ then the obvious corollary to draw is that perhaps 12,000 existing hedge funds should either cease to exist or content themselves with being discrete investment strategies serving the specific needs of their core partners. In other words, these 12,000 funds should depopulate the hedge fund universe and allow the ‘stars,’ or true performers, to be found and tracked by investors.

If the alternative investment advisors and consultants who evaluate this universe were to construct some metrics by which to isolate these stars more easily, it seems that there would be a highly motivated group of alternative asset investors eager to partake of these ‘power curve’ players. And while it might appear dire to wish roughly 80% of the hedge fund universe to expire or at least function more privately, the comparison to Swift’s modest proposal suggests a healthier long-term outlook in this alternative asset segment of investment management.

Diane Harrison is principal and owner of Panegyric Marketing, a strategic marketing communications firm founded in 2002 specializing in alternative assets. She has over 25 years’ of expertise in hedge fund and private equity marketing, investor relations, articles, white papers, blog posts, and other thought leadership deliverables. In 2016, Panegyric Marketing has been shortlisted for Family Wealth Report’s Outstanding Contribution to Wealth Management Thought Leadership and received AI Hedge Fund's Outstanding Contribution to Wealth Management Thought Leadership, M&A's Excellence in Financial Services Marketing Communications – USA, AI’s Innovation in Alternatives 2016, Wealth & Finance International's Best In Funds 2016 – US and their Women in Wealth Awards Best Financial Services Marketing Company - New York, and Investor Review's 2016 Fund Elite Award's Most Innovative Financial Services Marketing Firm USA. A published author and speaker, Ms. Harrison’s work has appeared in many industry publications, both in print and on-line. To read more of her published work in alternatives, please visit www.scribd.com/dahhome. Contact: dharrison@panegyricmarketing.com or visit www.panegyricmarketing.com.