The Global Sustainable Investment Alliance, a collaboration of green investment-oriented entities, has released its latest Global Sustainable Investment Review, looking at the state of SRI investments.

This is the third in a series of reports “presenting results from Europe, the United States, Canada, Asia, Japan, and Australia and New Zealand.”

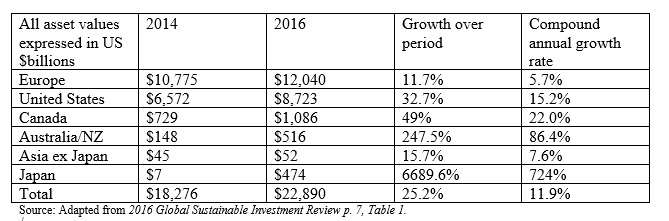

The report tells us that there are now $22.89 trillion of assets around the globe “being professionally managed under responsible investment strategies,” one-quarter more than the $18.28 trillion in 2014. Further, the 2016 AUM represents roughly 26% of all professionally managed assets. SRI has become a major force.

In emerging markets, including importantly the People’s Republic of China, “regional and local investors are the main investors in sustainable assets,” although GSIA says that this may change in the near future as China opens itself up to operations of foreign-owned fund managers.

A Broad Umbrella

The GSIA understands the broad umbrella of sustainable investing to cover all of the following practices:

- Negative exclusionary screening;

- Positive best-in-class screening;

- Norms-based screening;

- Integration of ESG factors;

- Sustainability themed investing;

- Impact/community investing; and

- Corporate engagement and shareholder action.

The sixth item on that list, “impact investing,” is defined by the GSIA as the targeting of investments, typically within private markets, that are aimed at solving social or environmental problems – which one might colloquially paraphrase as “trying to do well by doing good.” The GSIA says that this is “a small but vibrant sector” of the broader SRI universe.

Nearly all regions saw increases in the AUM. This table indicates as much.

Europe clearly retains a leading role in this field: more than half of the SRI assets included in this report are European. Japan has exaggerated percentage numbers because this two year period saw the industry take off from nearly ground level there, and as a consequence of changes in reporting/classification of assets in Japan.

By December 2015, 201 institutional investors in Japan had signed off on the country’s first Stewardship Code, encouraging constructive engagement between shareholders and managers.

Strategies and Retail Investors

Breaking the field down by strategies: negative/exclusionary screening remains the largest piece of the puzzle, representing $15.02 trillion, up from $12 trillion two years ago.

The smallest strategy, impact investing, now represents $248 billion AUM, up from $101 billion two years ago, a growth of 146%. The United States accounts for the largest share of the impact investing.

One theme of the report is that the market for SRI management isn’t as dominated by institutional investors as it has been in the recent past. The relative proportion of retail money in the SRI coffers increased in Canada, Europe, and the United States. Over one-third of the SRI AUM in the US is not retail in origin: just over a quarter, word wide.

There has also been a change in the relative importance of bonds versus stocks in these portfolios, at least in Canada and Europe. This information is not available for the other nations/regions represented. But taking Canada-and-Europe together: their SRI portfolios were 50% in equities, 40% in bonds, 10% in other assets, in 2014. In 2016, though, the split has changed in the direction of debt: 64.4% bonds, 32.6% equity, 1.1% real estate/property, 0.6% in private equity or venture capital, the remaining 1.4% in everything else (including hedge funds, cash, commodities, and infrastructure.)

Latin America

The Latin American Sustainable Investment Forum (LatinSIF) only formed itself in 2013. The report includes a sidebar about its origins.

LatinSIF got its start in Colombia, with help from the Colombia Stock Exchange, which was the second Latin American Stock Exchange to sign on to the Sustainable Stock Exchange Initiative (after Brazil’s).

Impact Investing is part of the Latin picture, or soon will be. The GSIA tells us that “stakeholders in Argentina, Paraguay and Uruguay have joined together to create an impact investment task force and launch an impact investment fund for the three countries.”