Mark Shore, chief research officer of Shore Capital Research, and an adjunct professor at DePaul University, has prepared an “overview” of marketplace lending for institutional investors and wealth managers.

The practice under discussion is also known as peer-to-peer, or even in these character economizing days as P2P, lending. Shore explains early on the origin of that terminology. "P2P" comes from the world of network design, where it refers to systems such as Gnutella in which computers are connected directly to one another without a central server, a possibility that generally requires that they use the appropriate software programs (Kazaa, Limewire, BearShare, etc.)

One point more about etymology. Around 2014, the name of the alternative lending industry began to shift: P2P lost ground, replaced by the phrase “marketplace lending.” This semantic change accompanied a structural shift away from individual toward institutional lenders, so that fewer lenders were participating in much more of the volume.

This kind of shift is quite common in marketplaces as they shift from start-up phase to growth phase. In New York City, only 6% of the Airbnb hosts control more than 3 rooms, and those "institutional" 6% had come, as of January 2016, to account for close to 40% of the transaction volume.

Explosive Growth

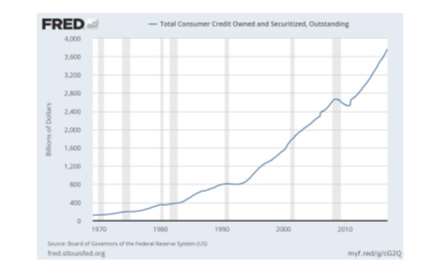

The existence and growth of the alternative lending world, under any name, fits into the story of the explosive growth of total consumer credit since 1969.

Shore includes in his report a graphic available through the Federal Reserve, and reproduced below, making this point.

The grey bars in the above graph represent recessions. The whole upward sweep of consumer credit might look like a smooth parabolic curve, but for three periods. The curve flattened out for a period in the early 1980s, carrying it through the two recessions of that period, then resumed its upward path. It flattened out again in the early 1990s, and again soon resumed that path., It was utterly unaffected by the dotcom bust and the resulting recession at the beginning of the new millennium. But it was thrown briefly into reverse by the global financial crisis less than a decade later. Still, here too, it has resumed its upward path.

What all this establishes, in Shore’s view, is that with total outstanding consumer credit at $3.7 trillion, MPL has room for further growth.

Loans made by the MPL industry typically range from $1,000 to $35,000. In 2016, the average loan via the industry leading Lending Club was about 14,700, which Shore calls “large-scale micro investing.” The periods involved are short term, from 36 up to 60 months.

How to Go About It

Suppose an investor wants to put some portion of its portfolio into this market. How to go about it? There are three approaches: self-directed, automatic, and fund managed. That is, an investor could in principle research the loans, yields and durations in-house, determine its own risk tolerance, and make the loans accordingly. Or, it could use the automatic function of a platform to invest based on the pertinent factors/inputs. Or, again, it could allocate money “to a professionally managed fund that lends on one or multiple online platforms.” Mediation by fund managers “allows for greater diversification and potential to reduce return volatility.”

The annualized yields range from as low as 5% to as high as 25% based on the level of risk that the platform assigns. Even the low end of that range looks like a premium compared to the 5 year T-note, which has been yielding below 2% since 2011. The 3-year note has been below 1.75% since 2010. These low Treasury yields have been “a contributing factor for institutional investors to allocate into the MPL space.”

MPL is a disruptive force for the banking industry. Nonetheless, Shore references PwC, which in turn has said that MPL platforms are creating alliances with traditional banks for customer referrals, and to create products useful on both sides.