Preqin, in collaboration with NXT Capital, has surveyed institutional investors about the U.S. lower middle-market direct lending space, and has issued a report on their attitudes.

The gist of the report is that investor appetite for the lower middle market “has steadily gained momentum in the past decade and … appears primed to continue this trend in the near term.”

Traditional bankers have been pulling back from this space since 2007, leaving a vacuum. The emptiness has become more marked over the last three years, “as the full effect of Dodd-Frank-driven limitations on leveraged lending has taken hold,” the report says.

As of April 2017, Preqin is tracking 256 direct lending managers worldwide. Nearly three fifths (151) of these participate in the North American marketplace. Of those who do, 79% say they prefer lower middle market direct lending, a category that excludes distressed, mezzanine, or infrastructure debt.

The early movers into this vacuum have reaped impressive rewards: a median internal rate of return of 8.9% for fund vintages 2004-2014, and a modest standard deviation to match against that of other alternative asset classes.

Survey Results

For this survey, Preqin collected responses from 100 institutional investors.

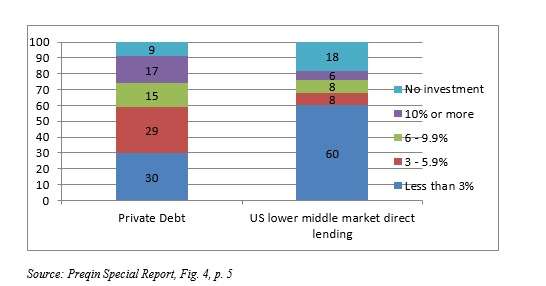

Only 9% of the institutions surveyed do not have any allocation at all to private debt. But among the 91% who do allocate there, the respondents are all over the map as to the amount of allocation as a percentage of total assets. Only 17% allocate 10% or more. The graph below, adapted from the report’s Fig. 4, gives further information.

Likewise, among those with some allocation to private debt, only 18% have no allocation at all to the U.S. lower middle market space on which Preqin’s survey focused. But among the other 82%, respondents differ as to the amount of their allocation as a percentage of total assets, and only 6% allocate 10% or more. This indicates room for growth.

Views on Strategies

Respondents were asked which strategies they believe present the most attractive opportunities over the next one to two years. They favored straight senior debt first, and unitranche debt secondly. These preferences manifest what Preqin calls defensive posturing, which is prevalent at this point in the debt cycle. Find managers might want to take heed that investors are more likely willing to forge relationships with them if they have such relatively defensive debt products on offer.

By way of reminder: “straight senior debt” is generally understood as all first lien debt, typically with less than 50% of a loan-to-value ratio. Stretch senior debt, on the other hand, is second lien debt (effectively replacing mezzanine debt) and it can involve a LTV ratio of 55 – 65%.

Only 40% of the institutions surveyed saw stretch senior debt as one of the best opportunities for the near future, whereas 52% took an optimistic view of straight senior debt.

Unitranche debt is an arrangement in which senior and subordinate debt have been consolidated, often at an interest rate that falls in between that for the senior and the subordinated notes, and often by way of preparing for a leveraged buy-out. The level of optimism regarding a strategy focusing on unitranche fell, appropriately, in between that of the optimists for the straight and the stretched senior debt, but closer to the latter (43%).

Prominent Managers

Of course strategy is hardly the only or even the dominant consideration for an institution considering an allocation in the lower middle market space. Among other points, there is a choice among managers. More than three quarters of the respondents cited a find manager’s track record as a key consideration in deciding whether to commit capital.

The surveyors asked the respondents to name names. A total of 57 managers were named by institutions as associated in the view with lower middle market direct lending opportunities in the U.,S., and four of these managers were named more than four times. But “no single … manager has managed to consistently stand out from the crowd in the minds of investors at this point.”

As this space grows, that may of course change, and some name or names may come to be thought of as best prepared “to manage the specific sub-strategies to be found in the market….”