Deloitte has recently posted the results of its survey of how private equity managers see central Europe.

A very concise summary of the findings of the survey is this: the PE industry expects that it will be buying CE assets in the coming months, and that it will be borrowing money in order to do so.

The Less Concise Version

In November 2017 the PE Confidence index got back to 130, which was where it had been in April 2015. It took a big drop in the summer of 2015, reaching 92 that autumn. It was at 113 in the spring of 2017. Deloitte calls the return to 130 “encouraging.”

What do the respondents to the survey think about the underlying economy in central Europe in coming months? Almost two thirds (64%) think it will remain at about the same level, 26% think it will improve, leaving a worrywart group of only 10% who expect a falling off.

That 26% who expect an improvement? That number is itself an improvement; it is up more than three-fold from a year before. The Brexit vote was still news a year before this survey, and pessimism about the risks it represented was a factor all over Europe.

What is just as impressive, the percentage of respondents who believe that leverage will be available (or, in the words of the key survey question, that debt finance will become more rather than less available) has been marching upward. In September 2016 only 7% of respondents said debt financing would increase. That number was 10% in April 2017 and was 21% in November.

Three Big Exits

Three highly successful exits this year (each involving supermarket chains) have helped get the level of confidence to this point. Mid Europa Partners sold Zabka Polska to CVC for more than €1 billion euros. Enterprise Investors sold the Romanian chain Profi Rom Food for €533 million, and Enterprise (again) also sold its position in the Polish chain Dino Polska, this time by way of an oversubscribed public offering, for €890 million.

Meanwhile, as Deloitte says, “a number of other smaller exits reaffirmed the region as a strong mid-market opportunity for creating value.”

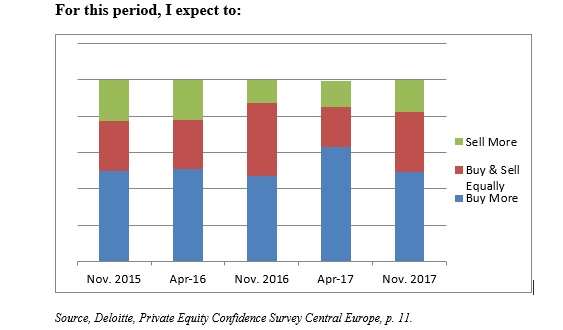

Though deal makers expect to buy more than they expect to sell over the coming months, Deloitte observes that “the focus may be shifting gently toward selling.” In April, 63% said they expected to sell more than buy. In November, that number had fallen to 49%. The particulars are displayed in the chart below.

So: where does the PE industry expect to put its money in these new buys in the months to come? Or to put the question another way, what does the industry collectively believe will be the most competed-for investment opportunities? Deloitte breaks the possibilities down into: market leaders; middle sized growing companies; start-ups.

A majority sees the market leaders in the industries of central Europe as the most competitive opportunity. This was a larger majority in the November 2017 survey than it had been in the spring, going up from 54% to 59%.

Roughly the second half of the publication consists of a “Deals Watch” for those curious about the pending deals in this space.

We’ll just give five of the pending deals here, as a taste:

- Hartenberg Capital (based in the Czech Republic) will buy a 50% stake in Avia Prime, a Polish provider of base and line MRO services (the maintenance, repair, and overhaul of aircraft).

- Coast2Coast Investments, a Polish PE house, will team up with Bounty Brands of South Africa to buy Zaklady Przemyslu Cukierniczgo, a manufacturer of snacks and confectionary goods.

- Enterprise Investors, through its Polish Enterprise Fund VII, will acquire SBA Slovakia, an operator of convenience food stores.

- Mid Europa , the UK based PE firm that sold Zabka Polska this year, has agreed to buy Hortex Holdings, a manufacturer and distributor of juices and other beverages from Argan Capital Advisors.

- Finally (for our brief survey) Black Pearls is investing in Find Air, which develops systems for asthma monitoring and control via its Black Pearls VC LQT Fund II.

For the curious, “LQT” stands for Life Quality Technologies.