By Diane Harrison

It used to be that if you asked most financial professionals what the single most important piece of sales collateral was, the answer would be the pitch book, of course. In the current era of tweets, email blasts, podcasts, and other media deliverables, has the old-fashioned deck of slides fallen by the wayside? I recently asked a number of financial colleagues from both the buy and sell sides to weigh in on this question. Their replies shed some interesting light on the topic.

YES…NO…MAYBE SO…

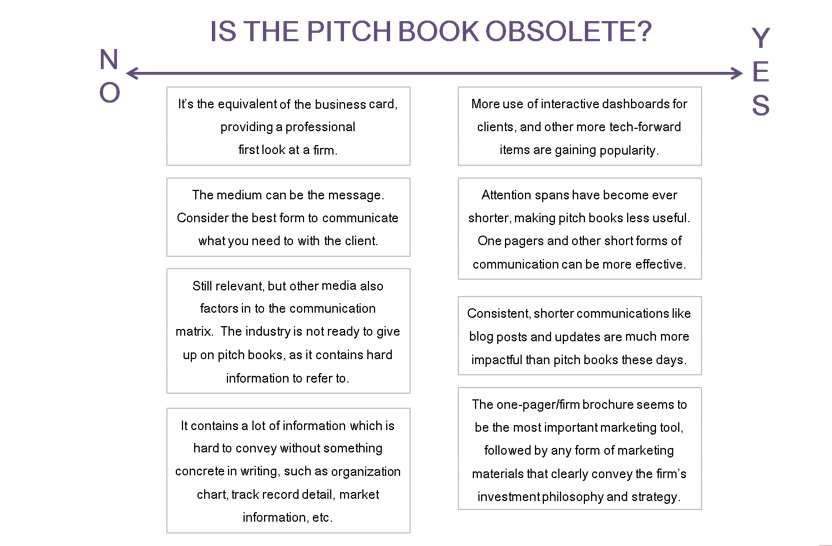

As most things in life go, the importance of pitch books in marketing is not a black and white issue. The responses I received to whether or not the pitch book is dead were fairly evenly split between no (alive) and yes (dead), and each side included the fund managers who create them and the investors and advisors who receive them. The graphic below summarizes the general arguments both in favor and against the pitch book’s relevance in today’s marketing efforts.

AN ARGUMENT FOR PITCHING THAT BOOK IN FAVOR OF OTHER COMMUNICATION FORMATS

Social media and other technological advances have played a major role in the way people both receive and exchange information. The variety, frequency, and typical length of information exchange has evolved dramatically over the past decade, with diverse formats and faster real-time delivery, while the content length of information has shrunk dramatically, to sound bites, memes, and tweets. This evolution has been so pervasive even within the financial community that a 20-page deck of slides seems archaic and quaint as a primary means of telling an investment story.

In 1964, Marshall McLuhan first coined the phrase, the medium is the message. “The content of any medium is always another medium," meaning some of the intent of a message is delivered via its format. This is even truer in 2018, as news, gossip, entertainment, and virtually all forms of communication have been impacted by surging popularity for individuals and companies to participate in the virtual party line that is global communication.

With so much content floating about in cyberspace, where do most investors look to find their investment information? It seems that fund fact sheets, or one-pagers, which typically highlight current performance versus benchmarks, remain the most popular medium. Growing in use are short articles, newsletters, and blog posts on financial news sites. These pieces often cover top news stories regarding fund activity, the most active strategies currently performing well (or not), personnel moves between firms or those launching new programs, and the like.

Fund managers, who historically were seen but not heard, are opening themselves up to be interviewed and quoted on a range of investment topics as a piece of their business development efforts. To be considered a thought leader in the investment world carries real financial impact to their fund’s visibility and, ultimately, their ability to grow capital. Today’s sales process benefits greatly from a multi-faceted communication approach to gain prospects. There are dozens of blog sites; some hosted by journalists, some by industry associations, others by individuals and companies, but all read by sellers and buyers of financial products. Fund managers who create their own blog can capture readership metrics through their site and use the information in focused marketing outreach.

RETHINK THE FORM THAT SHOULD BE FOLLOWING THE FUNCTION

But all is not lost in the world of pitch book communication. Indeed, none of the industry professionals I asked thought the pitch book should be totally discarded. Rather, the format and content of such a document should evolve with the times in order to deliver the information within most effectively. Pitch books are primarily used as either an entry point to starting a relationship with a new prospect, or as a reinforcing document detailing the differentiation points of a fund following the initial outreach to a prospect. In either case, it serves as a reminder of what makes a fund and its management team unique as an investment option.

Years ago, the pitch book was a cumbersome tome of data, formal descriptions of the fund’s structure and strategy approach, charts and graphs, all couched in legal disclaimer language that often dwarfed the actual messages being conveyed. It wasn’t unusual to see pitch books in excess of 30 pages, as managers threw everything but their investment ‘kitchen sink’ into the document they felt was their major sales piece.

Today, effective pitch books are streamlined, brief in content, and organized to relay the essence of a fund’s purpose. These pitches are often delivered electronically rather than in the glossy-paged booklets of old, and so can also include some dynamic formats. Managers who want their pitch book to assist them in sales are using striking graphics, including memorable logo marks, often accompanied by a tagline. The book has been pared down into something that leaves the audience with clear messages about who they are, what they are offering, and why it’s attractive to investors. Often, managers who want to grow their business to the next level on the investor food chain will outsource the creation of their collateral system, including brand identity systems; logos, stationery, pitch book and fact sheets, websites, and newsletters to create a seamless and professional messaging platform for their firm.

THE NEW NEW IS REALLY THE SAME OLD

What hasn’t changed over the years is the fact that winning new investors takes time and patience. There are multiple communication points that happen over the selling cycle, including introductions to the fund, regular updates on performance and the firm’s operational growth news, and thought leadership outreach that showcases the fund manager’s unique skills and perspective on the market. The pitch book remains one aspect of the whole, but has seemingly evolved from a primary communication tool to one that plays more of a supporting role.

Diane Harrison is principal and owner of Panegyric Marketing, a strategic marketing communications firm founded in 2002 specializing in alternative assets. She has over 25 years’ of expertise in hedge fund and private equity marketing, investor relations, articles, white papers, blog posts, and other thought leadership deliverables.