By Nicolas Rabener of FactorResearch

INTRODUCTION

Investors fear black swan events, although it can be argued that this fear is irrational. The black swan theory is a metaphor that describes a surprise event that has a major impact and is often rationalized with hindsight. A recent example would be the global financial crisis, which seems obvious from today’s perspective as the house price appreciation and subprime lending was unsustainable, but was almost impossible to predict beforehand.

If the event will be a surprise, should investors fear it? Markets are cyclical and bear markets are to be expected, so do not count as black swan events. How about a sudden meteor strike, the outbreak of an airborne Ebola virus, or the rise of a hostile artificial intelligence?

It is questionable if investors should or can prepare specifically for these kinds of events. Furthermore, black swan and major events tend to be unique in nature and affect companies differently. Positions in defensive sectors like healthcare or factors such as Quality often turn out differently than expected. Investors would likely consider asset-backed businesses like real estate stocks safer than consumer-discretionary companies, but that was not the case during the global financial crisis.

In this short research note, we will investigate the performance of common equity factors after black swan and major events since 1990. The objective is to simply take a walk through financial history, not necessarily to evaluate how to best prepare for the unexpected.

METHODOLOGY

We focus on seven factors namely Value, Size, Momentum, Low Volatility, Quality, Growth, and Dividend Yield. The long-only factor portfolios consist of the 30% of stocks ranked most favourably by the factor definition. Only stocks with a minimum market capitalization of $1 billion are included. Portfolios rebalance monthly and transactions incur 10 basis points of costs. Please see our Factor Guide for the factor definitions.

BLACK SWAN VERSUS MAJOR EVENTS

We focus on 12 events that had major impacts on the world and financial markets. Some were positive and improved the lives of millions of people like the dissolution of the Soviet Union. Others focus on single companies such as the bankruptcies of Enron and Lehman Brothers.

It is worth noting that it is challenging to define which can be called black swan events. If we define these as simply unexpected events, then most obvious were the 9/11 terrorist attack on the United States and the Tohoku earthquake in Japan. Most of the other events were expected or could have been anticipated by investors with a certain probability. The 12 events are the following:

- 1990 Iraq invaded Kuwait

- 1991 Dissolution of the Soviet Union

- 1997 Asian Financial Crisis – Revaluation of Thai Baht

- 1998 Russian Financial Crisis – Revaluation of Ruble & Debt Default

- 2001 9/11 Terrorist Attack on the United States of America

- 2001 Enron Bankruptcy

- 2005 Hurricane Katrina in the United States of America

- 2008 Lehman Brothers Bankruptcy

- 2011 Tohoku Earthquake & Tsunami in Japan

- 2015 Greece Debt Crisis – In Arrears to the IMF

- 2016 2016 United States Presidential Election

- 2016 UK Brexit Referendum

We will highlight the performance of common equity factor portfolios for four of the 12 events before providing a summary analysis. The four chosen events are the 9/11 terrorist attack on the United States of America (2001), the Lehman Brothers bankruptcy (2008), the Tohoku earthquake and tsunami in Japan (2011), and the Brexit referendum in the United Kingdom (2016).

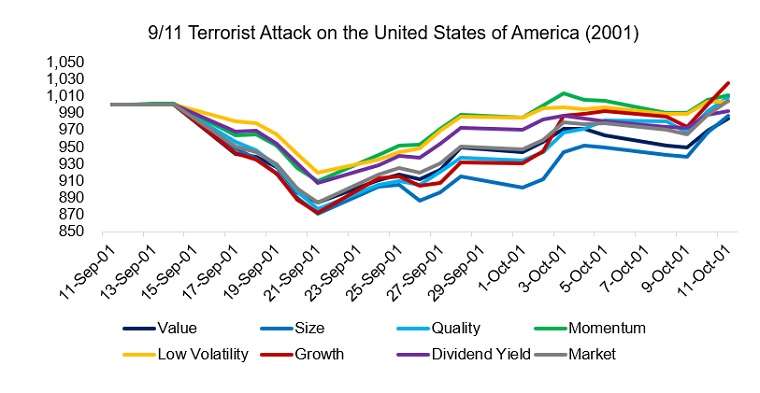

9/11 TERRORIST ATTACK ON THE UNITED STATES OF AMERICA

The terrorist attack in New York in September 2001 can likely be categorized as a black swan event as it was a sudden, unexpected event that struck the financial and military centers of the US. In hindsight, the event seems much more likely than beforehand.

The NYSE and Nasdaq markets were closed the days after the attack and opened significantly lower when trading resumed. The factor performance in the subsequent days was quite diverse and volatile. The dispersion in returns is explained by a strong sector rotation, e.g. airline and hotel stocks sold off aggressively in the days after the attack.

We observe that most factors followed the market, except for the Momentum, Low Volatility, and Dividend Yield factor portfolios, which all declined less. Although investors allocate to the Low Volatility factor for capital protection, it is less apparent why the other two factors outperformed. The Momentum factor performance can be explained by the sector exposure at that time, which had overweights in Consumer Staples and Healthcare as well as underweights in Consumer Discretionary and Real Estate stocks. However, the Momentum factor does not exhibit structural sector tilts over time, so the outperformance during 9/11 should be attributed to luck.

Source: FactorResearch

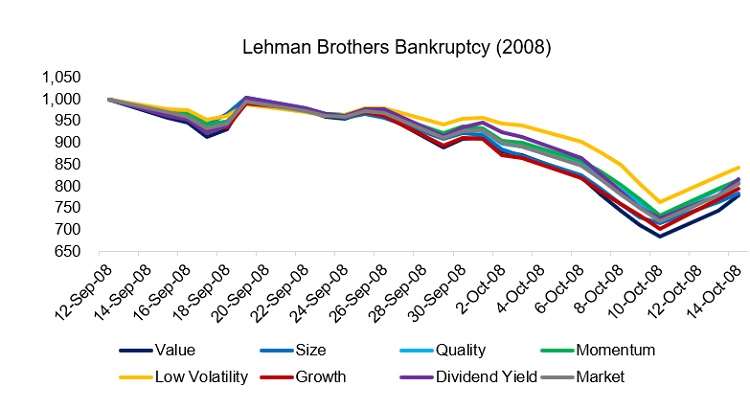

LEHMAN BROTHERS

The bankruptcy of the investment bank Lehman Brothers can be viewed as the symbolic low point of the global financial crisis in 2008 and 2009. The performance of the US stock market and factor portfolios was relatively homogenous post the event, which highlights the high correlation of all assets during the financial crisis and lack of diversification opportunities, especially within asset classes. Only when the market decline accelerated in the weeks thereafter, we observe attractive capital preservation characteristics of the Low Volatility factor portfolio.

Source: FactorResearch

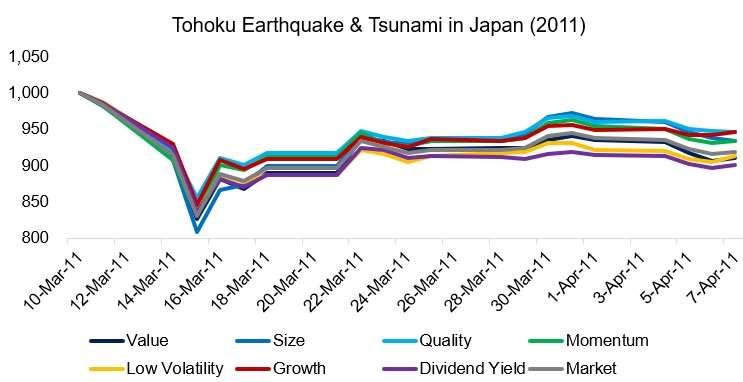

TOHOKU EARTHQUAKE & TSUNAMI IN JAPAN

The Japanese stock market lost approximately 15% in the days after the Tohoku earthquake and tsunami, which resulted in damaging the Fukushima nuclear plant and created a follow-on crisis.

In contrast to the previous two case studies, we can not observe an outperformance of the Low Volatility factor portfolio, which is explained by the large overweights to Utilities and Telecom sectors. Stocks from these two sectors were negatively impacted by the natural disaster. The Quality factor generated better returns, mainly due to exposure to highly profitably and lowly levered Technology stocks.

Source: FactorResearch

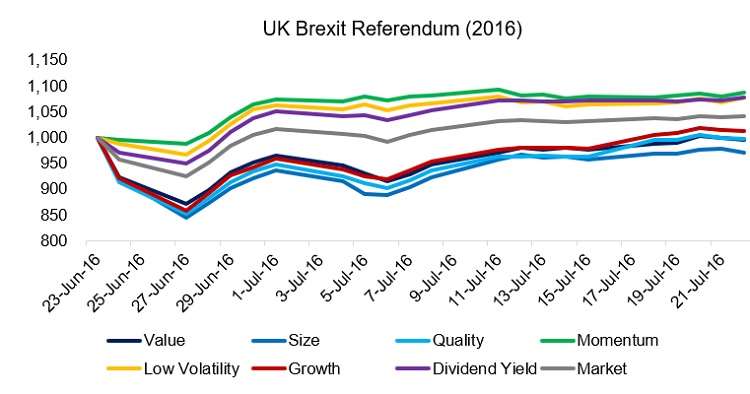

UK BREXIT REFERENDUM

Although the outcome of the Brexit referendum was a surprise to the majority of investors outside of the UK, it was not unexpected for the British people as the odds showed a decent probability of the UK exiting the European Union.

After the referendum results were announced, there was a clear bifurcation between small and large stocks. Small UK companies are more domestically focused, while their larger brethren are more export-oriented, thus benefitting from a lower exchange rate. The Size factor therefore exhibited the worst performance.

Source: FactorResearch

IMPACT OF BLACK SWAN AND MAJOR EVENTS ON FACTOR RETURNS

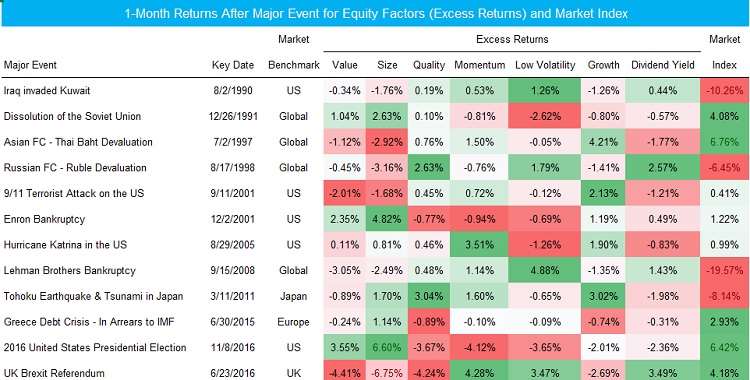

Next, we summarize the factor and market returns in the month subsequent to the event. It is worth noting that dates play an important role for some events like 9/11, while others like the Greece Debt Crisis took place across many months. Identifying the key date is often challenging and somewhat ambiguous.

Investors might have expected that the Low Volatility and Quality factors consistently show the best excess returns, but the analysis reveals an almost random factor performance post the major event. Only four out of the 12 events were negative for the market over the subsequent month.

Source: FactorResearch

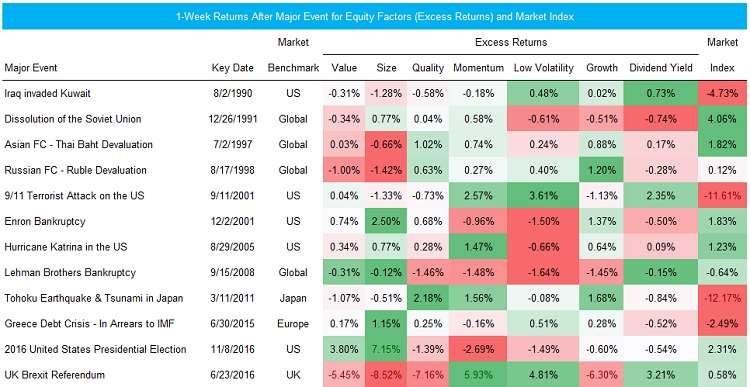

One month is a long time in financial markets and perhaps a shorter lookback might provide more insights on factor performance post a major event. However, the subsequent one-week returns highlight a similar random performance.

Source: FactorResearch

FURTHER THOUGHTS

This short research note highlights that factor returns were almost random after black swan and major events, which indicates the challenges of portfolio positioning even if an investor could anticipate such an event. Diversification across factors and asset classes is likely the best way to prepare for the expected and unexpected.