By Aaron Filbeck, CAIA, CFA, CIPM, Associate Director of Content Development at CAIA Association

Institutional investors have dramatically increased their allocations to alternative investments over the past few decades, including increased allocations to private equity. Private capital allocations remain highest in endowment portfolios, but other institutions, such as family offices and pensions, have begun to follow suit as future expected returns have looked relatively dire for public equities.

This trend has been exacerbated since the Global Financial Crisis (GFC), where investor capital has piled into private markets, leading to increased scrutiny around transparency, fees, and performance relative to public markets. Only further complicating the matter is the recent move (at least in the United States) to open access to a historically opaque industry to retail investors.

“The old adage claims that you should never talk about politics or religion around the Thanksgiving dinner table…maybe we should add private equity to that list.” – John Bowman

A recent panel discussion, co-hosted by John Bowman, CFA (Senior Managing Director of CAIA Association) and Greg Brown (Executive Director and Professor of Finance at Institute of Private Enterprise, University of North Carolina), with panelists Dan Rasmussen, Founder and Partner, Verdad Advisors, Christine Kelleher, CFA, CIO, National Gallery of Art, Chris Schelling, CAIA, Managing Director, Windmuehle Company, sought to answer the complex and multi-faceted question: is the allure of private equity (focused exclusively on buyout strategies) all smoke and mirrors?

A Look at Past Performance

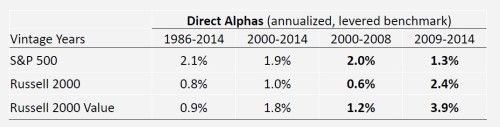

While the “since inception” return metrics have shown favorable outperformance of private equity relative to public equity, recent studies have argued that returns have converged with those of public equity (here, here, here, and here). In his opening remarks, Brown suggests that perhaps this mounting research doesn’t tell the whole story, citing Burgiss data that shows that public market equivalents (PMEs) direct alphas relative to a risk-adjusted benchmark have actually been positive over last decade. Of course, the level of alphas differs depending on the benchmark used for comparison, but is positive nonetheless.

Source: Have Private Equity Returns Really Declined?, Gregory W. Brown and Steven N. Kaplan, The Journal of Private Equity, Fall 2019

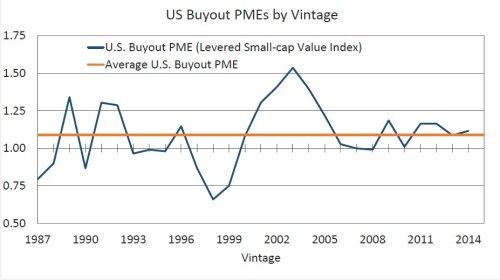

Additionally, when applying a Kaplan-Schoar PME (KS-PME), which assigns a performance multiple to funds relative to public market benchmarks, average multiples have been above 1.0. This suggests, on average, private equity has outperformed public equity even when adjusting for risk, fees, and other performance metrics. Perhaps, part of the reason private equity performance has faced negative perception is because KS-PME multiples have declined from the relatively high level experienced by mid-2000s vintage years. The long-term average KS-PME against a levered small cap value benchmark is around 1.1, approximately in line with today’s levels.

Source: Have Private Equity Returns Really Declined?, Gregory W. Brown and Steven N. Kaplan, The Journal of Private Equity, Fall 2019

However, it’s worth noting that empirical research with starting vintage years leading up to and during the GFC have KS-PMEs of around 1.0, meaning they performed roughly in line with public markets. In general, 10-year KS-PMEs are generally lower than 5-year and 15-year KS-PMEs, which could indicate an anomalous performance period.

On a Going Forward Basis

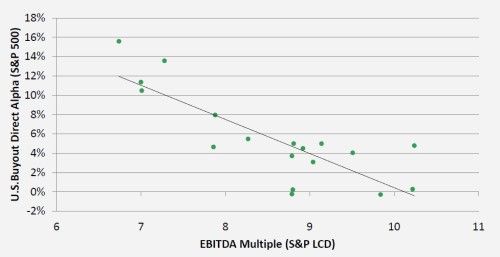

Depending on your view (and your starting point), performance metrics in the rearview may look great, but what about to new investors who haven’t entered the space or are looking to increase commitments? At a fundamental and cross-sectional level, Rasmussen’s thesis (which has also been supported by empirical research) is that the future drivers of private equity really rely to two factors: valuations and leverage.

Source: Have Private Equity Returns Really Declined?, Gregory Brown and Steven Kaplan, The Journal of Private Equity, Fall 2019. See also, Can Investors Time Their Exposure to Private Equity, Gregory Brown et al., 2020, forthcoming Journal of Financial Economics.

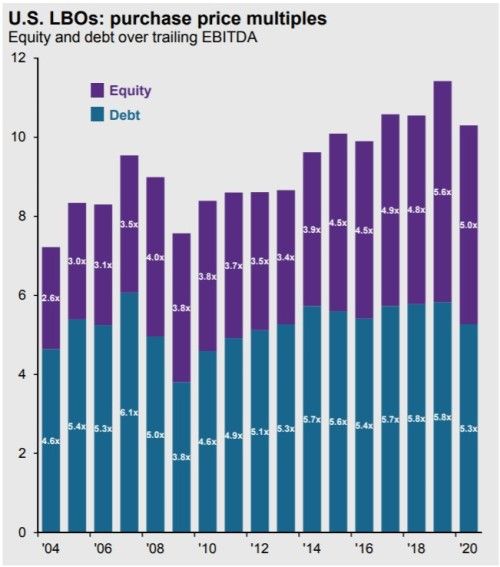

Research supports these claims and we see a strong empirical relationship between valuations and future performance. There is a strong negative relationship between the EBITDA multiple paid on a company, and its subsequent direct alpha relative to a publicly traded index. In fact, when deal multiples exceed about 10x, we expect to see negative direct alphas based on historical return patterns. So…where are we today? On average, deals currently sit in excess of 10x.

Source: JPMorgan Asset Management, Guide to Alternatives Q2 2020

However, Rasmussen notes that, while these two factors explain a majority or all of private equity performance, they don’t necessarily explain it at the same time. In fact, private equity manager commitments have historically been pro-cyclical. This means capital deployment ticks upward during the good times when debt is cheap and prices are high, which is the exact opposite of every investor’s mantra “buy low, sell high.” Performance has followed suit, and PMEs have historically be higher during periods where capital deployment is low.

Naturally, bankruptcies already tend be higher for smaller companies and companies with high leverage. If we look at the current environment, the average global buyout deal is around $600 million (the smaller end of publicly traded small cap stocks in US) and EBITDA multiples have grown substantially since the bottom of the GFC, and that growth has been driven by debt. Bankruptcies have also ticked up for PE-backed companies as the COVID-19 backdrop stifled economic activity, forcing many companies to slow or completely stop operations.

Making the Allocation Decision

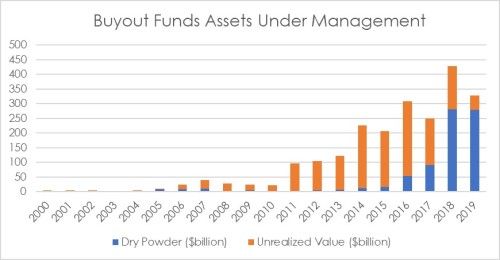

Even as private equity investor flows have caused increased company valuations, there’s still a lot that hasn’t even been put to work yet. As of December 31, 2019, Preqin shows the breakdown of invested capital and dry powder by vintage year, showing a good proportion of capital from last three vintage years sits in cash (note: we will see how this changes post-COVID). Schelling notes that 80% sits in funds $5 billion and larger. Regardless of the perceived or actual benefits private equity can provide for a portfolio, it could be difficult to see an environment where the average fund remains as competitive with public markets.

Source: Preqin Note: AUM figures are organized by vintage year

However, like many alternative investment strategies, private equity funds aren’t homogenous, and averages don’t tell the whole story. In fact, one major statistic is that small private equity funds tend to have lower average valuations than larger funds in the same vintage year. If valuations are a driving factor, perhaps the smaller market funds provide an opportunity relative to larger funds, even if absolute levels look expensive relative to history.

Regardless of where investors are looking, they should pay attention to both manager performance dispersion and performance persistence. Schelling, a former allocator himself, notes that unlike public markets, fund manager dispersion is much wider in private markets. However, unlike public markets private equity managers have shown return persistence, though Schelling emphasizes that this persistence has shifted from the organization level to the team and/or deal-making level, and it still takes a certain level of skill to select managers that persistently outperform.

Where are the bright spots? In her pursuit to build out a private markets program for her portfolios, Kelleher focused on trying to gain exposure while being creative with the structures. Hybrid managers (those who invest in both public and private opportunistically), evergreen funds (allowing the investors to better time commitments and redemptions relative to a LP structure), and replication products might be suitable solutions as long as risks remain elevated.

Bringing It All Together

While academic studies have shown that allocating to private equity can provide enhanced benefits in the form of returns and diversification for a traditionally public-only portfolio, those benefits may only be realized if certain factors are in place. Even if the institution’s strategic allocation calls for private equity, the current backdrop might suggest caution on the timing. Investors may want to consider allocating to smaller funds that can be nimbler and focus on valuations and leverage (if possible), or investigate creative structures, mentioned previously. Otherwise, investors may be faced with either allocating to over-levered and expensive companies, or having their investments locked up only to sit in cash for a better opportunity.

You can watch the recording of the discussion here.

Seek diversification of portfolio and people, education, and know your risk tolerance. Investing is for the long term.

Aaron Filbeck, CFA, CAIA, CIPM is Associate Director, Content Development at CAIA Association. You can follow him on Twitter and LinkedIn.