By Shana Sissel, CAIA, Spotlight Asset Group More than a decade ago the world of alternative investments witnessed hedge-fund-inspired Investment Act of 1940 (40 Act) funds appear on the scene. Much like their private alternative counterparts, liquid alternatives offer valuable diversification benefits within traditional portfolios, but it’s important to keep our expectations in check. Unlike traditional hedge funds, liquid alternatives are limited by the 40 Act in how and what they can invest in. These limitations can curb their alpha-generating potential compared to their hedge fund counterparts. There are three primary structural limitations that liquid alternatives face under the 40 Act. Liquidity: There is alpha in illiquidity, a key benefit offered by traditional alternatives, such as hedge funds and private equity. Investors often understand and expect that by giving up daily liquidity they should be rewarded with better returns. This can be generated in a variety of ways. For example, allowing the manager to invest in less-liquid investments or giving the manager time to trade more patiently. This illiquidity alpha is not available in liquid alternatives. The 40 Act limits the ability of liquid alternative funds to invest in illiquid securities (defined as instruments that take longer than seven days to liquidate in the public markets).[1] A 40 Act fund is mandated to maintain 85% of its portfolio in liquid assets. Shorting: The ability to go short as an investment strategy is what originally put the “hedge” in hedge fund. Strategies such as long-short equity and municipal bond arbitrage count on shorting to be a significant aspect of their investment approach. The rules of the 40 Act severely limit how much shorting can be done. As a result, many of the strategies that are most beneficial for diversification purposes cannot be effectively executed in a liquid alternatives structure. Leverage: Funds registered under the 40 Act cannot employ leverage as effectively as their non-40 Act peers. The 40 Act limits the use of leverage to 33% of the gross asset value of the fund, using either derivatives or securities as margin collateral. Leverage is a double-edged sword, but a manager with real skill in executing their strategy can use leverage to increase the rewards to shareholders. Leverage is often the key reason that liquid alternatives underperform like-minded hedge fund peers. Despite these structural limitations, the diversification benefits provided by liquid alternatives remain. Institutions have employed alternative strategies for decades with attractive results. Investors interested in alternatives are typically looking to achieve two main goals:

- Diversify away from conventional market risk

- Generate a source of return that has an economic rationale and is not entirely dependent on manager skill

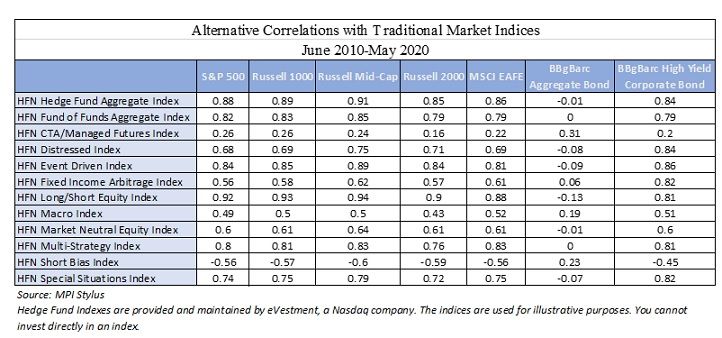

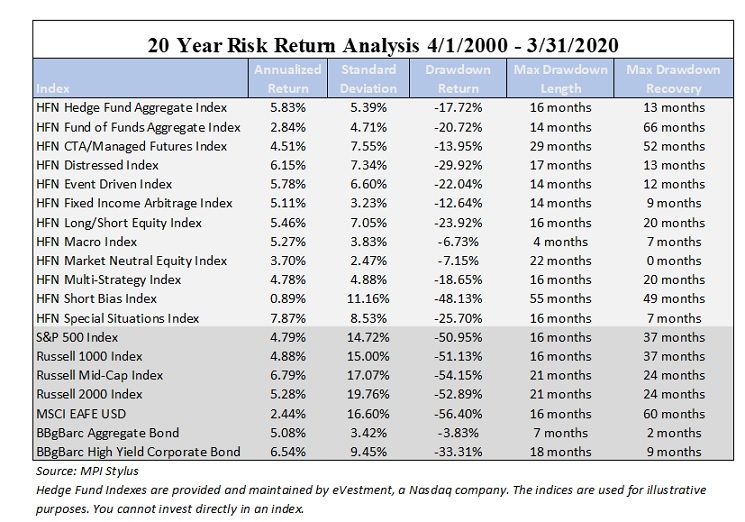

Alternatives have historically offered attractive risk-adjusted returns and show relatively low correlations to traditional equity investments. The table below shows the average correlations of the broad hedge fund indices with the more traditional investment benchmarks.  Hedging through shorts and option strategies allows alternative managers the flexibility to foster the consistency of returns. As a result, hedge funds can provide investors with an important benefit: the reduction of “volatility drag.” The public perception of hedge funds – above-average absolute returns – appears to be their initial appeal. But the truth isn’t quite so simple. In reality, an investor would likely be disappointed in the return stream of an average hedge fund. On paper, the returns don’t really blow you away. The clear advantage of the hedge fund is the elimination of volatility. The term “volatility drag” or “risk drag” refers to the actual, compounded, annual, real returns provided by an investment. This type of return stream is an often-ignored statistic that can have a significant impact on the actual returns seen by the client. The important takeaway from this is that drawdown periods (periods of negative returns) and recovery times are extremely important when evaluating an investment. Historically, alternatives have provided market-like returns but with smaller and shorter drawdown periods, making the investor’s realized, compounded return much more attractive.

Hedging through shorts and option strategies allows alternative managers the flexibility to foster the consistency of returns. As a result, hedge funds can provide investors with an important benefit: the reduction of “volatility drag.” The public perception of hedge funds – above-average absolute returns – appears to be their initial appeal. But the truth isn’t quite so simple. In reality, an investor would likely be disappointed in the return stream of an average hedge fund. On paper, the returns don’t really blow you away. The clear advantage of the hedge fund is the elimination of volatility. The term “volatility drag” or “risk drag” refers to the actual, compounded, annual, real returns provided by an investment. This type of return stream is an often-ignored statistic that can have a significant impact on the actual returns seen by the client. The important takeaway from this is that drawdown periods (periods of negative returns) and recovery times are extremely important when evaluating an investment. Historically, alternatives have provided market-like returns but with smaller and shorter drawdown periods, making the investor’s realized, compounded return much more attractive.  Whether using liquid alternatives or directly investing in hedge funds, investors can build an excellent alternative allocation. Understanding the limitations of their chosen investment option is the key to success. This material was prepared for information purposes only. This information is not intended to provide investment advice or solicit or offer investment advisory services. All information and data presented herein has been obtained from sources believed to be reliable and is believed to be accurate as of the time presented. You should not make any financial, legal, or tax decisions without consulting with a properly credentialed and experienced professional. Investing involves risk and past performance is no guarantee of future results. [1] Introduction and Overview of40 Act Liquid Alternative Funds, Citi Prime Finance. July 2013.

Whether using liquid alternatives or directly investing in hedge funds, investors can build an excellent alternative allocation. Understanding the limitations of their chosen investment option is the key to success. This material was prepared for information purposes only. This information is not intended to provide investment advice or solicit or offer investment advisory services. All information and data presented herein has been obtained from sources believed to be reliable and is believed to be accurate as of the time presented. You should not make any financial, legal, or tax decisions without consulting with a properly credentialed and experienced professional. Investing involves risk and past performance is no guarantee of future results. [1] Introduction and Overview of40 Act Liquid Alternative Funds, Citi Prime Finance. July 2013.

Interested in contributing to Portfolio for the Future? Drop us a line at content@caia.org