By Bill Kelly, CAIA Association CEO

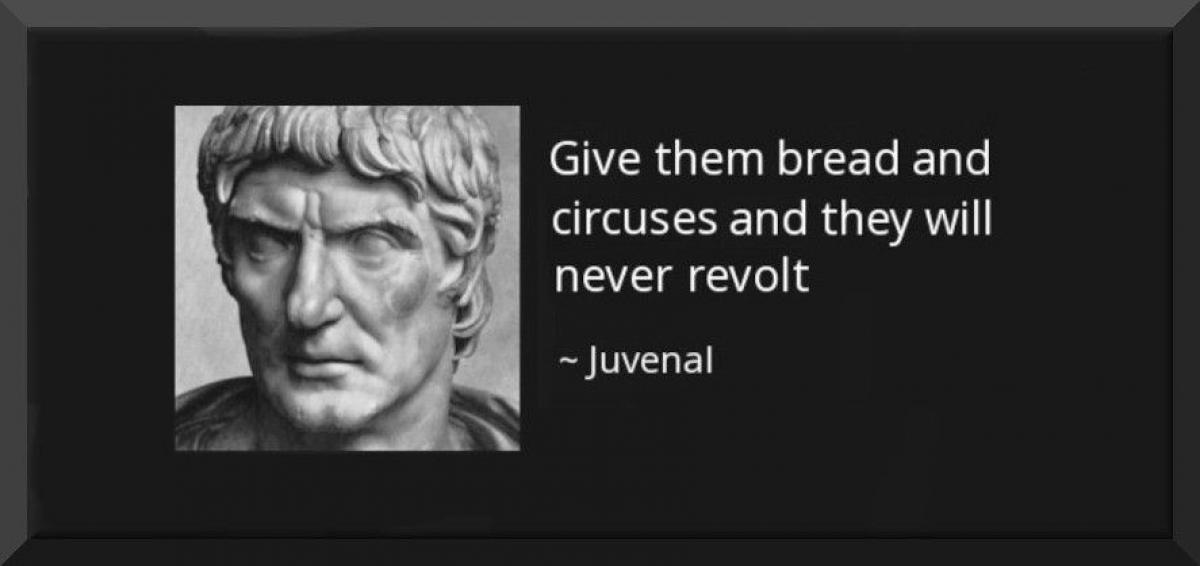

Pictured above is the bust and the borrowed line of Juvenal, a Roman poet from the late first century. His cynical reference to bread and circuses was simply to say: feed and entertain the masses and they will forget what they wanted in the first place. The announcement this week from the SEC regarding their final ruling on amendments to the definition of an accredited investor has a similar Juvenal twist for the average asset owner.

Last week’s news headlines heralded, “ease of access,” “game changing,” and “lower barriers for entry,” but the amendments might just be more superficial than real for the vast majority of investors. The rarified air of access now includes registered investment advisors, Indian tribes, specified government bodies, family offices of a certain size, and knowledgeable employees working for the GPs... the purveyors of these investment products. Certain designation holders also made the cut, and the pooling of spousal assets is now allowed to meet the asset and income hurdles. If you are, like most in this world, a natural born person, who does not work for a GP or is not a registered rep affiliated with a BD, there is nothing at all new to see here.

Those following this story also waited with bated breath regarding the income and asset level thresholds that had first been established almost 40 years ago and had not been indexed to inflation. The SEC acknowledged this fact but left this part of the definition unchanged. It is interesting to read parts of this particular analysis. In one paragraph on page 72 their ruling seems to give equal weight to an 11-page letter along with 37 footnoted citations (replete with charts and graphs) from the ICI, versus a simple one-paragraph letter from a frustrated engineer regarding opposing sides to this thesis. So much for your individual vote not counting in Washington DC!

The part of the discussion dealing with credentialing was an interesting one too. While the ruling was very prescriptive about who made the cut, the SEC also left the door open for the likes of the CAIA and CFA charterholders, as well as CFP certificants to gain access too. The specific inclusion of the 700,000-strong Series 7, 65 and 82 FINRA license holders as the newest accredited investors also has an important subtext; they only have access when acting as a principle for their own personal account and this ruling does not extend this privilege when acting on behalf of any client (see pages 79-80 of the above-referenced announcement). We could debate the merits of including a 22-year-old English major who just joined a BD and passed a low-stakes exam after two months on the job, but personal security transaction policies, minimum investment sizes, and Billions will largely inoculate this crowd from any form of public empathy.

Ultimately democratization needs a hard look along with equally hard investor-centric reforms. As previously reported here (and here), we have given the individual investor full responsibility for investment and longevity risk for retirement, at a time when the capital formation part of the market remains largely out of their reach. Nothing in the ruling last week addresses this, which is a shame and a big miss. Absent substantive intervention and reform, there will be very little bread and no entertaining circus acts in the future retirement of so many, but those professionals holding ethics based credentials (CAIA Association’s view) can be an important part of the building of this educational bridge; not for themselves, but for the benefit of the end investor.

Seek diversification of portfolio and people, education, and know your risk tolerance. Investing is for the long term.

Bill Kelly is CEO of CAIA Association. Follow Bill on LinkedIn and Twitter.