What is a smart city?

By definition, a smart city is “a city that uses technology and data purposefully to make better decisions and deliver better quality of life.” Technology is intricately embedded into the everyday life of city dwellers through network devices, applications, and widely distributed usage. The combination of these three components allow local governments, private companies and city dwellers (“Stakeholders”) to have a direct collaborative influence into the future of our cities. These three Stakeholders will play a pivotal role in implementing much needed efficiencies into current city structures if urban areas are expected to support approximately 70% of the world’s population by 2050.

The most important part of the smart city definition is “to make better decisions and deliver better quality of life”. Throughout this post, we will explore the necessity to retrofit our cities sustainably using environmental, social and corporate governance (“ESG”) and impact frameworks. The focal point will be converting current infrastructure and transportation into smart city standards as these are the biggest threats to future urban lifestyles.

Smart city technology

The first component of a smart city are network devices. Network devices are the foundation on which smart cities are built and include high-speed communications networks, open data portals, sensors and a critical mass of smart phones. Said otherwise, digital infrastructure is converged with physical infrastructure known as Internet-of-Things (“IoT”). IoT devices are being incorporated into each aspect of everyday city life, including but not limited to energy, mobility, security, healthcare, water and waste.

Wally Hunter, who has over 20 years of experience in the energy technology space and is Managing Director of EnerTech, recently shared his opinion that all devices will be internet-enabled and will have a power consumption toggle that the user will be able to monitor and adjust their carbon output instantaneously.

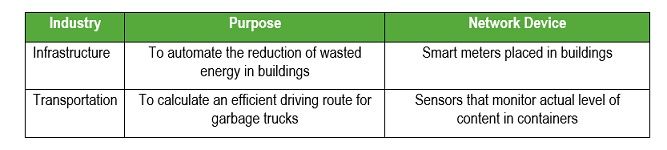

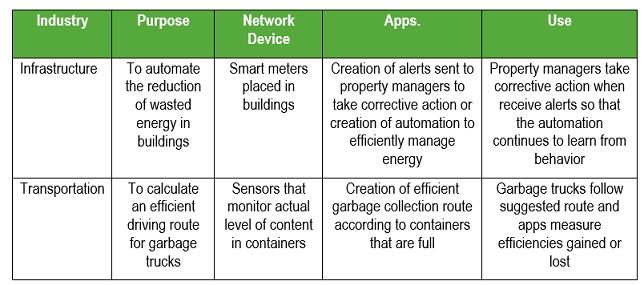

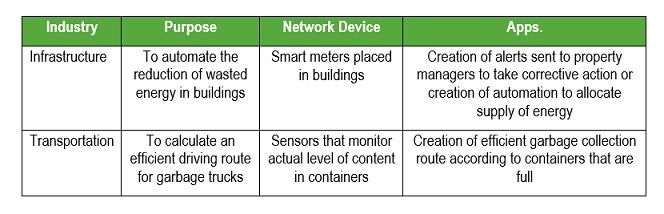

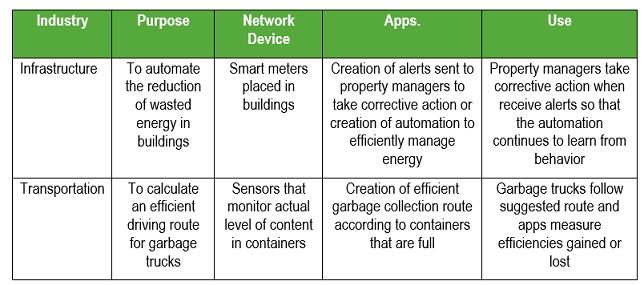

Below are two examples where IoT devices can help transform the infrastructure and transportation industries into smart city standards:

However, network devices only produce the raw data, while applications are needed to translate raw data into useful information. As a result, application developers are crucial to making a city smart. The applications digest the raw data and provide analytics and insights so that the Stakeholders can make informed decisions or even have decisions made for them using predictive analytics. The below chart outlines the next layer of technology and how it interacts with the IoT device.

The final layer is the continued and frequent use of the applications by the Stakeholders. Not only does this provide a better quality of life but also ensures that the feedback loop continues which creates further positive enhancements.

Do our cities need an upgrade?

With the drastic increase of 2.5 billion people expected to live in urban areas by 2050, city resources and current infrastructure will be stressed if enhancements are not made. Unfortunately, that is not the only concern. Currently, cities account for less than 2% of Earth’s surface but consume approximately 2/3rds of the world’s energy and produce approximately 70% of global greenhouse gas emissions because of infrastructure, transportation, commerce and urban lifestyles. On top of that, 90% of urban areas are extremely vulnerable to the effects of global warming because they are coastal cities.

Our current city infrastructure will not be able to sustain the expected population increase or climate change effects from that increase. However, by incorporating technologies that exist today and transforming current cities into smart cities, it is possible to cut carbon emissions by 90% by 2050. This includes making infrastructure more efficient, incorporating renewable energy into buildings, using different materials to build infrastructure and improving transportation.

It is estimated that in order to achieve these lower carbon emission levels it would require an investment of $1.8 trillion per year. However, starting in 2030 this investment would generate a return of $2.8 trillion per year which increases to $7.0 trillion per year in 2050. This results in an economic return of $23.9 trillion on a net present value basis over the next 30 years. The investment in lower carbon emission levels is also estimated to support 87 million jobs annually by 2030.

What is at risk if our cities are not upgraded?

Damage to U.S. real estate from extreme storms hit a record high in 2017, causing more than $300 billion in damage. These trends are estimated to continue and to increase in severity. Today, in the U.S., more than 300,000 coastal homes with a market value of approximately $117.5 billion and 14,000 coastal commercial properties with a market value of approximately $18.5 billion are at risk of inundation by 2045. Among those communities, Miami Beach faces the highest potential flooding-related real estate losses in the amount of $6.4 billion.

Luckily, the causes of climate change and the effects that it produces have not gone unnoticed. The frameworks of ESG and impact have been gaining traction in the marketplace and will hopefully be at the center of driving innovation for smart cities.

What are ESG and Impact Frameworks?

ESG and impact frameworks are two sides of the same coin; both are necessary to not only create smart cities but also a sustainable future in which all of Earth’s inhabitants thrive.

ESG primarily focuses on limiting risks and negative effects of a business process as it relates to environmental, social and corporate governance issues, while impact identifies positive evidenced-based priorities and intentionally works to measure and quantify the positive effects. A few of the key considerations as part of ESG are the following:

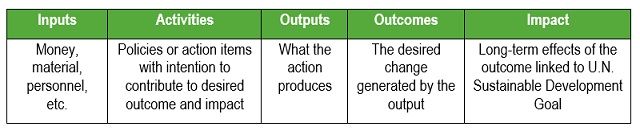

Impact investing starts with the end in mind, otherwise known as the Theory of Change. A clear end result is identified, and then necessary actions and steps are compiled in order to achieve the desired results.

Key steps in the impact process include:

Incorporating ESG and Impact into Smart Cities

In recent years, ESG adoption has been growing rapidly resulting in a secular market shift and is estimated that in the next 20 to 30 years, the millennial generation could put between $15 trillion and $30 trillion into US-based ESG investments. This trend has motivated investors and corporations to increasingly participate in meeting sustainability requirements.

It is estimated that 86% of corporations in the S&P 500 publicly report ESG performance through sustainability reporting. Specific to the real estate industry, approximately 89% of the top 100 REITs report ESG publicly. To put this into perspective, 84 of the top 100 REITs represent approximately 90% of the market capitalization of REITs.

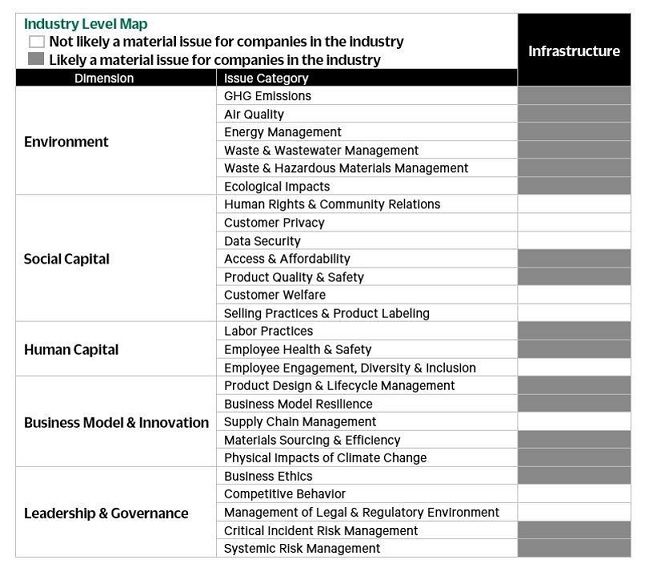

The Sustainability Accounting Standards Board (“SASB”) is one of the guiding frameworks that a number of REITs are using as the basis of their ESG reporting. Given the vast depths of ESG, SASB has identified material issues that are likely to impact the performance of different industries. Below is an example of the ESG considerations specific to the infrastructure/real estate industry:

As seen, environmental risks are the greatest concern for the infrastructure industry. Because of this, REITs and real estate developers have focused on constructing more Green certified buildings within their portfolio. Green buildings reduce energy consumption, water wastage and improve air and water quality which can cut carbon emissions by more than 30%.

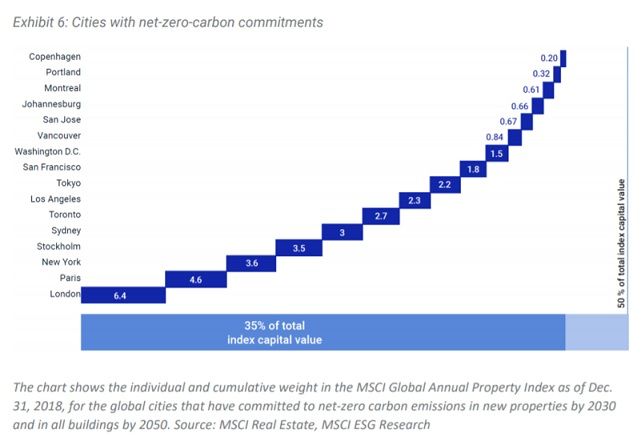

Green buildings not only positively influence the environment, but they also provide numerous benefits for the developer and owner. According to NAREIT’s industry report, Green certified buildings have led to reduced operating costs, increased property value, higher occupancy rates and higher rental income. As demand for Green buildings continue, there will no longer be a green premium but instead a brown discount. In other words, Green buildings are becoming the norm and buildings that do not meet the requirements will be priced at a discount. This continued trend can be seen in MSCI’s Global Annual Property Index which highlights the global cities that have committed to net-zero carbon emissions as a percent of the total index.

Additionally, David Fernandez, Managing Director of Goldman Sachs Renewable Power, shared that he has seen the cost of capital for renewable companies lower than that of fossil fuel companies. He also mentioned that the levelized cost of energy shows U.S. renewable energy prices lower than the cost of coal. The levelized cost of energy measures the total cost of building and operating a facility over its lifetime.

Allison Shapiro, Executive Director of Closed Loop Partners, stressed her opinion of the importance of decreasing emissions through infrastructure product waste diversion. This consists of optimizing the lifecycle of the product to extract the economic value that is still in materials to avoid more natural resource extraction. Examples of optimizing the lifecycle to decrease emissions include co-location of processing sites, last mile delivery, close proximity and distribution, and centralization of collection resources.

As renewable energy inputs are becoming cheaper and product lifecycles are being optimized, it allows companies to become more efficient with every dollar spent. This is one of the reasons why companies with high ESG scores, on average, also experienced lower costs of capital compared to companies with poor ESG scores.

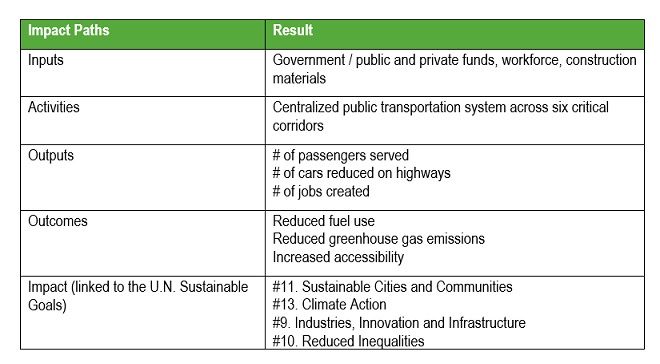

The other major cause of greenhouse gas emissions and an important factor into smart cities is the transportation industry, which we will look at from an impact framework perspective. More and more urban areas are investing into smart transportation to provide impact outcomes of improved mobility and reduction in greenhouse gasses. Given Miami-Dade’s public transport inefficiencies of long commutes over a short distance and average wait times of 30 minutes or more, we explore how the implementation of the much-needed Strategic Miami Area Rapid Transit (SMART) Plan is considered from an impact Theory of Change perspective:

Working backwards, one of the desired positive outcomes would be increased inclusive mobility which would create a positive impact of increased access to jobs and increased quality employment. Another desired positive outcome would be reduced fuel use of personal vehicles which creates an impact of decreased greenhouse gasses emitted. Of course, to create a much larger positive impact, renewable energy should be used to fuel the public transportation.

Current Smart City Examples

Numerous cities in the world are investing in the transition to a smart city. San Diego currently has the world’s largest IoT platform. The city created a network of connected lighting, sound and weather IoT devices based on the street lighting system which feeds data into an open cloud platform. This data is available to external developers who find different uses for the data. The initial cost incurred was approximately $30 million and it is estimated that it will decrease power consumption by 60% and save approximately $2.5 million per year. An important detail to note, is that the data collected by the IoT devices has been democratized via uploading the data to an open cloud platform. This represents a key implementation of ESG into smart cities by balancing the control of data and information across stakeholders.

Regularly ranked as the smartest city in South America, Santiago, Chile has committed to numerous initiatives to continue its trajectory. Since declaring a state of environmental emergency, the city has invested significantly in clean mobility through electric vehicles, electric buses and shared bike programs. Further, a Chilean start-up has created a technology platform to collect data and inform the government of the busiest city routes that do not have bike lanes as well as which bike lanes need improved infrastructure.

Smart cities don’t necessarily have to be centered around technology. The city of Paris is at the forefront of the development of 15-minute cities. The concept revolves around reorganizing city dwellers’ use of time to improve living conditions and the environment by structuring daily urban necessities within a 15-minute radius on foot or by bike. This includes work, home, shops, entertainment, education and healthcare. The concept was developed to decrease the dependency of using a car to purchase items which could be made on foot or by bike. Cities such as Barcelona, Detroit, London, Melbourne, Milan and Portland are all implementing similar concepts differently knowing that not all city dwellers are capable of working remotely or within a close vicinity to the office.

Conclusion

We live in an exciting time. With the exponential growth of technology and awareness of our negative effects on the environment, we have the capability to transform our cities into cities of the future. As we continue to interweave technology into all existing structures, we must do so with ESG and impact frameworks at the forefront of innovation. This will ensure that we are not only limiting our negative effects but also intentionally creating positive social and environmental change. We must also systemically approach impact investing in smart cities given the multi-faceted and interconnected nature of the aforementioned challenges to create lasting positive impact. To do so requires thoughtful portfolio construction, and a deep understanding of the key problems and desired solutions. Once key outcomes are identified and mapped to a theory of change, impact managers define relevant impact milestones, and measure towards their progress along with key financial KPIs.

There is no one right way to build a smart city, as evidenced above, but investment in smart cities must continue if we want to deliver a better quality of life and a cleaner environment.

This blog post was written by Julia Wilkinson, CEO and founder, and Kevin Webb of imvest.

imvest capacity builds family offices, funds, endowments and institutional investors on impact investing by designing and implementing impact strategy into the portfolio, asset allocation and enterprise.

Contact: julia.wilkinson@imvest.co kevin.webb@imvest.co