By Chris Keller, CFA, co-portfolio manager of Archean Capital Partners and Managing Director at Moelis Asset Management.

Is private equity still a 2 & 20 asset class? It depends on whether I’m referring to 2 & 20 fees or 2 & 20 returns. The 2% management fee and 20% carry has largely remained consistent. But achieving net returns of 2x MOI & 20% IRR is unquestionably less consistent. During my career, a 2x net MOI was always more of an aspirational objective and not necessarily a benchmark. But it hangs over the industry as a sort of unofficial expectation for locking up capital for 10+ years.

I thought it would be an interesting exercise to revisit the 2x expectation. I wanted to test that aspiration against actual results and better understand that goal from a probabilistic framework. I focused on MOI instead of IRR because it’s just more concrete and harder to manipulate.

A Probabilistic Framework:

There are three types of probability;

Classical – Measures the likelihood of something happening. Such as odds of heads when flipping a coin.

Subjective – Derived from an individual’s personal judgement or experience.

Relative Frequency – The number of times an event occurs divided by the number of trials.

Adopting a probabilistic framework is often at odds with the “high conviction” storytelling that influences decision making and therefore our individual incentives to express certainty. Probabilistic thinking also gets conflated with algorithmic decision making, which is why I will sometimes hear phrases like “probabilities don’t apply to private investing”. If I was making a case for classical probabilities, I would agree. This isn’t rolling dice or flipping coins. That’s not the case I’m making. And I’m not making a case against subjective probability. I do think pattern recognition, judgement and experience are valuable. This is especially the case if the individual, team or institution has a systematic process for learning from prior decisions. But what about relative frequency? Subjective analysis should probably incorporate an empirical understanding of how often an outcome occurs, also known as the base rate. It’s ok to bet against that empirical analysis but knowing how much your expectation deviates from the data should inform the level of certainty you have about the decision.

The 2x Myth:

Let me cut to the chase, 2x is not a high probability outcome when investing in private equity.

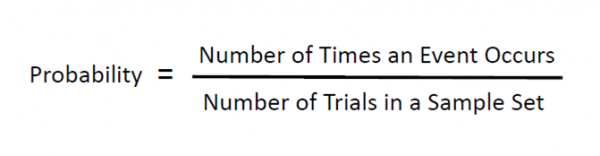

I pulled fund level returns from Preqin over a 20+ year period. I only included North American and European strategies >$100m in size across buyout, growth equity and turnaround. I chose these metrics because they will typically form the backbone of an institutional private equity portfolio. And I only went thru the 2011 vintage year to eliminate funds still maturing. With those filters, the data included a little over 1,200 funds or an average of 57 funds per vintage year and more like 75 funds per year since 2000. The chart below shows the probability of a 2x or better by vintage year.

It would have been nice to get into this business in the early 90s. A whole lot of people looked smart and made a lot of money! It’s not surprising that the probability of realizing 2x declined during the 90s as the asset class began to enter early adulthood. Except for some vintage year volatility around the last 2 recessions, the average probability of 2x is relatively stable at ~30-35%. Let me say that another way, the probability of NOT realizing at least a 2x is 65-70%.

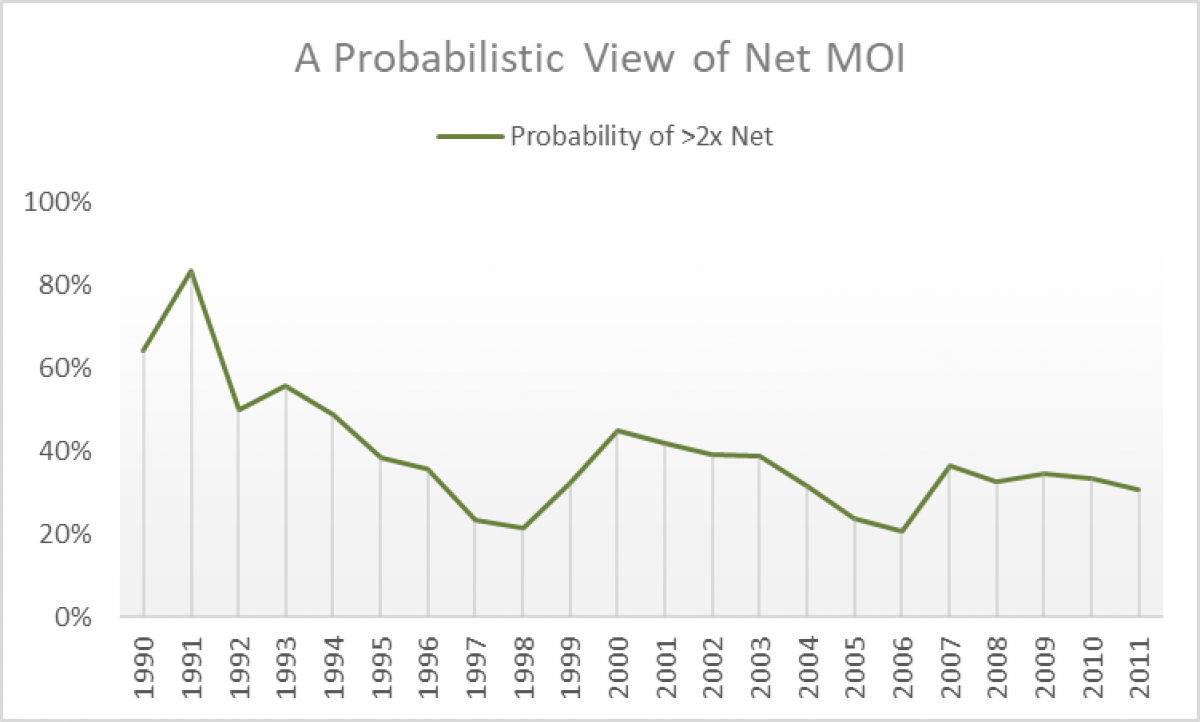

Obviously if the probability of not achieving a 2x is 65-70%, the probability of generating a 2.5x is even lower with almost 90% of funds not achieving that level of return. I insert this threshold for a couple of reasons. The first is that in certain segments of the market, there remains some hope or GP salesmanship around higher returns. But more pragmatically, if I’m an LP that owns 20, 30, perhaps 40+ funds across multiple vintage years, you have to own several 2.5x net funds just to counterbalance the funds below 2x to get back to a 2x at the total portfolio level. This assumes you aren’t perfect which some of us are not.

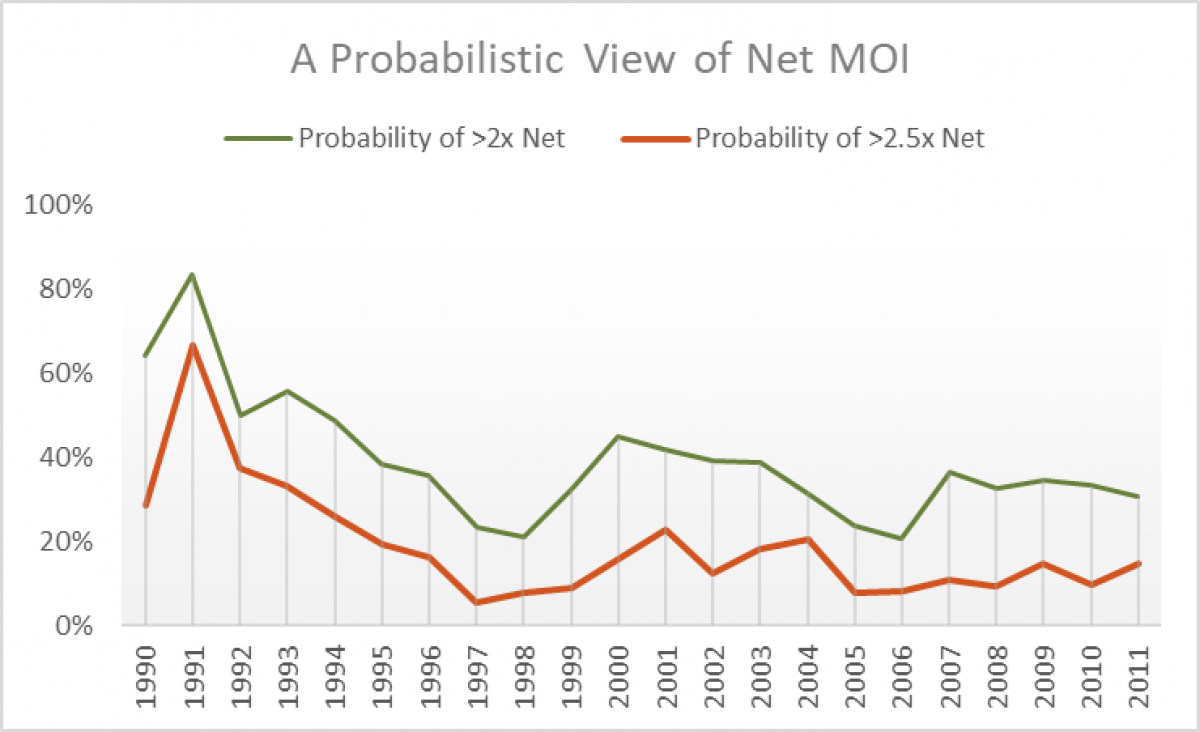

The second reason to introduce 2.5x is to look at the other side of the risk/return equation. From a purely probabilistic perspective, since the late 1990s the odds of getting 2.5x net is EXACTLY the same as getting a fund that doesn’t return captial. Clearly I’m not accounting for the magnitude of some outliers that might generate a 4x or better, while some of those <1x funds might be more like 0.99x. If you only owned 2 funds, and 1 was 4x and the other 0.99x, you’d still be pretty happy overall. (But just for perspective, a 4x or better happens 1% of the time)

So that’s the sober math. Sure, you can try to up the return potential by allocating to smaller funds, specialized funds or other strategies to improve overall returns. But you are almost certainly taking some form of risk to do so. There are no free lunches. And compounding the challenge is the fact that I cut the data off at 2011 to eliminate funds still maturing. Fundraising across the industry has almost tripled in this last decade, averaging $225 billion per year from 2000-2010 and averaging $600 billion per year since 2016. Increasing competition, elevated prices and more secondary buyout probably suggest a 2x net is even more challenging going forward.

About the Author:

Chris Keller is a Managing Director at Moelis Asset Management and co-portfolio manager of Archean Capital Partners. Before joining Moelis and Archean Capital, Chris led the Private Markets team and chaired the Investment Committee at Summit Strategies Group, an institutional investment consulting firm. Chris is a Kauffman Fellow, a CFA® charter holder and received an MBA from Washington University in St. Louis and an undergraduate degree in Molecular Biology from The University of Colorado LinkedIn