A review of a paper by William Kinlaw, Mark Kritzman, Sébastien Page, and David Turkington from Alpha Architect.

- Journal of Portfolio Management

- A version of this paper can be found here

What are the research questions?

Diversification has been around since the early 1950s and is often considered a “free lunch” in finance. But is that actually the case? We’ve highlighted here and here that the reality is more complicated than the theory. Consider the two basic assumptions about correlations in the context of mean-variance optimization: (1) Pair-wise correlations are assumed to be symmetrical relative to rising vs declining returns—they are, in fact, asymmetrical; (2) Diversification is assumed to be desirable when assets are rising and when they are declining—a questionable assumption.

This article examines the extent to which these assumptions hold and the extent to which investors should want them to hold. The authors deliver a clever quote from Mark Twain (or maybe it was Robert Frost) that nails the issue in simple terms: “Diversification behaves like the banker who lends you his umbrella when the sun is shining but wants it back the minute it begins to rain”. Nicely expressed!

In addition to using Monte Carlo simulations, the authors analyzed data on six benchmark indexes to represent six asset classes(1). The data was obtained from Datastream and covered the period January 1976 to December 2019. Data on emerging markets begin in January 1988. The following questions were addressed.

- Does diversification always benefit investors?

- How is correlation asymmetry measured?

- Do asset classes exhibit correlation asymmetry?

- What should investors do about it?

What are the Academic Insights?

- NO. The authors argue that while diversification is beneficial to investors on the downside, investors should prefer that it disappear when assets move in concert in an upward direction. In other words, Investors should seek out sources of diversification (-ρ) when assets are moving to the downside and “unification” (+ρ) when assets are moving to the upside.

- Correlation asymmetry is calculated for each asset class pair as the average difference between the empirical downside (and upside) correlation calculated at a threshold value for down and a threshold value for up markets(2). The correlations are calculated against two separate thresholds: one for an upside or downside threshold against one asset only or against a threshold for both assets.

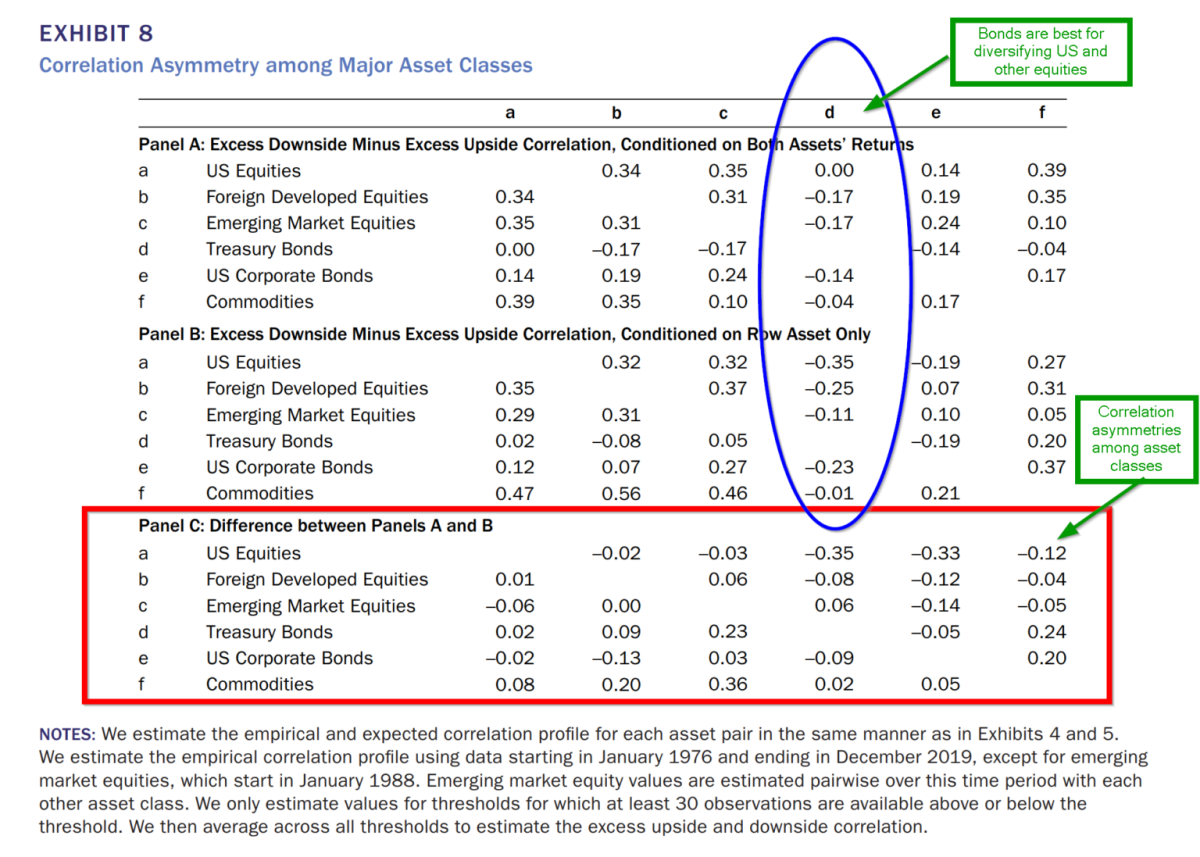

- YES. The results are presented in Exhibit 8 below. Note that emerging equity markets, international developed equity markets, and commodities exhibit the least attractive correlation asymmetries for US equities. However, Treasury and corporate bonds exhibited the most attractive qualities in terms of asymmetry. Further, Treasuries are universally attractive to all other asset classes when correlations are conditioned by thresholds. However, it appears that diversification potential appears larger when the correlation is calculated against a threshold for a single asset class. CAVEAT: interest rates are currently very low and price movement may be limited as a result. Commodities exhibited a negligible potential under either type of threshold conditioning.

- TWO OPTIONS ARE DISCUSSED. First, if regime shifts in the markets are expected then investors could increase allocations to “safe-haven” assets if the expectation is negative. This approach essentially requires investors to take a predictive stance with respect to which correlations are most likely to emerge in the future. Or, assign a larger weight to downside correlations when policy weights are being determined. This requires the investor to take a preparation approach by incorporating assets that would provide sufficient resilience during downturns.

Why does it matter?

The major contribution of this article lies in the application of the findings. We would recommend the interested reader to explore more fully the discussion of the third alternative for investors, a very technical method, that allows the use of full-scale portfolio optimization in the context of correlation asymmetry. The authors demonstrate that It is well within the reach of investors to use full-scale optimization to construct portfolios that account expressly for various asymmetric correlation situations. You can also reach out and set up a discussion on the topic of building robust portfolios that don’t suffer from poor correlation assumptions.

The most important chart from the paper:

Abstract

That investors should diversify their portfolios is a core principle of modern finance. Yet there are some periods in which diversification is undesirable. When the portfolio’s main growth engine performs well, investors prefer the opposite of diversification. An ideal complement to the growth engine would provide diversification when it performs poorly and unification when it performs well. Numerous studies have presented evidence of asymmetric correlations between assets. Unfortunately, this asymmetry is often of the undesirable variety: It is characterized by downside unification and upside diversification. In other words, diversification often disappears when it is most needed. In this article, the authors highlight a fundamental flaw in the way some prior studies have measured correlation asymmetry. Because they estimate downside correlations from subsamples in which both assets perform poorly, they ignore instances of successful diversification (i.e., periods in which one asset’s gains offset the other’s losses). The authors propose instead that investors measure what matters: the degree to which a given asset diversifies the main growth engine when it underperforms. This approach yields starkly different conclusions, particularly for asset pairs with low full-sample correlation. The authors review correlation mathematics, highlight the flaw in prior studies, motivate the correct approach, and present an empirical analysis of correlation asymmetry across major asset classes.

Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

About the Authors:

Mark Kritzman, CFA is a Founding Partner and CEO of Windham Capital Management, LLC and the Chairman of Windham’s investment committee. He is responsible for managing research activities and investment advisory services. He is also a Founding Partner of State Street Associates, and he teaches a graduate finance course at the Massachusetts Institute of Technology. Mark served as a Founding Director of the International Securities Exchange and as a Commissioner on the Group Insurance Commission of the Commonwealth of Massachusetts. He has also served on the Advisory Board of the Government Investment Corporation of Singapore (GIC) and the boards of the Institute for Quantitative Research in Finance, The Investment Fund for Foundations, and State Street Associates. He is currently a member of the Board of Directors of Protego Trust Company, the Advisory Board of the MIT Sloan Finance Group, the Board of Governors of St. John’s University, the Emerging Markets Review, the Journal of Alternative Investments, the Journal of Derivatives, the Journal of Investment Management, where he is Book Review Editor, and The Journal of Portfolio Management.

He has written more than 100 articles for peer-reviewed journals and is the author or co-author of eight books including Prediction Revisited: The Importance of Observation, Asset Allocation: From Theory to Practice and Beyond, Puzzles of Finance, and The Portable Financial Analyst. Mark won Graham and Dodd scrolls in 1993, 2002, and 2010 the Research Prize from the Institute for Quantitative Investment Research in 1997, the Bernstein Fabozzi/Jacobs Levy Award 10 times, the Roger F. Murray Prize from the Q-Group in 2012, and the Peter L. Bernstein Award in 2013 for Best Paper in an Institutional Investor Journal. In 2004, Mark was elected a Batten Fellow at the Darden Graduate School of Business Administration, University of Virginia. Mark has a BS in economics from St. John’s University, an MBA with distinction from New York University, and a CFA designation.

David Turkington is Senior Managing Director and Head of State Street Associates, State Street Global Markets’ decades-long partnership with renowned academics that produces innovative research on markets and investment strategy. David is a frequent presenter at industry conferences, has published more than 30 research articles in a range of journals, and currently serves on the editorial board of the Journal of Alternative Investments. He is co-author of the books “A Practitioner’s Guide to Asset Allocation” and “Asset Allocation: From Theory to Practice and Beyond,” and his published research has received the 2013 Peter L. Bernstein Award, five Bernstein-Fabozzi/Jacobs-Levy Outstanding Article Awards, and the 2010 Graham and Dodd Scroll Award. David graduated summa cum laude from Tufts University with a BA in mathematics and quantitative economics, and he holds the CFA designation.

Will Kinlaw is Senior Managing Director and Head of Research at State Street Global Markets. The team provides trade ideas and investment insights to thousands of investment managers, pension funds and sovereign wealth fund clients around the world. Its offerings leverage State Street’s proprietary information assets as well as data sourced through strategic partnerships with academics and alternative data partners.

Will and his co-authors were awarded the 2013 Peter L. Bernstein Award as well as the 2013, 2014, and 2015 and 2021 Bernstein Fabozzi/Jacobs Levy “Outstanding Article” Awards for their articles on liquidity, risk management, performance measurement, and diversification. His article on the role of sector exposures in describing the private equity premium won “Honorable Mention” for the 2016 Peter L. Bernstein Award. The second edition of his book, “Asset Allocation: From Theory to Practice and Beyond,” co-authored with Mark Kritzman and David Turkington, was published by Wiley in 2021.

Will serves on the editorial board of the Journal of Portfolio Management and the Journal of Alternative Investments. He holds an M.S. in finance from the Carroll School of Management at Boston College and a B.A. in Economics from Tufts University, as well as a CFA designation. He joined State Street in 2002.

Sébastien Page is head of Global Multi-Asset and chief investment officer at T. Rowe Price. He is a member of the Asset Allocation Committee, which is responsible for tactical investment decisions across asset allocation portfolios, as well as the Management Committee of T. Rowe Price Group, Inc.

Sébastien's investment has been with T. Rowe Price since 2015, beginning in the Asset Allocation department. Prior to this, Sébastien was employed by PIMCO as an executive vice president, where he led a team focused on research and development of Multi-Asset solutions. He also was a senior managing director at State Street Global Markets.

Sébastien earned a B.S. in business administration and an M.S. in finance from Sherbrooke University in Quebec, Canada. Sébastien also has earned the Chartered Financial Analyst® designation.

Sébastien coauthored award-winning research papers for The Journal of Portfolio Management in 2003, 2010, 2011, and 2022 and the Financial Analysts Journal in 2010 and 2014. He is the author of the book “Beyond Diversification: What Every Investor Needs to Know About Asset Allocation” (McGraw Hill, 2020) and the coauthor of the book “Factor Investing and Asset Allocation” (CFA Institute Research Foundation®, 2016). Sébastien is a member of the editorial board of the Journal of Portfolio Management and the Research Committee of the Institute for Quantitative Research in Finance (Q Group). He regularly appears in the financial media, including Bloomberg TV and CNBC.

Dr. Wes Gray: After serving as a Captain in the United States Marine Corps, Dr. Gray earned an MBA and a PhD in finance from the University of Chicago where he studied under Nobel Prize Winner Eugene Fama.

Next, Wes took an academic job in his wife’s hometown of Philadelphia and worked as a finance professor at Drexel University. Dr. Gray’s interest in bridging the research gap between academia and industry led him to found Alpha Architect, an asset management firm dedicated to an impact mission of empowering investors through education. He is a contributor to multiple industry publications and regularly speaks to professional investor groups across the country. Wes has published multiple academic papers and four books, including Embedded (Naval Institute Press, 2009), Quantitative Value (Wiley, 2012), DIY Financial Advisor (Wiley, 2015), and Quantitative Momentum (Wiley, 2016). Dr. Gray currently resides in the suburbs of Philadelphia with his wife and three children.

Dr. Jack Vogel conducts research in empirical asset pricing and behavioral finance. Dr. Vogel is a co-author of DIY FINANCIAL ADVISOR: A Simple Solution to Build and Protect Your Wealth and QUANTITATIVE MOMENTUM: A Practitioner’s Guide to Building a Momentum-Based Stock Selection System. His academic background includes experience as an instructor and research assistant at Drexel University in both the Finance and Mathematics departments, as well as a Finance instructor at Villanova University He has a Ph.D. in Finance and an MS in Mathematics from Drexel University. Dr. Vogel graduated summa cum laude with a BS in Mathematics and Education from The University of Scranton.