By Cameron Joyce, CFA, SVP, Deputy Head of Research Insights, Preqin.

Preqin’s forecast models see growth across the alternative assets spectrum, led by accelerations in private equity, private debt, and infrastructure

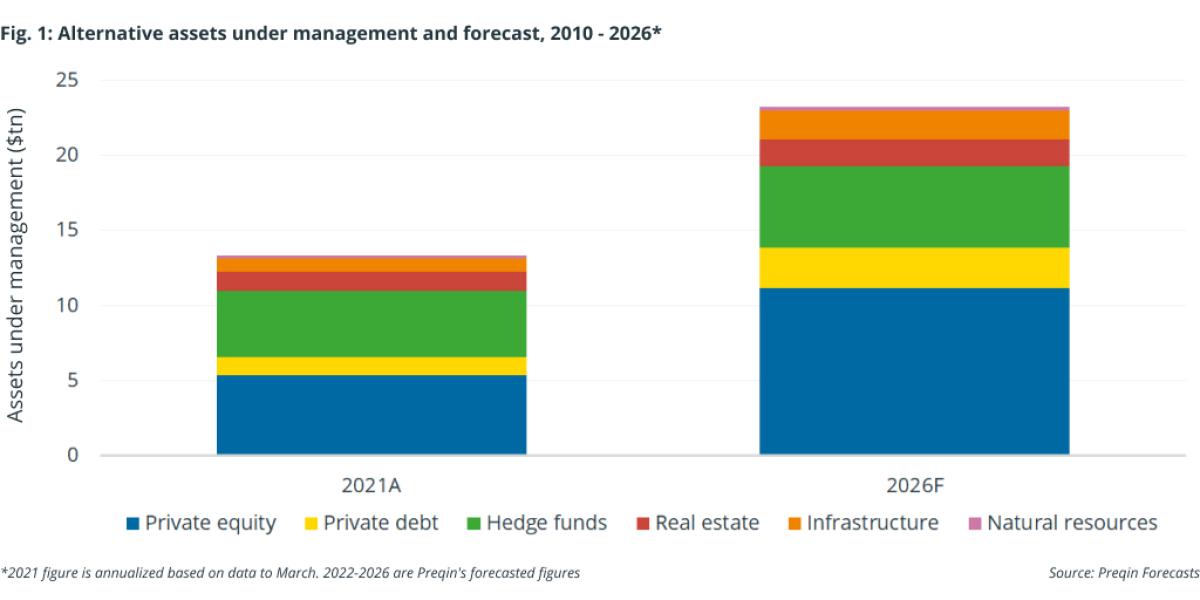

Preqin expects growth across alternative assets to accelerate over the next five years. Assets under management (AUM) in private capital grew from $4.08tn at the end of 2015 to $8.90tn at the end of 2021 (an annualized estimate based on data to March 2021), representing a compound annual growth rate (CAGR) of 13.9%. This was much faster than the 8.5% CAGR over the preceding five years, and Preqin is forecasting a faster CAGR of 14.8% between 2021 and 2026, taking private capital AUM to $17.77tn. We expect hedge fund AUM to grow more slowly, but a forecast CAGR of 4.2% would see AUM rise from $4.42tn at the end of 2021 to $5.44tn in 2026, giving an AUM total for the major alternative asset classes tracked by Preqin of $23.21tn (Fig. 1).

We expect the fastest AUM growth to be in private debt (CAGR of 17.4% between 2021 and 2026) and infrastructure (16.6%), but the engine of growth will be private equity because of its sheer size. Our model predicts that AUM in the largest alternative asset class will increase from $5.33tn in 2021 to $11.12tn in 2026. The 15.9% CAGR is not only above what the industry has enjoyed over the past five years, its substantially faster than the 10.2% experienced over the 10 years between 2010 and 2020.

The forecast model was created by Preqin’s Research Insights and Data Science teams, with more detail on the model and forecasts available in our 2022 Global Alternatives Reports.

Growth in all regions

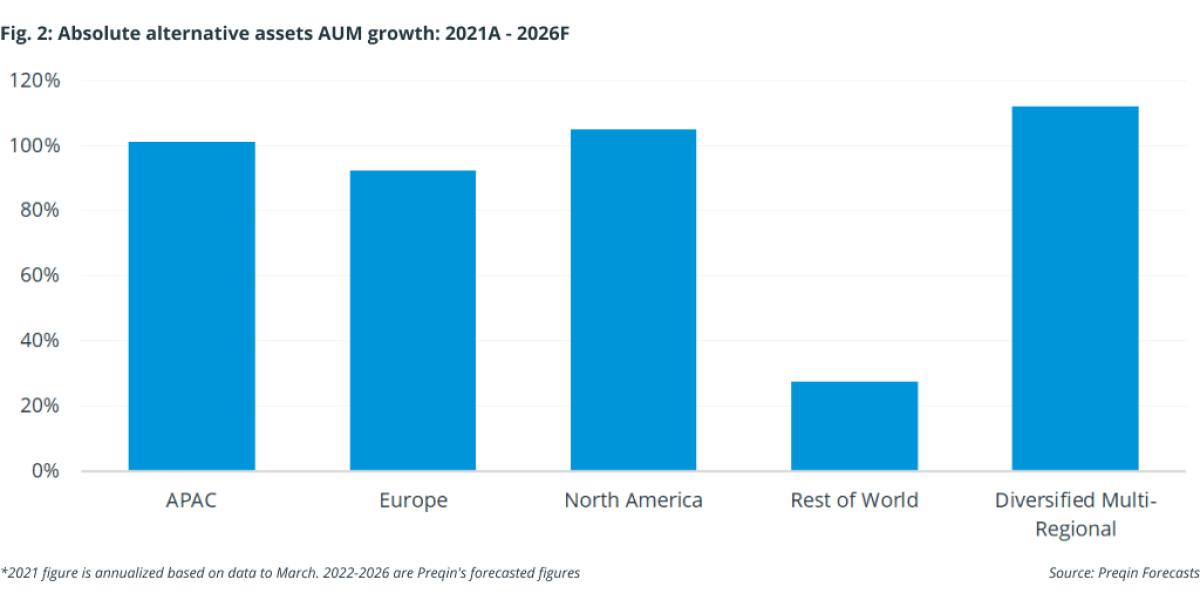

Perhaps surprisingly, we see similar growth rates in the three largest regions, with North America growing the fastest with a predicted CAGR of 15.4% between 2021 and 2026, closely followed by Asia-Pacific (15.0%) and Europe (14.0%), with AUM growth in Rest of World a much lower 5.0% (Fig. 2). AUM in diversified multi-regional funds is expected to grow at a CAGR of 16.2%, reflecting the increased draw of global mega managers without a specified single region of focus.

When we dig deeper into our regional forecasts, it becomes apparent that it is easier to grow an alternative asset market than to establish one. North America will likely experience growth across alternatives, with private equity, private debt, and real estate all boasting more than $1tn of AUM in 2026, and the largest, private equity, will account for 67% of private capital AUM. However, in Asia-Pacific, private equity will be even more dominant than it is now, with its $1.87tn of AUM accounting for 83% of the private capital total, as real estate trails a distant second with AUM of $191bn.

So, why do we think growth in alternatives AUM will accelerate? Firstly, we expect both components – the amount of dry powder available for investment and the unrealized value of existing investments – to increase over the next five years. Taking private equity as an example, fundraising will be driven by strong historic performance, with private equity delivering a net horizon IRR of 21.3% over the five years to June 2021, while strong exit activity will return capital to investors to be recycled back into private equity funds. In addition to this, the dynamics driving investors towards allocating more of their assets to higher returning and yielding investments will remain, even if there are increases in interest rates. The value of existing investments will increase as the larger sums of money that have been raised in recent years are deployed, while a trend for assets to be held for longer as the portfolio companies grow will also push up the value of unrealized investments.

Downside risks to AUM growth

There are, of course, downside risks that could lead to slower growth in private equity AUM. Some market participants expect materially higher interest rates would make the economics of buyouts, particularly the largest transactions, less favorable. But it would be easy to overstate this risk, as leverage is just one component of value creation in buyouts, with multiple arbitrage and operational improvement also important. On top that, markets appear not to be pricing in substantial increases in interest rates over the long term. The 10-year nominal bond yield is currently around 2%, while the implied real rate of interest is negative in the long term. Interest rates may be rising, but it is from very low – and negative in real terms – levels and a repeat of the dramatic hikes of the 1970s and 1990s is not widely regarded as likely.

Greater uncertainty surrounds stock market performance. A buoyant stock market would boost trade sale exits by giving listed corporates the firepower and currency to engage aggressively in M&A, as well as leaving the window open for investors to exit via IPO. Stock markets also set the valuations used by private equity investors as benchmarks for their portfolios of private companies, so stock market growth would drive an increase in unrealized value. On the other hand, if markets decline or stay in the doldrums, private market valuations will be lower, putting downward pressure on the total value of unrealized investments.

And, last but not least, what impact will the uncertainty arising from the war in Ukraine – and future unforeseen events – have? Whilst there will be impacts on many sectors and industries, at the headline level we expect investors continue allocating to alternatives. Our investor survey in November 2021 found that 90% of private capital investors are planning to increase or maintain their allocations and we do not expect this to change. Many investors missed out on the excellent vintages that followed the Global Financial Crisis as they pulled back allocations, sometimes by choice and sometimes because of changing allocation limits (the so-called denominator effect). During the COVID-19 pandemic, investors maintained commitments. In addition, the speed with which portfolio companies and fund managers reacted to the crisis, combined with improved LP-GP communication, reassured investors that private capital could perform well, regardless of the economic backdrop.

We are optimistic about the future of alternative assets. For institutional investors the question is less whether they should be investing in alternatives, more how they should be doing it and what benefits it can bring to their investment portfolios.

About the Author:

Cameron Joyce, CFA, SVP, Deputy Head of Research Insights, specializes in private equity and venture capital, globally and across emerging markets. He has previously worked in asset management for a pension fund and research at an investment bank. He is deputy head of Research Insights, a team of former analysts and financial journalists, including PhD, CFA, and CAIA qualified experts, who help institutional investors make sense of the increasingly complex world of alternative assets.