By Aaron Filbeck, CAIA, CFA, CFP®, CIPM, FDP, Managing Director and Head of UniFi by CAIA™.

Will the next decade look like the 2010s or the 1800s?

The concept of “frame of reference risk” has appeared in psychology, medical studies, and financial markets for many years – the basic premise is that our expectations are set by what we can observe. It’s human nature to do so, but its applications in investing cause us to compare ourselves to the wrong markets, asset classes, and benchmarks. Sometimes, it was easier to turn on the TV, get an adrenaline charge as we reacted to the red or green numbers across the screen, and ignore the nuance of our own goals. Complexity is hard and extremity feels good.

The Things We Take for Granted

“Always remember. Your focus determines your reality” – Qui-Gon Jinn, Star Wars: The Phantom Menace (1999)

To rephrase the great Jedi Master and take it a step further, frame of reference is everything, our experiences have been determined by a set of assumptions, and our reality is determined by what we observe and experience. A recent Tweet (X-eet?) highlighting a statistic from Vanguard hammers this home:

The punchline? Your allocation looks very different depending on when you first enter the market. Often, we take a backward-looking view when making forward-looking decisions, and the heaviest inputs into our decisions put the greatest weight on the most recent events. Plot twist: there are a lot of events that appear to be unraveling.

Let’s focus on three.

- Geopolitical Stability

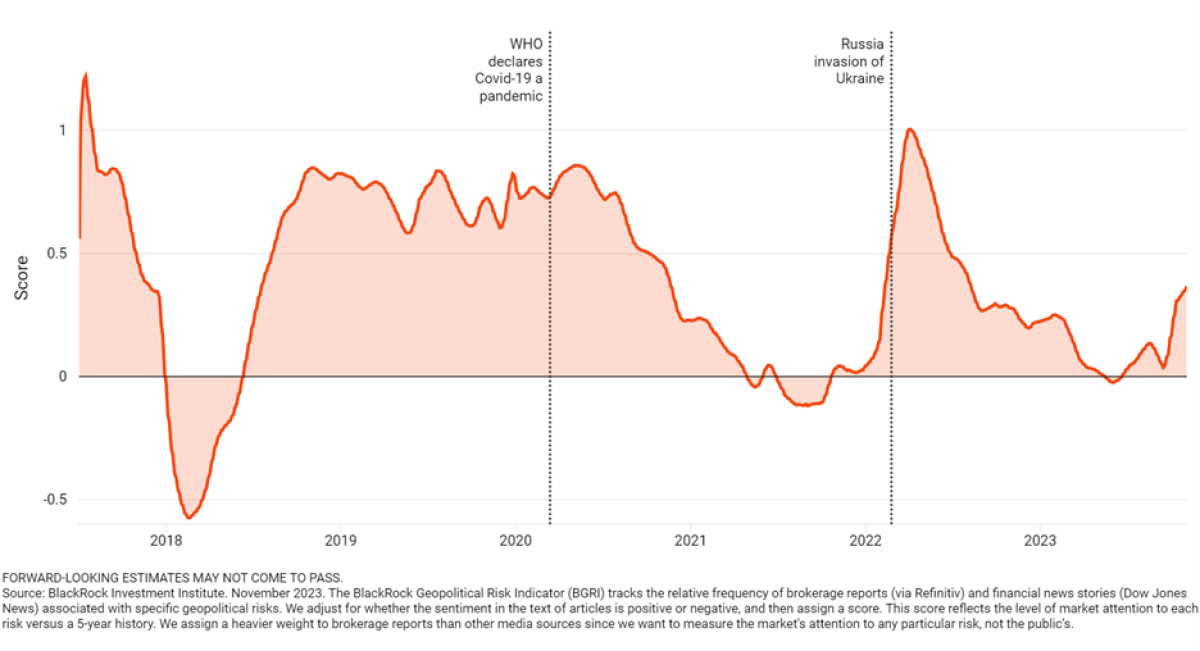

After decades of international cooperation and globalization, geopolitical instability is on the rise. One of my favorite indicators is the BlackRock Geopolitical Risk Indicator, which attempts to make this a bit more tangible. In the past, the indicators seemed to be a bit more benign, with a few big events popping up here and there. It now seems like a death by a thousand papercuts has begun: Brexit, COVID-19, China-US, Russia-Ukraine, Israeli-Palestine all adding to the narrative of unraveling cooperation amongst countries and civil unrest.

Bottom line: Past performance over the last few decades has had a backdrop of secular globalization and cooperation. How does that unraveling impact the future?

- Free Money

While on a panel a few weeks ago at ALTS Seattle, one of the other panelists boldly told the audience:

“Take a look at your portfolio today, look at every single asset class you own. The performance you’ve seen over the last ten to 15 years has had some proportion of it being driven by free money. Now is the time to look at every single manager you have, and ask: what happens when that goes away?”

The biggest implication for investors here is that a company’s cost of capital means something again and you must go deeper than the headline figures of interest rates to understand the implications. Private credit earned gathered assets over a period when rates were at rock bottom … what happens now? Rates may be attractive, but that’s a much higher cost to the underlying company. Is it sustainable?

Bottom line: Your assets must compete for space in your portfolio again. With money costing something, determine how each asset class or manager’s value proposition changes.

- Correlations Over the Long-Term

Since the early 2000s, the correlation between U.S. stocks and bonds has been negative, but that hasn’t always been the case. In fact, as pointed out by Larry Swederoe, writing for Alpha Architect, over long periods of time, the average correlation between stocks and bonds has been positive, albeit very dynamic. No one knows exactly where this relationship will go, but it’s important not to rely on the recent past to extrapolate into the future.

Source: WSJ

Bottom line: Don’t assume that asset class correlations are static. Diversification may be a free lunch, but the menu is always changing.

Looking into the Past

Almost four years ago, I wrote a piece on the importance of not relying on past performance and how different strategies come in and out of favor at different times. Here’s a snapshot I provided then:

The point was to put yourself in the time machine and go back to the end of the 90s, 00s, and 10s and look back at the previous decade … then look at the subsequent decade. The post focused primarily on returns, but the point was to try and put yourself in the shoes of someone sitting at that point in time with no view into the future. The point? Performance comes in cycles and regimes change, and you can’t extrapolate.

At the time of my original piece in 2020, COVID-19 was in full force and the mantra everywhere was TINA! Since then, we’ve had two massive equity drawdowns, an immense cryptocurrency boom and bust cycle, rapid growth and new skepticism around private debt, excitement and challenges in venture capital, and a re-emergence of interest in hedge fund strategies after nearly a decade of declaring them dead.

“What’s happened’s happened.” – Neil, Tenet (2021)

No one seemed to like Tenet when it came out, but I think it’s a good reminder that the past has already happened and while a useful guide to the future, you can’t simply drag and drop it into the future. Today, so many investors are still focused on rising rates, when rising rates have already happened – the question is not “what happens if interest rates go up?”, it should be “now that rates are higher, how does that change my assumptions?” Sometimes, we must go back even further beyond our lifetimes to challenge assumptions that we’ve ingrained into our decision-making.

Putting It All Together

Will the next decade look like the 2010s or the 1800s? Do we need a new playbook in this market regime, or do we just need to review the history books again? The truth is probably somewhere in the middle. I think the most valuable takeaway for all of us is to not take things for granted and broaden our frame of reference. After all, we’re the collection of our knowledge, perspectives, and experiences.

About the Author:

As Managing Director and Head of UniFi by CAIA™, Aaron Filbeck CAIA, CFA, CFP®, CIPM, FDP, oversees content and product strategy for the UniFi by CAIA™ Program. Prior to this, Aaron was responsible for the strategic direction of CAIA Association's content agenda, thought leadership, and member education initiatives, and supported content development for the CAIA Charter Program. His work has been published by Oxford University Press and The Journal of Investing, and covers topics such as ESG/sustainable investing, liquid alternatives, commodities, and asset pricing/factor investing. He is a frequent writer and speaker on these topics. Aaron’s practitioner experience lies in private wealth management, where he served as portfolio manager, overseeing asset allocation, portfolio construction, and manager research efforts for high-net-worth individuals and institutional retirement plans.

He earned a B.S. with distinction in Finance and a Master of Finance from Penn State University. He holds the Chartered Alternative Investment Analyst (CAIA), Chartered Financial Analyst (CFA), Certificate in Investment Performance Measurement (CIPM), Financial Data Professional (FDP) designations, is a CERTIFIED FINANCIAL PLANNER™, and holds the CFA Institute's Certificate in ESG Investing. He is a Past President of CFA Society Columbus and serves on the CFA Society Philadelphia Programs Committee. Aaron is an adjunct professor and serves on multiple advisory boards for Penn State University.