By Kai Wu, Founder & Chief Investment Officer, Sparkline Capital.

Since 2010, international stocks have stagnated. We argue this is due to their underinvestment in the intangible assets that drive growth today. Fortunately, within the international stock index lies a “right tail” of intangible-rich firms, many trading at attractive valuations. Extending prior research in the U.S., we find that these “intangible value” stocks also outperform in international markets. They offer U.S. investors a way to diversify into cheaper geographies without the unwanted bias against growth, innovation, and the intangible economy.

The Great Divergence

Lost Decade 👻

Since 2010, global equities have enjoyed a glorious bull market, buoyed by low interest rates and general prosperity. However, this period also witnessed a widening divergence between U.S. and international stocks (i.e., non-U.S. stocks).

Over this period, U.S. stocks produced a robust 10.3% per year above inflation while international stocks languished, eking out a meager 2.5% per year. Due to compounding, one dollar invested in U.S. stocks in 2010 is now worth almost three times as much as one invested in international stocks!

This divergence reflects the broader bifurcation wrought by the rising “intangible economy.” U.S. leadership in the new economy is exemplified by its many exceptionally profitable, innovative, and fast-growing firms, such as Apple and Nvidia. On the other hand, international markets remain dominated by traditional firms in banking, mining, and manufacturing.

International stocks’ lack of dynamism has led to a “lost decade” for investors. As the next exhibit shows, their real earnings per share in USD actually declined by 0.1% per year, in spite of U.S. stocks growing at a healthy 5.5% annual rate.

Stagnant growth is an existential problem for international stocks. It not only directly contributed -5.6% in annual underperformance relative to the U.S. but also precipitated a further -3.3% annual valuation hit, due to investors adjusting prices in anticipation of continued feeble growth.

Trapped in the Industrial Age 🦣🧊

We believe this stagnation is the result of international firms’ underinvestment in the intangible assets – intellectual property, brand equity, human capital, and network effects – that drive growth in the modern era.

In Intangible Value (Jun 2021), we created “intangible value” scores to quantify firms’ utilization of intangible assets. The next exhibit shows the market-cap-weighted average score for each country, with ranks in parentheses (1 is highest).

The U.S. stands out as the most intangible-rich country, followed by central and northern European economies like Germany, Ireland, Switzerland, Denmark, France, and the U.K. Next come Asian Tigers, such as Korea, Japan, and Taiwan, then Australia, Canada, and the rest of Europe. Least intangible are other emerging markets, such as Saudi Arabia, China, and Brazil.

This disparity is reflected in the international stock index’s heavy bias toward traditional, capital-intensive industries. Compared to the U.S., the international index has 20% more weight allocated to old economy sectors, such as financials, industrials, and materials. Conversely, it has 20% less in new economy sectors, such as technology and healthcare.

However, industrial differences do not tell the whole story. In the next exhibit, we compare the average intangible value scores of U.S. and international stocks in each sector.

In all eleven sectors, U.S. firms offer more intangible value than their international peers. The U.S. communications sector, which includes tech giants like Alphabet and Meta, not only is the overall most intangible sector but also boasts the greatest advantage over its international counterparts.

Moreover, not only are the U.S. tech giants more intangible, but so too are U.S. firms in financials, materials, and even real estate. Across all industries, U.S. companies have been quicker to incorporate modern technology, branding, and management practices into their respective businesses.

Our finding of U.S. leadership in the intangible economy should not be surprising. Despite its imperfections, the U.S. still has the world’s top universities, research institutes, and global brands. From Silicon Valley to Hollywood, the U.S. remains a top destination for entrepreneurship and talent.

Intangible-Led Growth 🚀

Why does this matter? Intangible assets are the drivers of growth in the modern economy. As the next exhibit shows, companies with greater intangible value have tended to enjoy more robust earnings per share in the future.

To be more precise, firms with one standard deviation more intangible value than their peers tend to grow 15% more over the next decade. But this growth occurs gradually. High intangible value firms actually have lower earnings the next year. Intangible investment, such as R&D, employee training, or brand marketing, often takes many years to pay off.

The link between intangible investment and future growth exists at not only the stock level but also the country level. The next exhibit illustrates this relationship by comparing countries’ 2010 intangible value scores with subsequent real earnings per share growth in USD (bubble size is proportional to 2010 market cap).

The correlation between starting intangible value score and subsequent growth is a robust 54%. On a market-cap-weighted basis, the correlation is an even higher 72%. Despite many other sources of variation, intangible value alone explains a remarkably large share of the differences in growth rates across countries over the past decade.

If we fit a regression line, we find that each unit of intangible value predicts 1.8% faster annual growth. Based on its lower starting score, this implies that the international stock index should have grown 5.1% less per year than the U.S., close to the 5.6% gap that actually transpired! 🎯

International Intangible Value

Intangible Superstars 🏆

Of course, while international companies use less intangible assets on average, a great deal of dispersion exists across individual firms. The box plot below shows the distribution of stock-level intangible value scores for each country.

The U.S. is the most intangible-rich country on average, although its lead diminishes without market-cap-weighting. More importantly, its slightly higher average is swamped by firm-level dispersion. For instance, the top-quartile Israeli stock is actually more intangible than the average U.S. one!

In other words, while the median international stock may be an asset-heavy bank or copper miner, the “right tail” of the distribution contains many firms exposed to the burgeoning intangible economy. Japan and the emerging markets have especially right-skewed distributions due to their cultivation of intangible-rich national champions, such as Samsung.

One quick way to visualize the “right tail” of the distribution, at least for intellectual property, is to examine the league table of the top ten recipients of U.S. patents in 2023.

Of the top ten spots, U.S. firms hold only four, with the other six belonging to Korean, Japanese, Taiwanese, and Chinese companies. In a sign of the times, IBM, which had famously held the top rank for 29 consecutive years, was dethroned by Samsung in 2022. Since then, Samsung has widened its lead, amassing over twice as many patents as IBM in 2023.

International companies are represented at the top of the league tables for not only intellectual property but also the other intangible pillars. The next exhibit shows international firms that score particularly well on each of the four pillars.

In addition to Samsung, firms like ASML, Airbus, and Takeda utilize specialized intellectual property to compete in chips, aircraft, and drugs. European luxury brands like Aston Martin and LVMH enjoy strong brand equity, while investment and consulting firms like Man Group and Accenture wield human capital. Network effects exist in both traditional telecom and modern ride-sharing, gaming, and e-commerce platforms.

Research has shown that stock market returns are driven by a handful of big winners, so why constrain ourselves to just the average firm? What if instead of buying all stocks in the index, we bought only those with high intangible value?

No Lost Decade 🎉

We follow the factor construction methodology introduced in Intangible Value (Jun 2021) but use the international rather than U.S. stock universe. As in the U.S., we select the top 150 stocks on intangible value score, weighted by score and sqrt(market cap). The next exhibit shows the portfolio, categorizing each holding based on its primary pillar.

The portfolio’s top ten holdings are Samsung, Accenture, L'Oréal, SAP, Siemens, Roche, AstraZeneca, Toyota, Shell, and Sony. These companies’ large weights result from the combination of their high intangible value scores and large market caps. That said, they still only constitute 19.7% of the portfolio, which is broadly diversified across 150 names.

As with U.S. intangible value, the international portfolio is mainly composed of intangible capital, with 88% weight in primarily-intangible firms. However, relative to the U.S., it relies more heavily on brand equity and tangible capital and less on intellectual property and network effects.

Our intangible value scores extend back in time, allowing us to backtest the historical performance of the factor. Each month, we rebalance the international stock portfolio using data available at the time. The next exhibit shows its performance compared to the international index.

International intangible value stocks outpaced the index by +5.2% per year. In total, they produced a +7.7% annual real return. If we adjust for U.S. dollar appreciation over this period, the strategy’s returns were actually similar to those of the U.S. It turns out that the “lost decade” was less about the divergence between U.S. and international stocks than between the intangible and tangible economies! 🤯

Disruption at a Reasonable Price (DARP) ⚖️

Next, let’s examine the characteristics of intangible value stocks to understand the reason for their outperformance.

For starters, the next exhibit compares the sector exposure of the international intangible value portfolio to that of the international index.

Compared to the international index, the intangible value portfolio has 32% more weight in new economy sectors, such as technology, healthcare, and consumer discretionary. Conversely, it has 32% less in old economy sectors, mainly driven by its underweight to financials.

While the strategy’s new economy bias did contribute to outperformance, it was not the only driver. In fact, more of its value added came from picking the right stocks within each sector than the right sectors themselves. The next exhibit decomposes the strategy’s total excess return into those derived from industry selection and stock selection.

Total excess return shows the return of the intangible value strategy relative to the international stock index. As we saw earlier, intangible value outperformed by +5.2% per year in a consistent manner (i.e., information ratio of 1.2). Of this total, industry selection contributed +2.0% per year, while stock selection added an even greater +3.2% per year.

Intangible value targets more innovative and fast-growing companies in all industries. This can be seen in the next exhibit, which compares the portfolio characteristics, both intangible and traditional, of the portfolio and index.

As the top panel shows, the portfolio has superior intangible value compared to the index. For each dollar invested, one obtains 2.9 to 4.3 times the R&D, marketing, patents, and PhD employees. It also has twice the share of firms working on disruptive technologies (e.g., AI, robotics). As a result, its expected growth rate is 60% higher than that of the index.

How much more do we have to pay for these more dynamic firms? It turns out that the portfolio’s higher intangible value and expected growth can be obtained at no additional cost, at least based on traditional valuation metrics. In fact, on price/earnings, price/book, and price/sales the portfolio is actually even a bit cheaper than the index!

In Investing in Innovation (Apr 2022), we coined the term “disruption at a reasonable price” (i.e., DARP) to describe the approach of buying innovative companies at fair prices. DARP is the key to the strategy’s outperformance. We see this in the next exhibit, which compares the returns of the strategy to the international value and growth indexes.

Since 2010, neither the growth stock index nor value stock index managed to materially outperform the broad market. Growth stocks’ faster growth was offset by drag from their higher valuations, while value stocks’ apparent discount turned out to merely be fair compensation for their inferior subsequent growth. The market was efficient.

Intangible value outperformed because its superior growth was not already baked into valuations. Earlier, we showed that intangible investment generates future growth, but this growth occurs slowly over the next decade. The market, perhaps due to its notoriously short attention span, appears not to have taken this relationship into account, setting prices roughly the same for intangible value as the market. Disruption was obtained at a reasonable price! 🎉

Intangible World Tour

Intangible Countries 🌎

Where in the world are intangible value stocks? The next exhibit shows the country exposure of the international intangible value portfolio.

The portfolio is geographically diversified, underscoring the existence of intangible-rich firms all across the globe. Its top allocation is to Japan, a market that has garnered a lot of interest from value investors, most notably Warren Buffett. The next largest allocations are to European intangible powerhouses Germany, France, the U.K., and Switzerland. Korea and Taiwan, along with Ireland, the Netherlands, and Sweden, round out the top ten.

In order to help us better understand why the strategy ended up with this particular country allocation, the next exhibit shows the primary pillar of its holdings in each country.

Its holdings in Japan, Korea, and Taiwan are mostly semiconductor and electronics manufacturers that leverage highly specialized intellectual property. German industrial manufacturing firms also fall in this category. Many of its other European holdings, such as those in France and Italy, are distinguished by world-renowned brands, while its Swiss and U.K. pharma holdings enjoy superior human capital.

As a quick aside, the story of Asia’s ascent to intellectual property leadership is particularly fascinating. The region’s steady rise stands out in the patent league tables, which we briefly reviewed earlier. The next exhibit compares the share of U.S. patents by country in 1963 and 2023.

From 1963 to 2023, the U.S. patent share decreased from 81% to 47%, a decline almost fully driven by the remarkable rise of Japan, Korea, China, Taiwan, and India, whose collective share surged from 1% to 32%. Meanwhile, the rest of the world maintained a relatively stable share, ranging between 18% and 21%. When it comes to intellectual property, the U.S. is no longer the only game in town!

Returning to our analysis of the intangible value portfolio, the next exhibit shows how its country exposures compare to those of the international stock index.

The portfolio’s top overweight is to Germany, which, as we saw earlier, is the most intangible country outside of the U.S. The portfolio also overweights other intangible-rich European economies, such as Ireland and France. While Japan is its top absolute allocation, it represents only a 2% overweight relative to the index. On the other hand, the portfolio is most underweight China, India, and asset-heavy commodity producers, such as Canada and Australia.

Next, let’s explore to what extent the strategy’s country tilts contributed to its historical outperformance. We apply the same methodology used in the earlier industry vs. stock selection attribution, but this time we decompose total excess return into country selection and stock selection.

Country selection contributed +2.1% annual returns. As we saw in Exhibit 7, intangible-rich countries enjoyed stronger subsequent growth and thus higher returns. However, stock selection was an even more powerful driver, adding +3.1% per year. Within each country, the highest intangible value stocks outpaced their less-intangible compatriots.

Emerging Markets 🌱

Asset allocators often design equity model portfolios using three regional building blocks: United States, international developed markets (i.e., ex-U.S.), and emerging markets. The next exhibit shows country memberships based on the popular MSCI index methodology. We also show the MSCI country weights, which are based on free-float market cap.

In the last section, we saw that intangible value worked well in the international stock universe. However, this does not necessarily mean that the factor works in emerging markets. Emerging markets not only comprise just a small subset of the international index but also tend to be less intangible-intensive than their more developed counterparts.

Thus, we need to test the factor separately in emerging markets. We use the same factor construction methodology as earlier, but this time we build two distinct portfolios, first selecting the top 150 stocks in international developed markets and then, separately, in emerging markets.

The next exhibit shows some of the top-scoring intangible firms in the emerging universe, grouped by primary pillar.

Asian manufacturing firms, such as LG, TSMC, and BYD, rely on IP to compete in markets ranging from semiconductors to washing machines. The most brand-intensive firms tend to sell food products (BRF, Bimbo, CJ), cars, and electronics. Those most reliant on human capital are hospital systems, consultants, and financials. Finally, Chinese internet giants, such as Baidu and Alibaba, dominate on network effects.

The next exhibit shows the full emerging market intangible value portfolio, segmented by primary balance sheet pillar.

The portfolio’s top ten holdings are TSMC, Tencent, Alibaba, Tata Consultancy, Samsung, MediaTek, Xiaomi, Hyundai, Vale, and Hon Hai. Compared to the U.S. and international portfolios, it is slightly more top-heavy, with the top 10 holdings comprising 29% of the portfolio. This reflects the more right-skewed distribution of both market caps and intangible value scores in emerging markets.

While still mainly intangible, the emerging intangible value portfolio relies more heavily on tangible capital than its more developed counterparts due to the prevalence of firms engaged in resource extraction, banking, and commodity manufacturing. Of course, this mix may change as these economies continue on their path toward modernization.

Next, let’s compare the historical performance of emerging intangible value stocks to the broader emerging index.

Earlier, we found that the “international stagnation” could be remedied by focusing on stocks with high intangible value. As we now see, this result also holds true within the emerging market subset of international stocks. Since 2010, emerging intangible value delivered an annual return of +7.2%, similar to that of international intangible value. However, relative to its weaker emerging equity benchmark, its excess return was an even greater +6.7% per year!

What fueled this outperformance? For investors in emerging markets, the most pivotal recent decision has been their allocation to Chinese stocks. At its peak in Oct 2020, China comprised almost 40% of the MSCI Emerging Markets Index. Since then, Chinese stocks have greatly underperformed the broader emerging index, lagging by an astounding -43%.

The next exhibit shows the strategy’s China exposure relative to that of the emerging index. For context, it overlays Chinese stock returns relative to emerging index returns.

Since 2010, the strategy has been consistently underweight China, albeit with considerable variance. Due to its value orientation, its China exposure has roughly been the inverse of Chinese stock returns. Its smallest underweight was in 2014, when Chinese stocks were near their relative lows. It increased its underweight as China rallied to its 2020 highs, hitting a peak underweight of -20%. Then, as Chinese stocks collapsed, it took profits and is now only -4% underweight.

How much of the strategy’s historical outperformance can be explained by its successful bet against Chinese stocks? To answer this, the next exhibit attributes its total excess return to country selection and stock selection.

As total excess return shows, the strategy beat the index by +6.7% per year. Over the past few years, its outperformance accelerated due to its successful anti-China bet. That said, this windfall only explains a small share of total returns. Not only did country selection also contribute in other periods, but the majority of excess returns were from stock selection, which delivered a consistent +4.0% per year.

While we believe that investors should also pay attention to country-level factors, such as geopolitics, demographics, and domestic policy, simply focusing bottoms-up on buying stocks with undervalued intangible assets has done a decent job picking not only winning stocks but also countries!

Going Global ✈️

Finally, let’s put everything we’ve learned into a fully global context.

We’ll start by studying the performance of the intangible value factor in the United States, international developed, and emerging markets universes. The next exhibit shows the excess returns of high intangible value stocks in each region relative to their respective indexes.

The factor worked well in all three regions, adding between +5.0% and +6.7% per year with consistency (i.e., information ratio between 1.0 and 1.4). In international developed, its excess returns were steady throughout, while in emerging markets, it received a boost from China’s post-2020 collapse. In the U.S., it experienced a mini boom-bust around the pandemic due to its implicit “small-cap bias” (the result of its weighting by square root- rather than full-market cap).

Interestingly, the correlations between the factor’s returns in the three regions are reasonably low, ranging between 25% and 50%. While the factor is constructed the same way in all markets, the resulting portfolios have, by definition, no overlap in their holdings. Modest correlations imply that investors can benefit from diversifying across regions.

Global investing not only expands the sheer size of the opportunity set but also enables investors to access a more diverse set of firms. We see this in the next exhibit, which compares the sector composition of high intangible value stocks in each of the three markets.

In all three regions, the top exposures are to technology and consumer discretionary. However, from here, they diverge. In the U.S. and emerging markets, the factor is more bullish on communications, while in international developed it finds more value in health care and industrials. Notably, in emerging markets, it holds more stocks in old economy sectors, such as energy, financials, and materials.

Lastly, let’s pull together all three regional intangible value portfolios into a single global portfolio. While there may be more optimal weightings, we’ll start by allocating among the three regions using the MSCI index weights. The next exhibit shows the full global intangible value model portfolio.

While the top holdings are still U.S. companies like Alphabet and Amazon, the portfolio is now much more global. It also holds meaningful positions in international firms, such as SAP, Roche, L'Oréal, Airbus, GSK, TSMC, Tencent, Samsung, Hyundai, and Vale. Its ability to access international markets conveys a considerable advantage, as many of the world's highest intangible value firms reside abroad.

In the intangible economy, firms compete across national boundaries (e.g., Boeing vs. Airbus), and supply chains link companies across the world (e.g., ASML, TSMC, Nvidia). The most dominant firms, regardless of domicile, leverage their prodigious intangible assets across a global customer base. Investing only in the U.S. risks missing out on a substantial share of the next generation of intangible leaders!

International Outlook

The Great Debate 🤼

Let’s now turn to the outlook for international stocks. The international stock allocation decision is the subject of fierce debate in the investment community. While some investors view international stocks as an amazing contrarian buying opportunity, others argue they are value traps to be avoided.

First, we’ll outline the bull case. On traditional valuation metrics, international stocks appear to offer a generational buying opportunity. As the next exhibit shows, after years of underperformance, international stocks now trade at the widest discount relative to U.S. stocks since 1980.

Proponents of international stocks argue that this discount is overdue for mean reversion, implying significant upside for international relative to U.S. stocks. For example, if the -51% discount shown above were to close, it would produce a 104% relative gain, likely spread over many years.

Moreover, international stocks may receive a further boost from currency appreciation. Since 2010, their currencies have depreciated against the U.S. dollar, compounding their underperformance for U.S.-based investors. However, as the next exhibit shows, the currencies in the international index now appear -26% undervalued relative to the U.S. dollar.

In theory, real exchange rates should be mean-reverting. Weak real exchange rates make exporters more competitive, which should in turn promote a stronger currency. This would provide an additional tailwind for U.S. investors in international stocks (assuming no currency hedge).

Bulls point to many potential catalysts for an international revival, such as concerns around surging U.S. government debt. In one sign the tide may be turning, Japanese stocks, after spending 34 years below their 1990 bubble peak, have finally retaken their all-time highs on the back of governance reforms and a reprieve from deflation.

The Bear Case 🐻

Let’s now hear the bear’s rebuttal. Skeptics argue that the international discount is actually justified by worse growth prospects. They point to the past thirteen years of zero real earnings per share growth, arguing that international firms are unlikely to escape this morass anytime soon.

This view is supported, at least directionally, by the evidence linking intangible investment and future growth. Foreign firms have, on average, invested less in intangible assets than have their U.S. peers, resulting in a bias against modern, innovative firms. Weaker intangible investment is likely to contribute to slower future growth as the intangible economy continues to gain in importance.

Another argument advanced by the bears is that the foreign discount embeds a “risk premium” to compensate investors for the fact that these firms tend to operate in less profitable, more cyclical industries with less shareholder-friendly governance and more geopolitical risk (e.g., China, Russia).

Importantly, when it comes to putting real money to work, investors’ revealed preferences are overwhelmingly on the side of the bears. The next exhibit shows the average equity allocation of U.S. financial advisors from a 2019 study.

While “home bias” is a commonly observed phenomenon, it has reached extremes among U.S. investors. As U.S. stocks have outperformed, allocations have crept north. As of a few years ago, U.S. financial advisors were already a whopping 18 percentage points overweight U.S. stocks compared to market-cap-weighted indexes.

After years of disappointment, most investors have written international stocks off as portfolio deadweight. While one could interpret this as a contrarian buying signal, in reality, most investors face career risk when attempting to deviate from their peer group. Buying the past decade’s losers is not exactly the hill most want to die on!

A Third Way 🔱

This “international dilemma” has put investors in a pickle. On one hand, investors would love to be contrarian heroes, backing the underdog before a huge comeback. At the same time, they are terrified by the potential embarrassment of sticking their necks out for the perennial losers, only to see them go nowhere for another decade.

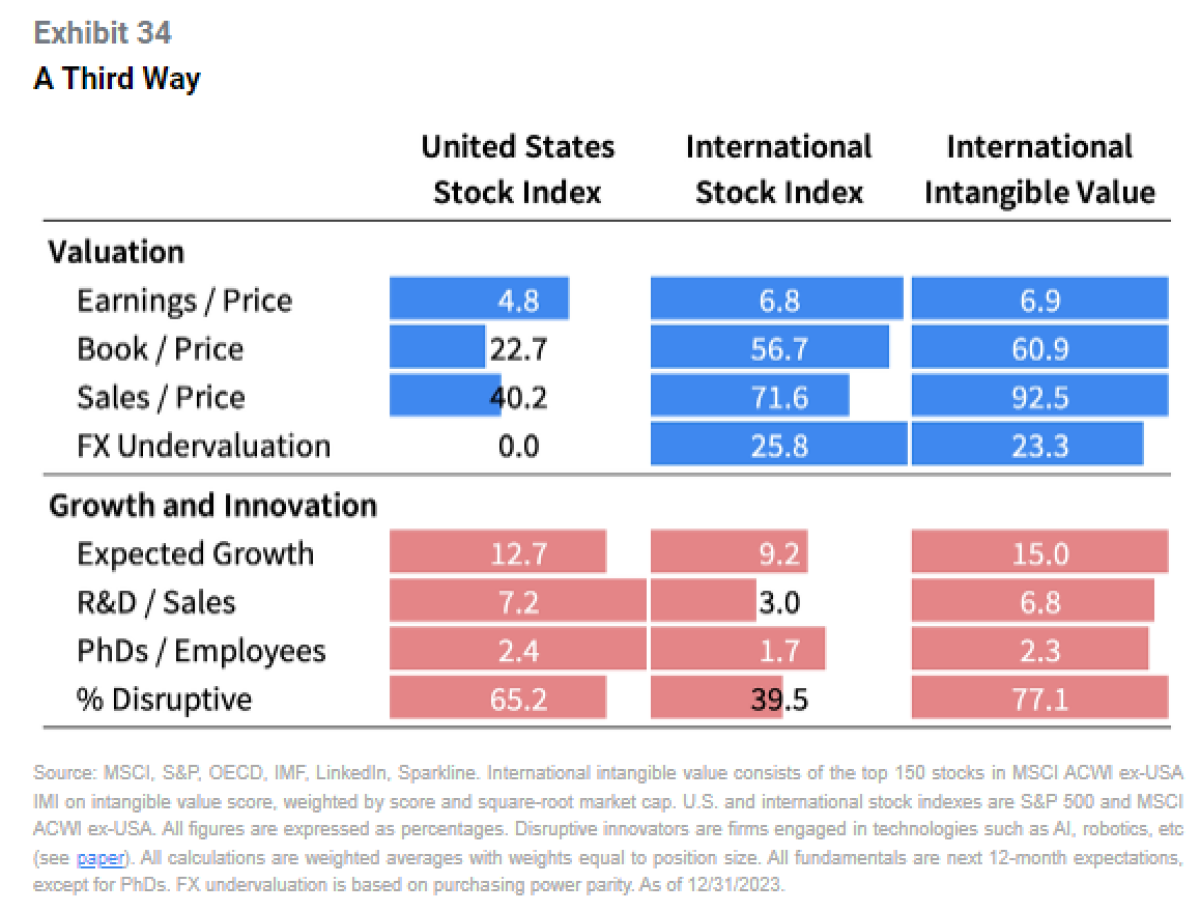

Fortunately, we believe there is a “third way” that allows investors to avoid making this tough choice. We see this in the next exhibit, which shows the portfolio characteristics of the U.S. stock index, the international stock index, and international intangible value stocks (i.e., the high intangible value subset of the international stock index).

The first two columns frame the perceived tradeoff at the heart of the “international dilemma.” U.S. stocks enjoy more robust growth and innovation but trade at less appealing valuations. In contrast, international stocks offer more attractive valuations but less growth and innovation. In this framing, investors are forced to choose between value and growth; achieving both simultaneously is not an option.

However, we believe this is a false dichotomy. As the third column shows, international intangible value stocks offer a “best of both worlds” alternative. These stocks trade at the same discounted valuations as the broader international index, while also offering the same attractive growth and innovation properties as U.S. stocks.

As discussed, intangible value’s ability to obtain “disruption at a reasonable price” was key to its past outperformance. Importantly, as shown in the prior exhibit, the market has yet to catch on and reprice the factor. Intangible value stocks still appear to offer superior growth and innovation at no additional cost on traditional valuation metrics.

In summary, we believe that international intangible value stocks provide a useful tool for investors seeking to diversify outside of the U.S., allowing them to take advantage of the foreign discount without compromising the growth and innovation characteristics of their portfolios.

Conclusion

Since 2010, international stocks have underperformed, due primarily to their lack of growth. We provide evidence that this weak growth can be attributed to their underinvestment in the intangible assets that power the modern economy.

Fortunately, the international stock index is quite diverse, with significant dispersion across countries and firms. While its average holding may be trapped in the industrial age, the index also harbors a promising “right tail” of intangible-rich firms, many of which boast attractive valuations.

High intangible value stocks selected from the international index outperformed by +5.2% per year, nearly matching the total local-currency returns of the U.S. market. It turns out that the international index’s underperformance was mostly an artifact of its lower exposure to the intangible economy; intangible-rich international firms have continued to thrive!

Importantly, the intangible value factor’s outperformance cannot simply be attributed to a few lucky style, country, or sector bets. First of all, it significantly outpaced both the value and growth indexes. And, while it helped avoid the Chinese stock rout, the resulting gains were only a small share of total returns. Stock selection, rather than country or sector selection, was its primary source of excess returns.

This paper extends our prior research on U.S. intangible value, finding that the intangible value factor works not only in the U.S. but in all three equity regions – U.S., international developed, and emerging markets. A global portfolio that allocates to intangible value stocks in all three regions can provide a more diversified and complete exposure to the burgeoning intangible economy than can the U.S. alone.

International intangible value stocks provide an interesting solution for U.S. investors looking to diversify internationally without sacrificing their exposure to the modern economy. We believe these stocks combine the best attributes of U.S. and international stocks, offering the innovation and growth of U.S. firms at the discounted prices of international ones.

Original Article

This paper is solely for informational purposes and is not an offer or solicitation for the purchase or sale of any security, nor is it to be construed as legal or tax advice. References to securities and strategies are for illustrative purposes only and do not constitute buy or sell recommendations. The information in this report should not be used as the basis for any investment decisions.

We make no representation or warranty as to the accuracy or completeness of the information contained in this report, including third-party data sources. This paper may contain forward-looking statements or projections based on our current beliefs and information believed to be reasonable at the time. However, such statements necessarily involve risk and uncertainty and should not be used as the basis for investment decisions. The views expressed are as of the publication date and subject to change at any time.

The performance shown reflects the simulated model performance an investor may have obtained had it invested in the manner shown but does not represent performance that any investor actually attained. This performance is not representative of any actual investment strategy or product and is provided solely for informational purposes.

Hypothetical performance has many significant limitations and may not reflect the impact of material economic and market factors if funds were actually managed in the manner shown. Actual performance may differ substantially from simulated model performance. Simulated performance may be prepared with the benefit of hindsight and changes in methodology may have a material impact on the simulated returns presented.

The simulated model performance is adjusted to reflect the reinvestment of dividends and other income. Simulations that include estimated transaction costs assume the payment of the historical bid-ask spread and $0.01 in commissions. Simulated fees, expenses, and transaction costs do not represent actual costs paid.

Index returns are shown for informational purposes only and/or as a basis of comparison. Indexes are unmanaged and do not reflect management or trading fees. One cannot invest directly in an index.

No representation or warranty is made as to the reasonableness of the methodology used or that all methodologies used in achieving the returns have been stated or fully considered. There can be no assurance that such hypothetical performance is achievable in the future. Past performance is no guarantee of future results.

About the Author:

Kai Wu is the founder and Chief Investment Officer of Sparkline Capital, an investment management firm applying state-of-the-art machine learning and computing to uncover alpha in large, unstructured data sets.

Prior to Sparkline, Kai co-founded and co-managed Kaleidoscope Capital, a quantitative hedge fund in Boston. With one other partner, he grew Kaleidoscope to $350 million in assets from institutional investors. Kai jointly managed all aspects of the company, including technology, investments, operations, trading, investor relations, and recruiting.

Previously, Kai worked at GMO, where he was a member of Jeremy Grantham’s $40 billion asset allocation team. He also worked closely with the firm's equity and macro investment teams in Boston, San Francisco, London, and Sydney.

Kai graduated from Harvard College Magna Cum Laude and Phi Beta Kappa.