By Claire Sawyer, Associate Director of Content Development, CAIA Association

It’s no secret that private markets have undergone some pretty dramatic changes in recent years. The historical divide between public and private is narrowing, forcing both GPs and LPs to rethink their typical playbook. For those focused on alts, this convergence introduces some unique opportunities and risks, requiring an evolution of both mindset and toolkit. Private markets, meet public problems.

We recently sat down with Tim Koller, Partner at Mckinsey & Company, to explore what this convergence means for valuation, exits, AI-driven theses, and market mispricing. You can watch the full conversation here.

One might (understandably) expect that this new and arguably more complex environment also demands a more complex approach, but this isn’t necessarily the case. What it does demand is an approach that’s more refined and reliable; it’s not about what’s new and flashy, it’s about what actually works. At the risk of provoking some of Elon Musk’s more rabid fans, a Tesla’s sleek profile and luxury features don’t mean much if the thing doesn’t start (or it self-drives you into a semi-truck). In today’s market environment, we can afford neither stagnation nor approaches that are all form, no function. If there were ever a time to go back to dependable “basics,” it’s now… Toyota Camrys of the investment world, this is your moment.

Editor’s Note: No Teslas were harmed in the writing of this article.

Where We’re Going, We Do Need Roads

As the public-private convergence accelerates, it becomes increasingly important for valuation methods to keep pace. The traditional approach of assigning a single value to a private asset simply doesn’t meet the mark anymore. And with real-time public market feedback now more closely linked to private company assessments, the challenge shifts from just identifying a number to understanding how value is created and how it changes over time. It’s less about the specific price and more about the direction of travel. Think of it like GPS: you can follow a turn-by-turn system that takes you on a reliable route, or you can let autopilot take over and hope it doesn’t reroute you into a lake à la Michael Scott because that’s technically the shortest path to your destination. The distance matters, but there’s more to a successful trip than the mileage. (Obligatory shoutout to MapQuest.)

Leading GPs are already on the ball. Their focus has sharpened around discounted cash flow modeling and identifying tangible levers for incremental value creation. The question isn’t just, “What is this company worth today?” but “How can we make it worth more tomorrow?” LPs, on the other hand, need to elevate their analytical game. As they engage more directly with GPs, the need for talent that’s capable of dissecting company fundamentals rises in tandem. Simply relying on IRRs or historical performance isn’t good enough. In a world that’s changing quickly, LPs need to go back to basics, re-engage with forward-looking valuation techniques, and understand the assumptions that underpin them. In other words, learn how to pop the hood and know what you’re looking at.

Exit Strategies: A Getaway Car that Doesn’t Stall

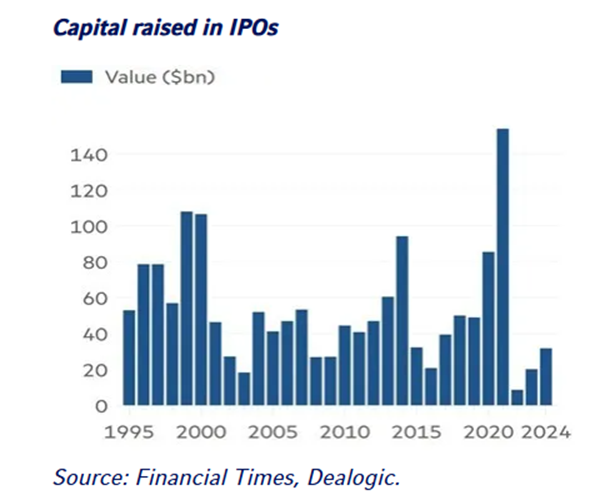

When it comes to exits, there's a growing recognition that predicting market cycles or strategic buyer interest years in advance is a speculative game (and, arguably, a fool’s errand). Rather than try to time IPO markets, which are cyclical, investors may need to return to first principles: focus on improving the underlying business. This includes investing in talent, enhancing operations, and building competitive advantages that are stable over the long term.

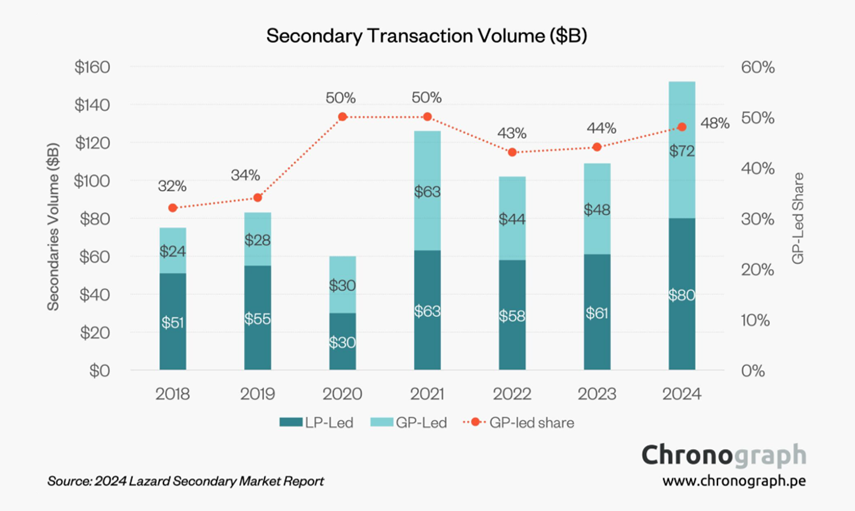

Importantly, flexibility around exit timeframes can create significant strategic optionality. With liquidity windows becoming less predictable and the IPO market showing cyclical volatility, being able to hold an asset for longer (or exit earlier if a good opportunity arises) can have a significant payoff.

Establishing and maintaining this kind of flexibility requires operational excellence, patient capital, and a clear view of value creation over time. It means buying the car that starts every time, can handle a few potholes, and doesn’t need twelve software updates before you can flee the scene of the (assumingly metaphorical) crime.

…But Can it Drive?

Artificial intelligence is frequently touted as a game-changer, but for private markets investors, there’s an important pragmatic question: how will it impact cash flows?

Like previous waves of innovation, AI promises cost reductions and an improved customer experience. But assuming that those productivity improvements will necessarily translate into higher profits is risky and potentially misguided. If history is any indicator, the benefits from disruptive technologies may largely be passed on to the consumer. We can look to history as a guide here, as the automotive and chemical manufacturing industries are great examples: both have seen massive efficiency gains over time, and much of the resulting value was passed to end users, not to shareholders.

To accurately assess an AI-driven investment thesis, you may need to conduct some reverse engineering. Instead of modeling benefits explicitly, investors have to ask themselves, “What would we have to believe for this company to justify its valuation? Can the business capture a meaningful portion of the value created, or will competitive forces drive margins back down? Are there brand attributes or proprietary features that can give the company a lasting advantage?”

Tesla recently announced that Grok, its “AI companion,” is now available in certain U.S. models. While it can’t control your car (yet), it can respond to questions and comes with a customizable personality, with options “ranging from Storyteller to Unhinged.” A car that can double as an on-demand standup comedian (yes, really—it tells jokes) is all well and good if that’s your thing, but does that really make it a better car? Does the massive touch screen and litany of entertainment features in a Tesla make any of us better drivers? Or is this a case of “just because you can doesn’t mean you should?” (One also has to wonder about the future intersection of an “unhinged” AI with a car that’s been known to lock people out during/after software updates… I’m beginning to fear that The Jetsons may have misled us about our collective automotive future).

Kicking Tires: Navigating Market Mispricings

In public markets, mispricings often persist longer than expected, especially when driven by momentum and retail investor enthusiasm. Retail investors rarely do much in the way of analysis, often acting on public perception of the company and its recent performance. (People actually buying Cybertrucks? Check). These dislocations can be amplified when traders anticipate retail behavior, buying in themselves and further driving up the stock price. This then leaves institutions feeling pressured to invest, regardless of the company’s underlying fundamentals. The result is a stubborn feedback loop in which prices are pushed higher than their intrinsic values and short selling is muted (not a great combination for those left holding the bag when the bubble eventually pops).

Private markets investors can and should learn from this dynamic. Reverse engineering valuations (starting with a company’s current value and working backward to the cash flow assumptions required to justify it) can be a powerful approach. And if those underlying assumptions are unreasonable, maintaining discipline should be the priority. (Resisting the siren song of FOMO is usually a good idea, in investing and in life more broadly. This is especially true when FOMO is dressed like a SpaceX prototype but handles like a Roomba on an ice rink). The same principle applies to new sectors or themes that are being shopped around. It should go without saying that hype cycles are a very real phenomenon, and they’re a pretty poor indicator of longevity.

Lessons for New Investors: How Not to Buy a Lemon

As private markets open to a broader set of investors, the learning curve can be steep, and one of the most common pitfalls is underinvesting in talent. Achieving outperformance in this environment requires a world-class team with deep expertise across due diligence, operations, and portfolio management.

Another critical factor is deal sourcing and selection. Co-investments, for instance, should be pursued with long-term partners who have skin in the game and a strong incentive to protect reputational capital. If a deal is being broadly marketed or appears opportunistic, it may be a sign that alignment is lacking. Would you buy a used Tesla from a guy named “Elon4Ever” on Craigslist? Hopefully not. Choose partners just as carefully as you choose assets.

Sophistication is Not a Sunroof: A Call for Analytical Discipline

The convergence of public and private markets is not a passing trend. As lines blur and transparency increases, private markets investors should retain the long-term, value-creation mindset that has historically been their strength while also embracing the analytical rigor that has long characterized public equity investing.

Valuation requires understanding how value changes over time, what levers are available to influence it, and whether the assumptions embedded in any model are reasonable. The exit environment can’t be forecasted with reliable precision, but it can be navigated effectively by focusing on fundamentals and retaining optionality. And while technologies like AI promise new efficiencies, they don’t guarantee margin expansion unless the business is positioned to both capture and retain that value.

Remember: boring doesn’t mean bad. Sometimes the best strategy is to ignore the hype machine, skip the beta-test features, and just drive the damn Camry.

About the Contributor

Claire Sawyer is Associate Director of Content Development at CAIA Association. Prior to her current role, she served as Program Manager and Relationship Manager for the UniFi by CAIA™ learning platform. She holds a BA in Legal Studies from UC Berkeley, the Sustainability and Climate Risk (SCR) certificate from GARP, and is a Level 2 CAIA Candidate.

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/