By Shreyash Shrivastava, FRM and Shubham (Sam) Goyat, CAIA

Why Private-Credit Liquidity Now?

Private credit has evolved from a niche strategy to a $2 trillion asset class in less than a decade, surpassing syndicated bank loans and high-yield bonds as the primary source of growth capital for middle-market companies. Despite double-digit unlevered yields, investors who enter today’s bilateral, unitranche deals confront lockups of five to seven years and typically concede discounts of 10–15% for the few secondary exits that do clear. At precisely the moment when institutional allocators are raising their target weights, the market’s plumbing is failing to deliver the liquidity, price discovery, and balance-sheet velocity that underpin mature fixed-income markets such as CMOs and CLOs.

We argue that the illiquidity premium in private credit is no longer a structural inevitability; it is a solvable engineering problem. By standardizing the handful of contractual terms that appear in 80 percent of recent agreements, i.e., benchmark, collateral package, transfer language, reporting cadence, and soft-call protection, and encoding the remaining covenant variations in a machine-readable digital loan-tape, we can repackage otherwise bespoke loans into static-pool Private-Credit CLOs. Issued under Rule 144A, these securitizations would settle through DTC, publish real-time prints via FINRA TRACE, and pay a servicing strip that incentivizes dealers to make markets.

The thesis is simple: unlock liquidity without sacrificing the yield edge that makes private credit attractive in the first place. A transparent, standardized securitization wrapper can compress bid-ask spreads, slash exit discounts, and attract new capital from insurers to total-return hedge funds without requiring borrowers to change a single operational covenant. The payoff is twofold: investors gain a reliable secondary market, and originators recycle capital faster, fueling the next cycle of middle-market lending.

The Illiquidity Gap: Anatomy of Today’s Bilateral Private-Credit Market

A market too big to stay private

Assets under management in direct-lending and opportunistic credit funds reached about $1.5 trillion at the start of 2024 and are projected to exceed $2.6 trillion by 2029, roughly the size the CLO market took 25 years to build. Yet almost every dollar still sits in bilateral or club agreements that are neither rated nor freely transferable.

Structural lockups, thin exit lanes

Most private-credit vehicles are closed-end funds with five-to-nine-year terms with extensions at the manager’s discretion, leaving LPs (Limited Partners) effectively captive for the life of the loan. Secondaries offer scant relief: although 2024 set a record U.S. $160 billion in combined PE (Private Equity) and credit secondaries, < 1 % of private-credit AUM changed hands, versus 2 to 3 % for private-equity stakes, and trades still cleared 5–10 % below par. While “Evergreen” semi-liquid funds aimed at wealth management channels have grown to $300 billion, quarterly redemption caps mean managers can gate redemptions and still face run risk in stressed markets.

Contrast with seasoned loan & mortgage ecosystems

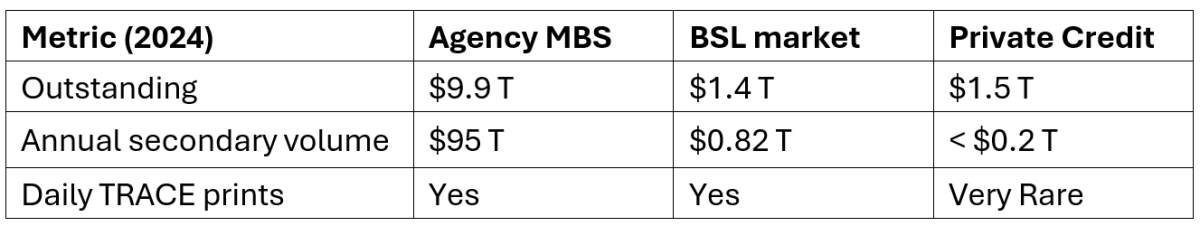

- Broadly syndicated loans (BSL) / CLO collateral: In 2024 alone, the secondary BSL market recorded $821 billion in trades, i.e., $3.5 billion a day across 1,577 distinct loans; all TRACE‑stamped and DTC & ClearPar settled. CLO notes themselves trade on the same TRACE tape, giving investors two‑way quotes within minutes.

- Agency CMOs / MBS: The mortgage market eclipses everything else for liquidity; agency MBS averaged $370 billion of turnover per day in 2024, second only to Treasuries. Tight documentation standards (FNMA/GNMA guidelines) and granular pool-level tapes let dealers price to 1/32nd of a basis point.

Annual Secondary Trading Volume Across Fixed Income Markets (2024)

Why it matters.

Without real-time prints and a transferable wrapper, private-credit investors must accept duration risk they did not underwrite: economic cycles, policy shifts, and their own liquidity needs. Bridging this “illiquidity gap” therefore, is less about chasing spreads and more about importing BSL/CMO market infrastructure, i.e., standardized loan tapes, TRACE visibility, and rated tranching into an asset class that has already reached systemic scale.

Standardization Kernel: The “LMA-Lite” Loan Agreement & Digital Loan-Tape

The illiquidity gap outlined above is not caused by credit weakness; it is caused by document entropy. Each bilateral deal carries hundreds of bespoke definitions, baskets, and cure mechanics that block any hope of straight-through pricing. The solution is to carve today’s fat agreements into two layers:

Two-Layer Standardization Framework (LMA‑Lite vs Digital Loan Tape)

Result

The LMA-Lite kernel compresses legal complexity into two elements: a single, fixed wrapper and a dynamic data layer. This standardization is the critical prerequisite for the securitization blueprint that follows. Without a uniform contract and loan tape, Rule 144A notes would still trade only by appointment; with them, they can clear and re-clear through TRACE like any other floating-rate bond, creating the mechanical foundation for a genuinely liquid secondary market.

Pricing Model: Unitranche OAS + Covenant Adjustment Grid

Our day-one pricing spine starts with a leverage-linked Option-Adjusted Spread (OAS) calibrated to middle-market default data. A senior-secured unitranche that underwrites at 3.5× net leverage clears at 400 bp over 1M SOFR; every incremental 0.25X of leverage adds 30 bp, reflecting the ~120 bp-per-turn elasticity observed in 2018-24 LCD datasets. Because documentation quality drives realized losses and secondary liquidity, we overlay a Covenant Adjustment Grid.

Add-ons are strictly additives, producing a transparent, auditable matrix that syndicate desks can quote in minutes. The result is a hygiene price, a borrower-agnostic spread that can then be fine-tuned for sector, ESG score, and sponsor quality.

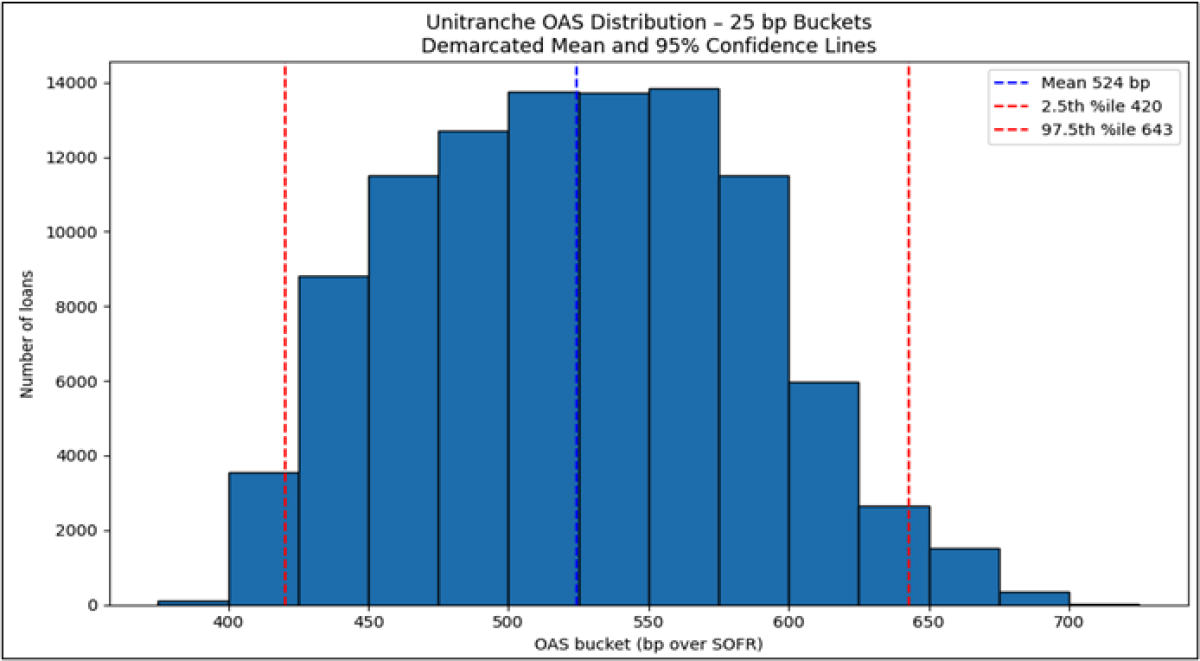

Monte Carlo Simulation of loan spreads

We draw 100,000 synthetic loans, sampling leverage, covenant mix, MFN tenor, and soft-call from 2024 deal-flow probabilities. Each loan’s spread equals baseline OAS + covenant add-ons. The run produces a bell-shaped distribution with a mean of ~527 bp and a 95 % confidence band of 422-652 bp. This band defines the quote envelope: bids outside it flag unusual documentation or mis-markings.

Covenant-Adjusted OAS Distribution

Blueprint for a Static-Pool PC-CLO: Issuance, Tranching, and Enabling Liquidity

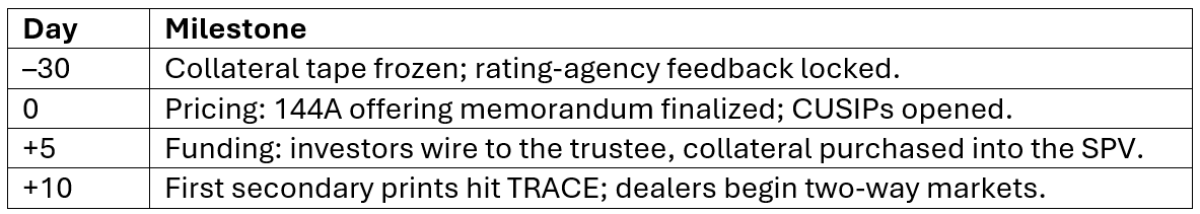

Building on a uniform LMA-Lite contract and live loan-tape, the next step is to wrap the collateral in a securitization structure that clears quickly, trades transparently, and satisfies today’s regulatory constraints. A static-pool Private-Credit CLO meets those goals: the asset pool is locked at closing, cash flows follow a straightforward waterfall, and the notes are distributed under SEC Rule 144A, making every secondary trade TRACE-printable.

Illustrative PC‑CLO Issuance Timeline

Result: A static-pool PC-CLO combines predictable loan cash flows with public-market infrastructure. DTC settlement, TRACE reporting, and a transparent 25–50 bp fee stack gives investors and dealers an economic incentive to trade rather than warehouse the notes, unlocking the liquidity premium absent in today’s bilateral private-credit market. The structure is deliberately plain vanilla and fully rule-compliant, so its tranches ride the same rails as the $1 trillion traditional CLO market, importing proven liquidity mechanics into an asset class that has, until now, had none.

Policy Recommendations: Better Plumbing, not a New Asset Class

Private credit already rivals high-yield bonds in size, but it still trades like a private partnership. The blueprint laid out in this paper reframes the problem: liquidity is a function of plumbing, not of underlying credit quality. By hard-wiring common terms in an LMA-Lite wrapper, capturing all flex items in a digital loan tape, and issuing static-pool PC-CLO notes under Rule 144A with TRACE visibility, we import the same mechanics that support the US$1 trillion CLO market. Investors gain reliable marks and exit lanes; originators recycle capital faster; dealers earn a recurring fee strip instead of a one-time underwriting margin.

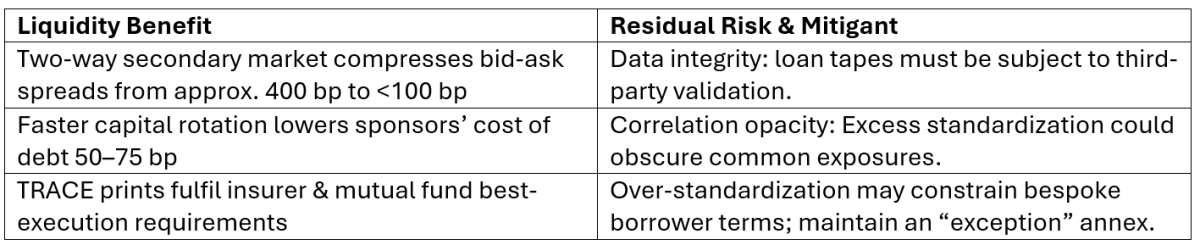

Liquidity Benefits and Residual Risks

Policy recommendations

- Adopt FINRA’s one-minute TRACE clock for 144A ABS (SR-FINRA-2024-004) to bring private-credit prints in line with Treasuries.

- Create a dedicated TRACE product flag, “PC-ABS,” so data vendors can build indices and ETFs.

- Issue an SEC-FINRA joint technical bulletin endorsing the JSON loan-tape schema in Appendix C as a de facto market standard, avoiding piecemeal data races.

- Retain the 5 % skin-in-the-game rule (17 C.F.R. § 246), which is proven in the CLO market and necessary to curb originate-to-distribute excesses.

Investor guidance

- Demand schema-validated tapes and third-party covenant audits before buying.

- Benchmark mini-CLO spreads to the covenant-adjusted OAS grid rather than headline coupons.

- Treat the equity slice as a volatility absorber, not a free option; require detailed cash-flow projections from managers.

With the abovementioned safeguards, the proposed framework can eliminate the illiquidity penalty in private credit while preserving the yield and bespoke underwriting that define the asset class. Standardized documentation and real-time trade reporting once transformed mortgages into CMOs and bank loans into CLOs; applying the same plumbing-first philosophy to direct lending will unlock comparable liquidity, without inventing a new product, merely by giving an existing one the market rails it has always lacked.

About the Contributors

Shreyash Srivastava, FRM - Shreyash is a Principal Risk Quant at a leading asset management firm and is currently pursuing a Master’s in Applied Statistics at Southern Methodist University. He previously held roles at Bank of America, JPMorgan Chase & Co, and Private Equity Secondaries Firm.

Shubham (Sam) Goyat, CAIA - Sam is currently pursuing a Master’s in Finance at the Cox School of Business, Southern Methodist University. He previously served in the Global Operations Group at Bank of America.

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/

Appendix A: Agreement Terms Source Catalogue

U.S. Direct-Lending Agreements

- [1] Comtech Telecommunications Corp. Credit Agreement (Form 8-K, Ex. 10.1, 15 Aug 2024).

- [2] Meadowbrook Run LLC Loan & Security Agreement (Form 10-Q, Ex. 10.2, 3 Nov 2023).

- [3] FS/KKR Capital Corp. Unitranche Facility (Form 8-K, Ex. 10.1, 29 Sep 2022).

European Direct-Lending Agreements

- [4] Arqiva Financing plc Facility Agreement (Companies House filing, 5 Jul 2022).

- [5] Cinelab London Unitranche Agreement (Companies House, 12 Jan 2025).

- [EU-A&O-1] Allen & Overy, European Private Credit Insights 2024 (Dec 2024) — covenant study based on 20 disclosed deals.

Secondary Commentary / Data Memos

- LSTA & Proskauer, U.S. Direct-Lending Deal Study 2025 (Jan 2025).

- Moody’s, Middle-Market CLO Methodology (Oct 2024).

Appendix B: References

1. Comtech Telecommunications Corp. Credit Agreement (Form 8-K, Ex. 10.1, 15 Aug 2024).

2. Meadowbrook Run LLC Loan & Security Agreement (Form 10-Q, Ex. 10.2, 3 Nov 2023).

3. FS/KKR Capital Corp. Unitranche Facility (Form 8-K, Ex. 10.1, 29 Sep 2022).

4. Arqiva Financing plc Facility Agreement (Companies House filing, 5 Jul 2022).

5. Cinelab London Unitranche Agreement (Companies House, 12 Jan 2025).

6. Form 8-K, Comtech Telecommunications Corp., 15 Aug 2024.

7. Credit Agreement, Meadowbrook Run LLC, Ex. 10.1, 3 Nov 2023.

8. Various Form 8-K direct-lending facilities, 2020-2025 (55 filings).

9. SEC, Rule 144A—Private Resales of Securities to Institutions (17 C.F.R. §230.144A).

10. SEC, Rule 3a-7 under the Investment Company Act of 1940 (17 C.F.R. §270.3a-7).

11. Reuters, “Private-Credit Secondary Deals Clear 5-10 % Below Par,” 15 Jan 2025.

12. FINRA, Trade Reporting Notice—TRACE for 144A ABS, Jan 2021.

13. FINRA, Proposed Rule Change SR-FINRA-2024-004 (one-minute reporting), Feb 2024.

14. FINRA Technical Notice, Securitised-Products 144A Feed Upgrade, Mar 2025.

15. Barings, Press Release: Barings Prices Euro Middle Market CLO 2024-1, 25 Nov 2024.

16. Offering Circular, Barings Euro Middle Market CLO 2024-1, Euronext Dublin, 23 Nov 2024.

17. S&P Global, Presale Report: Barings Euro MM CLO 2024-1, 22 Nov 2024.

18. LSTA / Proskauer, U.S. Direct-Lending Deal Study 2025, Jan 2025.

19. Moody’s, Middle-Market CLO Methodology, Oct 2024.

20. Clifford Chance, Direct-Lending Covenant Trends, Apr 2025.

21. LSTA Secondary Trading & Settlement Study 2024.

22. Morgan Stanley IM, MBS Market Review 2024, Dec 2024.

23. GlobalCapital, “Barings’ €380 m MM CLO Draws Strong Insurance Bid,” 26 Nov 2024.

24. MarketAxess Post-Trade Data, Euronext Dublin / TRACE Prints for BE-MM-2024-1, 26 Nov–10 Dec 2024.