This is the second part of our two-part discussion of recent developments on the island-continent of Australia as they may affect the alternative investments world. In the first paper, we described two recent publications of the Australia Securities and Investments Commission. Today, we look into a recently promulgated view of stock return predictability aimed at stock data Down Under.

This is the second part of our two-part discussion of recent developments on the island-continent of Australia as they may affect the alternative investments world. In the first paper, we described two recent publications of the Australia Securities and Investments Commission. Today, we look into a recently promulgated view of stock return predictability aimed at stock data Down Under.

A paper, recently published in the Australian Journal of Management, contends that investors can exploit the information offered by 15 variables to produce predictable excess returns. The strategy the authors propose, based in essence on sector rotation, produces alpha, that is, it outperforms the markets on a risk-adjusted basis, by 3.27% per year. Without adjusting for risk, the outperformance number is 7.18%.

The study is called “Out-of-sample stock return predictability in Australia,” and it builds on the groundwork of Ivo Welch and Amit Goya in a 2008 paper. The idea in both cases is that it is easier for a model to fit a given initial sample (it might of course be consciously or unconsciously be formed to fit that sample) than it is for the same model to show impressive results in another period or against other indexes, the so-called out-of-sample results. Welch and Goyal showed, as the authors of the AJM study paraphrase it, that “many well-known predictors do not consistently generate superior out-of-sample equity premium prediction relative to a simple forecast based on the historical average.”

Contrast with the U.S.

The AJM study has a more upbeat result. The authors are: Yiwen (Paul) Dou and David R. Gallagher, of the Macquarie Graduate School of Management, Sydney, David H., Schneider, of UniSuper Management Ltd., Melbourne, and Terry S. Walter, of the School of Finance, University of Technology, Sydney.

In contrast to the U.S. equity markets, the Australian equity markets (and the predictability or otherwise of their returns) are a relatively untilled field for scholarship. As Dou et al observe, Boudry and Gray, in 2003, showed that dividend yield and term spread have an economically significant influence on optimal asset allocation. But Dou et al use a broader set of factors in hopes of attaining a more general result.

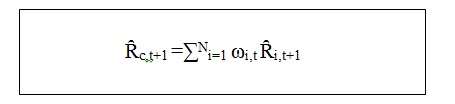

Source: “Out of sample stock return predictability in Australia,” Australian Journal of Management.

There’s nothing cutting edge about the mathematics as reflecting in the above equation. It is a tool for weighting the averages of the individual forecasts (here, fifteen of them) produced by the various predictors.

The expression on the left hand side of the equal sign is the combination forecast made at time t.

Bottom Line

Dou et al. adopt the combining methods of David E. Rapach, Jack Strauss, and Guofu Zhou (RSZ) from a 2010 paper to give a value to that expression. There are two distinct methods involved. First, the RSZ approach uses simple averages: mean, median, and trimmed mean. Second, it uses something a little more complicated called the discount mean square prediction error method (DMSPE), assigning higher weights to the predictions that have the best historical forecasting track record.

The bottom line for Dou et al. is what it was for RSZ three years ago. It is possible that model uncertainty and instability is what impairs the forecasting ability of individual predictive regression models. On that hypothesis, combining the various models properly in a way linked to the real economy may well substantially improve forecasting.