SEI, in collaboration with the financial advice website ETF Trends, has posted a new paper on actively managed exchange traded funds. The paper contends that “the rise of active management in the ETF space may well be the next step in its evolution.”

SEI, in collaboration with the financial advice website ETF Trends, has posted a new paper on actively managed exchange traded funds. The paper contends that “the rise of active management in the ETF space may well be the next step in its evolution.”

The Basics

Passively managed ETFs hold a basket of securities based on an underlying index. The active side of the industry also involves a fund that holds a basket of securities, but its aim is to “achieve an investment objective such as outperforming a given segment of a market, or investing in a focused sector….” The difference between the two sorts of ETF is, then, much the same as the difference between passive and actively managed mutual funds.

Active ETFs share many traits with their passive cousins. They can both be traded on an exchange throughout the day; and taxable events are rarer in a conventional ETF structure than they are in the mutual fund setting. On the tax point, the SEI paper cites product sheets from both Invesco PowerShares and Fidelity.

Of course through the process of trading on an exchange the price of an ETF will generally incorporate either a premium or a discount vis-à-vis the underlying net asset value, a fact that provides the Authorized Participants with an arbitrage opportunities. These APs, availing themselves of those opportunities, keep the value in proximity to the NAV.

A Dilemma

The creation/redemption process in turn sets up the feature of ETFs and in particular of active ETFs that constitutes a potential competitive disadvantage vis-à-vis mutual funds. Given the portfolio transparency requirements, which for ETFs are daily but for mutual funds are only quarterly, the former are susceptible to front running. Investors or competitors can use the disclosed positions to construct their own portfolios. So: why should they participate in the ETF and pay the investment manager?

Given this challenge, the paper observes that many ETF providers “are trying to find ways to work around the transparency rules and limit their disclosures of holdings.” Navigate Fund Solutions, a subsidiary of Eaton Vance, is working on a product it calls an exchange traded managed fund, ETMF. In an ETMF, managers would not publicize their positions until trades were settled.

Any such workaround, though, will have its own costs. It will impair the ability of the Aps to arbitrage, and thus would allow for larger premiums or discounts to the actual value of the holdings. So an actively managed ETF faces something of a dilemma: should it impair arbitrage by its friends in order to disable front-running by its adversaries, or should it enable them both?

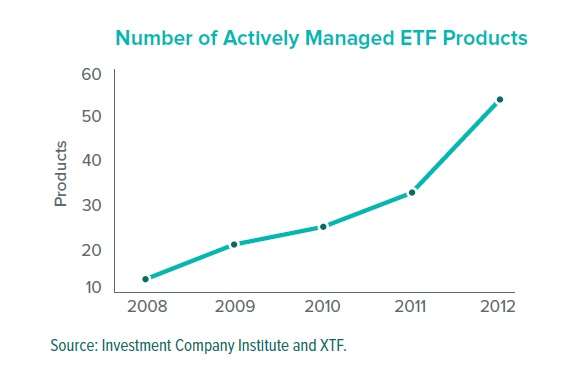

Whatever the challenges, the trend is clear. Measured either by the number of actual products or by the total net assets wrapped therein, active ETFs have seen a burst of growth since the world financial crisis.

Restoring Derivatives to the Mix

Until quite recently, the Securities and Exchange Commission prohibited the creation of actively managed ETFs that incorporated derivatives in their portfolios. This changed in December 2012.

As a consequence of the change in policy, SEI says, newly created active ETFs can now represent in their filings that the board will periodically review and approve the use of derivative and of how the ETF’s IA assesses and manages risk with regard to the use of derivatives. The use of derivatives must itself be disclosed in its offering documents and periodic reports.

This could help continue the ongoing increase in the number of active ETF launches. It allows for head-to-head competition between an ETF following a particular strategy and a mutual fund following the same strategy. For example, well known portfolio manager Bill Gross has expressed his desire to include derivatives in his PIMCO Total Return Bond ETF, as does the PIMCO Total Return Bond mutual fund.

Mutual fund providers are moving into this space. There are differing ways in which they can do so. On the one hand, they might create a new legal entity under the same brand umbrella. This, though, can be cumbersome, as it requires the approval of shareholders and the board of directors.

Another approach, associated especially with Vanguard, is the creation of a new share class for an existing mutual fund. Van Eck Global is considering ETF share classes for some of its existing funds, the report says, “but it is unclear whether the proposal would use Vanguard’s patent or challenge it.”

A third approach involves the creation of a master-feeder structure.

Thus, we end where we began. ETF Trends and SEI conclude that as more attention is drawn to the ETF world from both managers and investors, more creative approaches to the active idea of that space will appear, and the resulting products will “eventually rival traditional active mutual funds for market share.”