Uncorrelated LLC has created the Investment LAB (an acronym from “Learn, Apply, Brainstorm”), an initiative to give investors forums in which they can engage in those three vital activities.

Uncorrelated LLC has created the Investment LAB (an acronym from “Learn, Apply, Brainstorm”), an initiative to give investors forums in which they can engage in those three vital activities.

In June of this year, an Investment LAB workshop in New York brainstormed about the ongoing energy revolution: renewables, fracking, efficiencies, etc.

Among the key points coming out of that workshop, according to a newly-available report, were the following:

- Energy companies are growth stocks, “not sleepy dividend providers solely dependent on rising commodity prices.”

- The innovation/revolution underway permeates the portion of the energy sector once deemed the sleepiest, conventional oil and gas.

- Everybody loves transparency, both the environmental activists who demand everything be documented and the industry of data collectors that has grown up to do so.

- The grid is getting “smarter, cheaper, and better.”

- Talent can demand and will get a premium – labor of a not-at-all fungible sort is much in demand throughout the energy and related industries.

- Renewables will grab important market share over time even without subsidies.

- The United States will become a net exporter of natural gas over the next five years. Yes, China has a lot of the stuff, but it lacks the sort of legal grounding necessary for developing it.

- Infrastructure!

- Oil will fall into second place among fossil fuels in the years to come, surpassed by coal. India and other developing countries have a lot of coal to sell.

The workshop heard from the following experts: James Ivey; Hunter Carpenter; Randy Allen; William J. Berger; John C. Moore; Gregor MacDonald; Gregory Zuckerman; and (as a team) Daniel Rice & Dan Neumann.

James Ivey, the founder of Pintail Oil and Gas, discussed how the larger players in the oil market are spurning certain assets from which nimble creatures such as Pintail can profit. With the new seismic 3D technology, Ivey can re-visit fields thought unprofitable. By purchasing one field in particular, Ivey says, he acquired between one and 1.5 million barrels in known reserves, but he will get three million out of it.

Carpenter is a PE investor, and was formerly a managing director at The Stephens Group. He spoke about managerial talent. In 2011, The Stephens Group invested in Pinnergy, an oil and gas services business. The group made this investment at a time when natural gas was trading at $4.50/MM btu. The price soon dropped to $3. This “did not feel so hot,” Carpenter said.

But managerial talent can overcome a negative trend in commodity prices. Pinnergy’s management “was able to tactically shift assets and has grown revenue over 50% since the date of the original investment.”

Allen is a graduate of the Colorado School of Mines and co-founder of Lucas Energy Ventures. He spoke of the advantages of the U.S. in energy exploration. As these explorations bring new supplies on line, and as efficiencies cause domestic consumption to fall, the U.S. is no longer condemned to keep sending great sums of money to “places that don’t like us very much.”

Berger was there to try to bust some myths about solar energy, and renewables in general. For example, he countered the notion that solar energy needs subsidization, inclusive of tax benefits, to survive. Indeed, as a VC committed to the field, he’d like to see the federal investment tax credit disappear. Solar can thrive as the low-cost producer as it scales up.

Moore is the chief executive officer of Acorn Energy, a conglomerate that invests in entrepreneurs who focus on efficiency issues. “The future of energy,” he said, “is about information.” In the near future, there will be “a vast system of sensors and control systems connected invisibly and automatically and responding to our needs.” Invest it that as it unfolds.

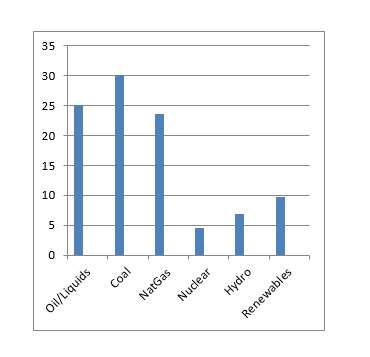

The graph below is adapted from one presented by Gregor MacDonald, founder of Terrajoule.us, a monthly newsletter on macro trends in the energy sector. It displays the shares of global energy use of various energy sources projected for 2025, and illustrates MacDonald’s view that “fossil fuels are not going away.”

Gregory Zuckerman (the fellow whose image I’ve put at the top of this article) is a two-time winner of the Gerald Loeb Award for breaking news coverage. He is also the author of The Frackers, an inside look at who bet on fracking before it became a household name, and who backed away from that gamble.

At the workshop, as in that book, Zuckerman contends that fracking is here to stay, is good for the country, and that although it does have environmental costs, they can be managed.

Rice and Neumann are portfolio managers are GRT Capital Partners. They discussed how the market drastically undervalues the energy sector. Their talk encompassed both the opportunity this offers investors, and the need to hedge against commodity price risk to minimize what Neumann calls “the casino aspect of energy volatility.”