KPMG, the Managed Funds Association, and the Alternative Investment Management Association have jointly issued a report on the future of the hedge fund industry. The gist of the report will likely surprise few within the industry. What it amounts to is: certain conspicuous ongoing trends will continue.

KPMG, the Managed Funds Association, and the Alternative Investment Management Association have jointly issued a report on the future of the hedge fund industry. The gist of the report will likely surprise few within the industry. What it amounts to is: certain conspicuous ongoing trends will continue.

For example: institutional investors now drive and will continue to drive the growth of the industry. Most of the managers surveyed for the report say that pension funds in particular will be their primary sources of capital by 2020.

Why pension funds? In large part because people live longer than they used to. Pension funds will have to become more aggressive in search of yield. Hedge funds will be a “primary beneficiary” of that need.

Ahead of the Curve

Funds in Asia-Pacific are ahead of the curve on this. Seventy two percent of the funds there report that they manage capital for corporate pensions at present. In North America the corresponding figure is 65%: in Europe it is 54%. Meanwhile, considering another sort of institutional investor: more than half (52%) of Asia-Pacific managers manage money for sovereign wealth funds. The number in North America is 43%: in Europe it is 41%.

This trend is congruent with another: pressure on funds of funds. For high net worth individuals, the F of F can be a valuable go-between, choosing and tracking the results of the underlying funds. But as HNWs are becoming a less important part of the picture, the F of Fs are losing that function. Corporate pension funds, SWFs, and their kin can do their own due diligence, thank you very much, and select their own underlyings.

Customization from Product to Fee

Customization is another ongoing trend whence the authors of this report expect great things. For example, 12% of fund managers have developed alternative UCITS funds, and another 26% expect that they will do so within the next 5 years. This is an example of the most obvious sort of customization, creativity as to the product mix.

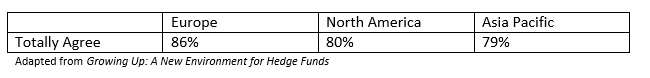

But the report also refers to the customization of services, strategies, and fees. Let’s focus on fees, which are always a fascinating subject. Two thirds of the respondents said that they expect to offer specialized fee structures in the years ahead. A staggering 84% said they “totally agree” that customized fee structures will become in general more prevalent.

The regional breakdown on who agrees with that statement is as follows:

Agreement with this proposition varied somewhat more markedly by the size of the fund than by its geography. A full 91% of small hedge funds agree; a ‘mere’ 76% of large funds do likewise. My own suspicion is that there is a natural human tendency to believe that whatever is working out to one’s own benefit has some lasting power. Thus, the largest hedge funds, as the greatest beneficiaries of the traditional 2 + 20 fee structure, may be more inclined than their smaller counterparts to believe that it has some staying power.

The institutionalization of the investor side of the industry is pushing changes in the fee structure. The report quotes a European based manager who says in this connection: “Some pension funds and institutional investors often put too much focus on fees in an effort to be as cost effective as possible, but ultimately this will impact performance and I’m not sure anyone wins in that scenario.”

Regulatory Issues

The report also looks at the recent increase in the extent to which alternative investments are regulated. It quotes one fund manager based in the UK: “It’s pretty clear that regulators aren’t thinking about the industry when they make changes. The workload created certainly doesn’t help investors, and does nothing to improve the business.”

Dodd-Frank notwithstanding, funds with headquarters either in Europe or in Asia-Pacific are more likely to cite regulation as a potential limiting factor than are their North American cousins. Although 67% of North American respondents identify regulations as the biggest threat to their growth, and that night seem impressively high already, the corresponding number for Europe is 81%, and for Asia-Pacific it is 83%.

The problem is the cost of compliance and what this does to operating costs generally.

Finally, breaking this down by size, hedge funds in the medium range are least likely to see regulation as the gravest threat (69% of them do so). The corresponding numbers for small and for large funds respectively are: 77%, and 79%.