A recent publication in the Financial Analysts Journal presents a model by virtue of which long-term passive investors may hedge the risks associated with climate change and/or with climate change related public policies.

One incidental feature of the article is the sense it provides of the difference between carbon-free indexes on the one hand and a decarbonized index on the other. It’s a bit like the difference between grape juice and de-alcoholized wine.

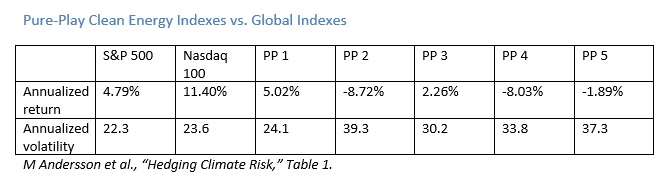

The article, written by Mats Andersson, Patrick Bolton, and Frédéric Samama, acknowledges that “green” financial indexes have “significantly underperformed market benchmarks” in recent years. The table below shows the extent of this underperformance with regard to two of those benchmarks, and four of the pure-play indexes. The return and vol figures for the table were both calculated using daily data from January 2007 to November 2014. (The period ends when it does because the Market Vectors Global Alternative Energy ETF, portrayed in the table as “Pure Play 1,” was liquidated in November 2014.)

Not the Hedge You’re Looking For

The article suggests some reasons for this underperformance: one of them is that after the global financial crisis the markets rationally anticipated that nation states would postpone the introduction of limits on CO2 emissions.

“These changed expectations,” (runs this hypothesis) “benefitted the carbon-intensive utilities and energy companies more than other companies.”

At any rate, use of such indexes and pure lay green funds is not the hedge on climate risks that the managers of institutional investors may well be looking for. A better approach is a hedging strategy that uses “decarbonized indexes [to] keep an aggregate risk exposure similar to that of standard market benchmarks.”

The idea is to arrange a free option on carbon. So long as carbon based policies remain permissive, a properly arranged decarbonized portfolio can obtain the same returns as a market benchmark. But at such time as governments do act to limit carbon and save the planet from potentially disastrous climate changes, the free option is exercised, and the decarbonized portfolio “should outperform the benchmark.”

So how is the alcohol withdrawn from the wine, that is, the carbon dependency from the portfolio, without a drastic change in taste, that is, risk/return performance?

The “basic idea,” the authors say, is to “begin by imposing a constraint on maximum allowable tracking error with the benchmark index and then subject to this constraint exclude and reweight composite stocks in the benchmark index to maximize the green index’s carbon footprint reduction.”

Some Questions

This general formulation leaves one with a lot of particular questions. For example: will this process change the sector balance of the benchmark? One hypothesis is that a sector-blind filtering out of issuers on the basis of the size of their carbon footprint alone will result in an unbalanced decarbonized index that would “have a very high tracking error and would be undesirable.” So the filtering probably shouldn’t be sector blind.

But the authors think this inference is not alarming. More than 90% of the world’s greenhouse gas emissions are attributable they say, to sectors other than the obvious one, oil-and-gas. Thus, it is possible to adopt a filtering approach that reduces the carbon footprint well enough to ‘buy’ that free carbon option, without abandoning the balance of the benchmark.

Another question: how are the carbon footprints to be measured for the purpose of the filtering? The organizations that provide metrics of the footprints of the largest publicly traded companies disagree with one another. The authors discuss issues of measurement for some time, but then conclude that it will work itself out gradually once decarbonization becomes an accepted process. As with credit ratings, methods for determining the carbon footprint will surely be imperfect but will improve over tie.

The authors believe that decarbonization is a strategy “especially suitable for passive long-term investors.”

A word about those authors: Andersson is the chief executive of AP4, Sweden’s public pension fund, though he has recently announced he will leave that post in order to devote himself more completely to environmental investment projects. Patrick Bolton is a professor of business at Columbia University, New York City. Frédéric Samama is deputy global head of institutional clients at Amundi Asset Management, in Paris.