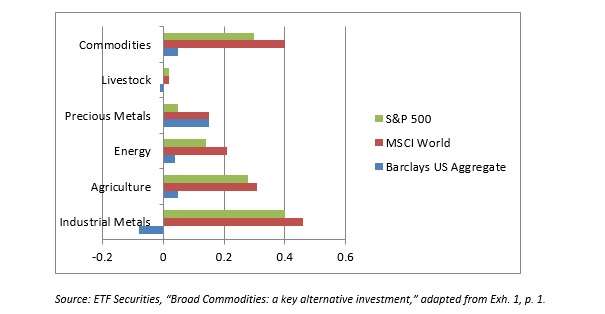

ETF Securities (US) LLC, a New York-based asset manager and manufacturer of ETP’s (Exchange Traded Products),” has issued a white paper written by its Director, Investment Strategy, (Maxwell Gold), on “broad commodities,” that is, on the use of a broad basket of commodities, as a way of allowing an investor’s portfolio an improved risk-adjusted return. One important point in making this case is that broad commodities have exhibited a low correlation to the equity markets, both global and U.S. Further, their correlation with the Barclays US Aggregate Index, a proxy for fixed income markets, is near zero. Industrial metals and livestock both have negative correlation with Barclays US Aggregate. The full graph is below. Note that none of the correlations included exceeds 0.5  Throughout the Business Cycle Suppose, though, that an investor has already diversified its portfolio, by balancing 60% equity with 40% bonds. Does this investor still benefit by including commodities as well? Yes, says Gold, for ETF. The average 3 year correlation of three major commodity indexes to such diversified portfolios has been approximately 0.2 over the 38 years since 1979. Such considerations are not novel. In 2011, Joëlle Miffre, from EDHEC’s business school in Nice, France, described the investment case for a long-short commodity portfolio in quite similar terms. “[T]he strategic decision to include commodity futures in a well-diversified portfolio does not solely depend on the risk premium of these long-short portfolios,” Miffre said. “It is also driven by a desire for risk diversification.” To confirm and perhaps expand upon such observations, Gold looks at the value of broad commodities over the course of whole business cycles. The experience over the course of such cycles, despite “periods of extremes,” has been lower portfolio volatility and drawdowns, higher risk adjusted returns, for those portfolios with a sizeable allocation to commodities. Further, this is true for each of the three standard portfolio profiles: aggressive risk, balanced risk, conservative. Inflation There is a natural link between inflation on the one hand and the inclusion of commodities in a portfolio on the other. As Gold puts it, “rising prices in food and energy remain central to many inflation measures such as the commodity price index (CPI).” This creates an “overlap” between commodity prices and inflationary pressure, making the former a hedge against the latter. During months when the consumer price index in the U.S. rises by 0.5% annually, all commodities historically have risen by an average of 16%, measuring by the Bloomberg Commodity Index. Speaking a little less broadly, energy commodities on the one hand and agriculture/livestock commodities on the other did the best during rising inflationary periods. Industrial metals was the least portfolio-friendly of the commodities in this respect, although it, too, posted positive returns (+8%). Implementation Choices After making its case for the inclusion of broad commodities, the white paper moves to the issue of implementation. “Investors should … note,” Gold writes, “that diversified commodity indices come in many flavors, with different weightings and holdings.” For example, the S&P GSCI Index is relatively concentrated in the energy sector so it will be driven especially by developments in the oil and gas markets. The Thomson Reuters CRB Index, on the other hand, is allocated toward the industrial metals, and the Bloomberg Commodity Index has more exposure than the others to agriculture and to the precious metals. Investors will want to determine which best matches their own objectives and outlook. Also, if an investor uses the futures markets to participate in the commodities space (a natural choice given that it can be tricky to track spot prices for many commodities), the matter of contract selection arises. Many of the indexes look to the contract nearest to maturity. But some investors may find that that approach creates volatility and a performance drag. Historically (and this is the final observation of the white paper prior to the lawyer-mandated fine print), investing in longer dated contracts “has helped reduce the performance impact of rolling contracts and the associated market volatility versus investing solely in the near month contract across” the broad commodity indexes.

Throughout the Business Cycle Suppose, though, that an investor has already diversified its portfolio, by balancing 60% equity with 40% bonds. Does this investor still benefit by including commodities as well? Yes, says Gold, for ETF. The average 3 year correlation of three major commodity indexes to such diversified portfolios has been approximately 0.2 over the 38 years since 1979. Such considerations are not novel. In 2011, Joëlle Miffre, from EDHEC’s business school in Nice, France, described the investment case for a long-short commodity portfolio in quite similar terms. “[T]he strategic decision to include commodity futures in a well-diversified portfolio does not solely depend on the risk premium of these long-short portfolios,” Miffre said. “It is also driven by a desire for risk diversification.” To confirm and perhaps expand upon such observations, Gold looks at the value of broad commodities over the course of whole business cycles. The experience over the course of such cycles, despite “periods of extremes,” has been lower portfolio volatility and drawdowns, higher risk adjusted returns, for those portfolios with a sizeable allocation to commodities. Further, this is true for each of the three standard portfolio profiles: aggressive risk, balanced risk, conservative. Inflation There is a natural link between inflation on the one hand and the inclusion of commodities in a portfolio on the other. As Gold puts it, “rising prices in food and energy remain central to many inflation measures such as the commodity price index (CPI).” This creates an “overlap” between commodity prices and inflationary pressure, making the former a hedge against the latter. During months when the consumer price index in the U.S. rises by 0.5% annually, all commodities historically have risen by an average of 16%, measuring by the Bloomberg Commodity Index. Speaking a little less broadly, energy commodities on the one hand and agriculture/livestock commodities on the other did the best during rising inflationary periods. Industrial metals was the least portfolio-friendly of the commodities in this respect, although it, too, posted positive returns (+8%). Implementation Choices After making its case for the inclusion of broad commodities, the white paper moves to the issue of implementation. “Investors should … note,” Gold writes, “that diversified commodity indices come in many flavors, with different weightings and holdings.” For example, the S&P GSCI Index is relatively concentrated in the energy sector so it will be driven especially by developments in the oil and gas markets. The Thomson Reuters CRB Index, on the other hand, is allocated toward the industrial metals, and the Bloomberg Commodity Index has more exposure than the others to agriculture and to the precious metals. Investors will want to determine which best matches their own objectives and outlook. Also, if an investor uses the futures markets to participate in the commodities space (a natural choice given that it can be tricky to track spot prices for many commodities), the matter of contract selection arises. Many of the indexes look to the contract nearest to maturity. But some investors may find that that approach creates volatility and a performance drag. Historically (and this is the final observation of the white paper prior to the lawyer-mandated fine print), investing in longer dated contracts “has helped reduce the performance impact of rolling contracts and the associated market volatility versus investing solely in the near month contract across” the broad commodity indexes.

←

Back to Portfolio for the Future™

Broad Commodities: Value, Inflation, Implementation

May 29, 2017