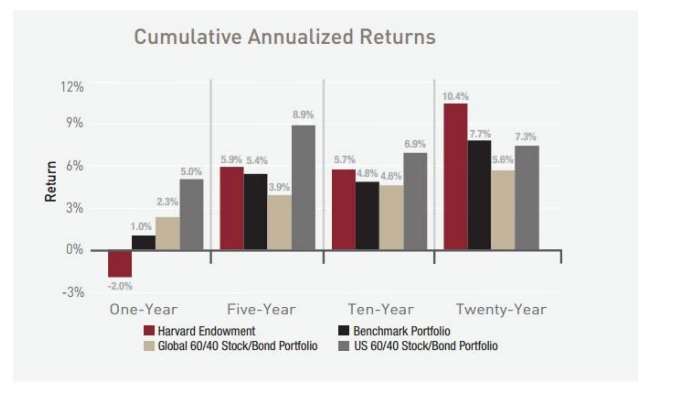

By Hossein Kazemi & Kathryn Wilkens, CAIA Endowments and foundations are tax exempt and charitable organizations that rely on permanent pools of capital to fund their activities. These pools of capital are owned by institutions such as colleges, universities, hospitals, museums, scientific organizations, charitable entities, and religious institutions. When well-funded and well-managed, an endowment can provide a permanent annual income to the organization, while maintaining the real value of its assets in perpetuity. These institutions typically lack the internal expertise to manage their assets. Only the largest endowments and foundations have the resources to build an internal team to manage their assets. Small- and medium-size organizations may choose to outsource the management of their assets. However, whether they are small or large, managing the assets that fund these organizations’ activities costs money. Of course, there are significant economies of scale in managing assets and for the largest endowments and foundations the ratio of management expenses to total assets is expected to be relatively low. For instance, Harvard Management Company (HMC), which manages Harvard University’s endowment, reported around $200 million in expenses while managing around $35,000 million in assets. This means that Harvard University spends around 0.57% of its endowment to manage its assets. This figure does not include the fees that HMC paid its outside managers, which is not as relevant since the reported returns are net of these fees. The following chart, which is obtained from HMC’s 2016 Annual Report, shows the performance of the fund over that past 1, 5, 10 and 20 years.  While the endowment has outperformed the basic 60/40 stock/bond portfolio during the past 20 years,it has underperformed this portfolio during the past 1-, 5- and 10-year periods. NACUBO-Common Fund Study of university endowments reports aggregate annual performances of those organization that report to National Association of College and University Business Officers (NACUBO). The following chart displays the annual performance of the largest endowments, median performance of endowments, 60/40 stock/bond ETFs and a multi-asset portfolio of ETFs. We will discuss this “mystery” multi-asset portfolio later.

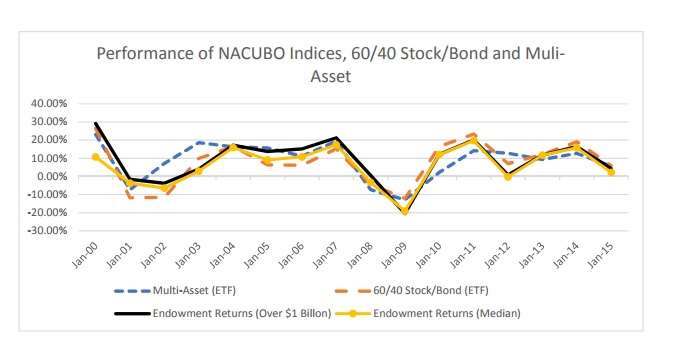

While the endowment has outperformed the basic 60/40 stock/bond portfolio during the past 20 years,it has underperformed this portfolio during the past 1-, 5- and 10-year periods. NACUBO-Common Fund Study of university endowments reports aggregate annual performances of those organization that report to National Association of College and University Business Officers (NACUBO). The following chart displays the annual performance of the largest endowments, median performance of endowments, 60/40 stock/bond ETFs and a multi-asset portfolio of ETFs. We will discuss this “mystery” multi-asset portfolio later.  We can see that all four indices show remarkable similarities. Interestingly, the median performance of endowments has matched the performance of the largest endowments in recent years. The following table displays the basic statistics:

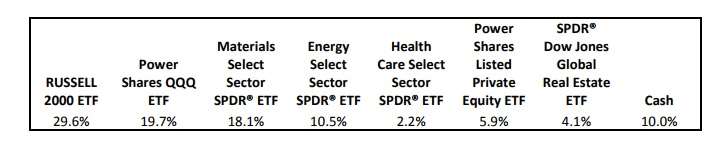

We can see that all four indices show remarkable similarities. Interestingly, the median performance of endowments has matched the performance of the largest endowments in recent years. The following table displays the basic statistics:  The “mystery” multi-asset portfolio consists of ETFs and has provided the same rate of return as the largest endowments with lower volatility since 2000. Two important points must be raised here. First, notice that while endowment returns are net of asset managers’ fees, they are not net of expenses paid by the endowment to its own staff to oversee the endowment. The ETF portfolios are net of all fees, of course. Second, endowment portfolios contain a significant amount of illiquid assets, which could impose unexpected costs on them. The ETF portfolios consist of the most liquid ETFs. The above figures raise an obvious question: What is the point of assuming significant illiquidity risk and spending significant amount of resources to manage these pools of assets, when over the past 15 years their performances have matched those that can be earned by simple allocations to ETFs? The above performance figures report aggregate numbers and there are bound to be some endowments who significantly outperform or underperform the above ETF benchmarks. For example, some endowments may have access to top tier hedge fund, private equity and real asset managers. Of course, not every manager can be top tier. Therefore, the question posed above is more applicable to those organizations that do not have access to these top tier managers. We propose that these smaller endowments will be better off giving up their ‘fancy’ endowment portfolios and just try to replicate the performance of the largest endowments using liquid ETFs. In fact, this is how the multi-asset ETF portfolio was created. That is, we used a set of available ETFs to replicate in real time the performance of an index representing the performance of largest endowments. Only past performances of these endowments were used to construct the replicating ETF portfolio to be held for the next quarter. This means, one can implement this procedure in real time to manage an actual endowment. The procedure requires one to rebalance the portfolio on a quarterly basis. For those who are curious, the following was the tracking portfolio for the first quarter of 2017.

The “mystery” multi-asset portfolio consists of ETFs and has provided the same rate of return as the largest endowments with lower volatility since 2000. Two important points must be raised here. First, notice that while endowment returns are net of asset managers’ fees, they are not net of expenses paid by the endowment to its own staff to oversee the endowment. The ETF portfolios are net of all fees, of course. Second, endowment portfolios contain a significant amount of illiquid assets, which could impose unexpected costs on them. The ETF portfolios consist of the most liquid ETFs. The above figures raise an obvious question: What is the point of assuming significant illiquidity risk and spending significant amount of resources to manage these pools of assets, when over the past 15 years their performances have matched those that can be earned by simple allocations to ETFs? The above performance figures report aggregate numbers and there are bound to be some endowments who significantly outperform or underperform the above ETF benchmarks. For example, some endowments may have access to top tier hedge fund, private equity and real asset managers. Of course, not every manager can be top tier. Therefore, the question posed above is more applicable to those organizations that do not have access to these top tier managers. We propose that these smaller endowments will be better off giving up their ‘fancy’ endowment portfolios and just try to replicate the performance of the largest endowments using liquid ETFs. In fact, this is how the multi-asset ETF portfolio was created. That is, we used a set of available ETFs to replicate in real time the performance of an index representing the performance of largest endowments. Only past performances of these endowments were used to construct the replicating ETF portfolio to be held for the next quarter. This means, one can implement this procedure in real time to manage an actual endowment. The procedure requires one to rebalance the portfolio on a quarterly basis. For those who are curious, the following was the tracking portfolio for the first quarter of 2017.  Going forward, every quarter We will be posting the replicating portfolios in this publication. This paper was written in April, 2017.

Going forward, every quarter We will be posting the replicating portfolios in this publication. This paper was written in April, 2017.

←

Back to Portfolio for the Future™

A Simple Approach to the Management of Endowments

August 7, 2017