Credit Suisse, in its new report on its mid-year survey of hedge fund investor sentiment, says that there is “continued appetite to allocate to hedge funds” and that there is increased interest, especially, in quantitative strategies.

Specifically, 81% of investors say that they will likely make allocations to hedge funds in the second half of this year. In the 2016 mid-year survey, the corresponding number was 73%. In strategic terms, equity long/short is the most popular for this second half, followed by global macro discretionary.

Looking a little further out, nearly 60% said they plan to increase allocations to quantitative strategies over the next 3-5 years.

Who Responded?

The survey drew responses from 212 different investors. Breaking it down by type of investor: a third of the respondents were funds of funds. Roughly one fifth were family offices, and 9% were advisor/consultants. The remaining slices of the pie are small but varied, from sovereign wealth funds to insurance companies to endowments.

Looking at the spread of the 212 responses among the three great world regions: it is heavy on the Americas, the home of 127 of the 212 respondents. Another 47 come from Europe, the Middle East, or Africa (EMEA) and the remaining 38 from Asia-Pacific.

EMEA’s investors showed the largest year-to-year rebound in their appetite for hedge fund allocation in the second half. An impressive 20% more EMEA investors expect to invest in the second half than did so in mid 2016.

Fee Structures

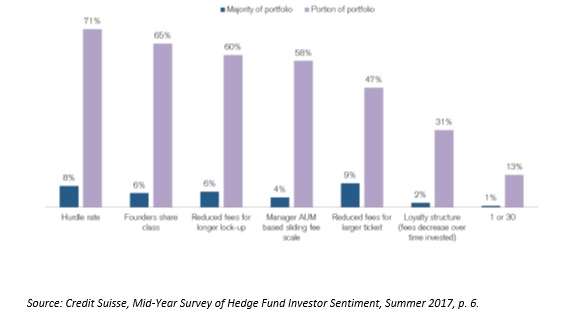

The survey asked about fee structures, and the report included the graph below. The frequency in use of the various fee structures for at least some of a respondent’s portfolio is indicated by the height of the violet bar. The frequency with which that structure is present in a majority of the respondent’s portfolio is indicated by the green bar.

Of course the listed structures are not mutually exclusive: any specific investor-manager relationship will involve some combination of these.

Hurdle rate, founder’s share class, and reduced fees for longer lock-ups, in that order, are the three most frequently used structures. Hurdle rates (the contractual stipulation of a minimal acceptable rate of return that a hedge fund must exceed before it can charge a performance fee) are especially popular when the investors are family offices or pension funds.

The authors consider it remarkable that the “1 or 30” structure, which is quite novel (it wasn’t available in the market at all until late last year) has already achieved a presence in 13% of portfolios. This is a structure that guarantees that the investors will always pay a 1% management fee to the hedge fund regardless of performance, but that they will never pay more than 30% of the gross alpha the hedge fund provides.

The “1 or 30” is especially popular thus far among pension funds, least popular among the advisor/consultant respondents.

The different types of investor present in the surveyed universe have markedly different preferences as to fee structures. Funds of funds, for instance, make much more use of founder’ share class opportunities than do the others.

Redeemed Money

Another important subject of the survey’s questions is: what do the investing institutions plan to do with the money realized by redemptions from their hedge fund investments? Does it go back into hedge funds or somewhere else? And if it goes back into hedge funds, does it go to hedge funds those redeemers already have in their portfolio, or to new ones?

For investors who redeemed in the first half of 2017, 63% said that they intend to recycle that to a combination of existing and additional hedge fund managers; 19% that they will recycle it to additional hedge fund managers alone, 5% to existing managers alone. That means that a healthy total of 87% say that their redeemed money will stay within the industry in one way or another.

The recycling commitment is higher than the analogous figure in the middle of 2016, to 87% from 83%.

A final point concerns the structures of the funds. Traditional master-feeder structuring remains the most popular, but various alternatives, especially co-investment and risk premia, are gaining ground. Those two are up 9% and 5% respectively from last year.

Liquid alts, on the other hand (UCITS and 40 Act funds) lost some ground from mid-2016 to mid-2017.