By Charles Skorina

In early 2016 certain Congressional committees sent letters to 65 major private universities asking for information about their endowments. They supposedly had an urgent need for this data and gave the schools just 30 days to respond.

It was worded as a polite request, but it came from people who could, for instance, compel the endowments to adopt a strict spending rate (like private foundations) instead of the more flexible regime they currently enjoy as "charities." Needless to say, the schools all coughed up the information forthwith.

Apparently, this data-dump just went into filing cabinets, and neither the schools nor Congress have been eager to share those reports with the general public. Nevertheless, we scrounged up copies of 15 of the responding letters from various sources. The other 50 schools have kept theirs out of sight.

We were especially curious to see what the schools had to say about endowment management costs, which has always been a cloudy issue for us.

Commonfund agrees. In a 2015 study they opined that:

...unlike other factors that affect investment returns, such as asset allocation and the many types of operational and investment risk, costs are almost certainly the least well understood.

See: Commonfund Institute: Understanding the cost of Investment Management (October 2005).

As we said in our OCIO report, the perceived cost of managing the endowment is a major factor in the decision to outsource, or not to.

It's not the only factor, but a big one. But how can a board make that decision if they don't know whether they're spending more or less than their peers? And, whether outsourcing will actually save them any money?

Investment returns can be benchmarked to the second decimal place, but the costs of managing those investments are harder to come by.

NACUBO and Commonfund include questions about those costs in their annual NCSE survey, and report broad averages. But there is almost no data on specific schools. We also have suspected that the reported NCSE average costs are on the low side, but had no hard evidence one way or the other.

Recent 990 filings also require a dollar amount for "investment management fees," but we haven't had much confidence in that number.

So, we've attempted to do our own analysis of the cost data reported by those 15 schools. It has some limitations, but we seem to be the only ones to have ransacked these letters.

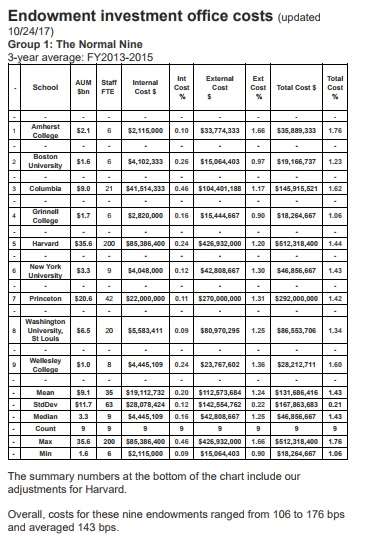

The Nine "normal" endowments

Nine of the endowments offered plausible numbers (expressed as annual dollar amounts and/or percentages of AUM) for both their investment-office costs and fees paid to external money-managers for the three fiscal years 2013-2015.

Here's what we extracted from their responses.

"Internal cost" is our terminology. It means, basically, the cost of running an internal investment office, including salaries, travel and overhead, with comp being the single biggest item. Generally, it also includes payments to outside vendors for things like consulting and custody services. It excludes all fees to outside vendors for actual, hands-on investment-management services.

Untangling these various items wasn't easy. Many of the responses were long, wordy essays rather than a few crisp numbers. Some interpretation was required and we can't guarantee that we got it all right. But anyone who wants to check our work can consult the original documents.

As we see, the "internal" costs averaged about 25 basis points (BPS) on AUM, but that average disguises a lot of variation from school to school. External costs averaged about 123 BPS, with much lower variance than for internal costs.

Harvard, as usual, is a special case. Before Narv Narvekar arrived they pursued a "hybrid" model, managing around half their AUM internally. So, that 70 BPS we came up with includes hands-on investment management of about $17 billion, in addition to office expenses that should be allocated over the whole endowment.

Remove Harvard's number and the average internal cost for the other eight drops dramatically to about 19 BPS and the remaining variance is much smaller.

In their letter, Harvard argued that their hybrid model actually reduced their total management costs vs. their peers. Our analysis suggests they were probably correct. Their total cost was just 110 BPS, lower than any other school except Grinnell, and lower than the average of 138 BPS for this group.

It's counter-intuitive, given the notoriously high staff costs at Harvard, but the hybrid model may have been relatively low-cost on a total BPS basis.

Grinnell, of course, pays Midwestern salaries, not Northeastern salaries and, in general, seems to run a pretty thrifty investment office.

The problem for Harvard, of course wasn't so much their cost structure, as their net returns. Amherst, Columbia and Princeton paid more for managing their endowments, but still attained much higher net returns in this period.

Commonfund weighs in:

The best publicly available work on endowment costs has been published by Commonfund. They issued a report in 2015 and a follow-up this year.

Their overall best estimate is that total endowment cost for a "well-diversified" endowment is currently between 100 and 175 BPS. That squares quite well with our 9-school sample, which ranged from 106 to 165 BPS, and gives us some confidence in our results.

See: Commonfund Institute - Counting the Cost (2017) published as part of the full NCSE report for FY2016.

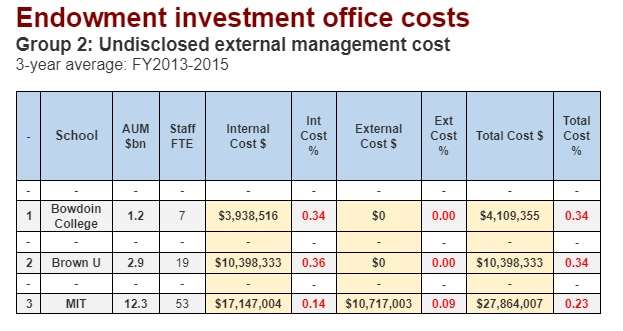

Three endowments who decline to disclose external costs:

"I would prefer not to," said Herman Melville's famous Bartleby. And three major schools preferred not to disclose total fees paid to money managers, or perhaps couldn't generate the requested numbers.

The defaulters were Bowdoin, Brown and (mostly) MIT.

Here's what we gleaned from their letters to Congress. In-house management and non-disclosed external management cost:

3-year average: FY2013-2015

Here's what Bowdoin said, in relevant part:

Endowment management expenses are paid directly by the endowment. The college does not pay for any endowment management expenses through its operating budget.

Fees paid for asset management are embedded in the market value and returns of the individual commingled investment vehicles through which he College invests.

We interpret this to mean that Bowdoin's accounting system doesn't capture these expenses in any definite, reportable way. No doubt they're well aware of the general fee schedules of their various external managers, but they may feel that "un-netting" such costs is unnecessary, or possibly just not cost-effective.

Brown gave a similar response:

The cost is the expense of running the office and does not include external management or incentive fees that are typically embedded in the net asset value of the investments. Investment managers provide the university with valuations that are net of management and incentive fees.

So, again, external management costs can't be unpacked, even for Congress.

MIT did state external management costs for a single sub-category: assets managed in separate accounts (which averaged $3.6 million or 3 BPS). But they responded like Bowdoin and Brown as to the rest:

In addition to separate accounts, the endowment is also invested in many pooled investment funds. Such funds, and not MIT, are directly responsible for paying the management fees and any performance allocations.

These schools, of course, are entitled to do their bookkeeping as they wish, as long as they stay within the bounds of GAAP and the IRS, which presumably they do.

Even among the "Normal Nine" schools on our first list, some of the respondents editorialized about incentive fees to alternatives managers.

Princeton said: Consistent with prior reporting and conventional accounting, the figures...do not include the external managers' performance-based compensation, which is properly understood as a share of returns rather than a cost of management.

Philosophically, we think that's a good argument. After all, Congress itself maintains that these "fees:" aren't really fees, which is why they are taxed as capital gains instead of ordinary income to the managing partners.

But other schools disagree and include those items as a cost in their response letters.

Washington University takes the same position as Princeton. They say: Incentive payments are not included... as they represent the sharing of the profits generated by the managers, rather than an expense.

Commonfund concluded in 2015 that many schools seemed to be confused on this point: ...only 18 percent [of respondents] included incentive and performance fees paid to asset managers, despite the fact that nearly 85 percent of NCSE respondents, or 704 institutions, reported having asset allocations to alternative investment strategies. Clearly, a gap exists between practice and understanding with respect to certain types of costs.

And some respondents seemed to be more confused still: ...the fact that almost 15 percent of NCSE participants did not provide cost data at all suggests that they may not have known what their costs were or were uncertain about them.

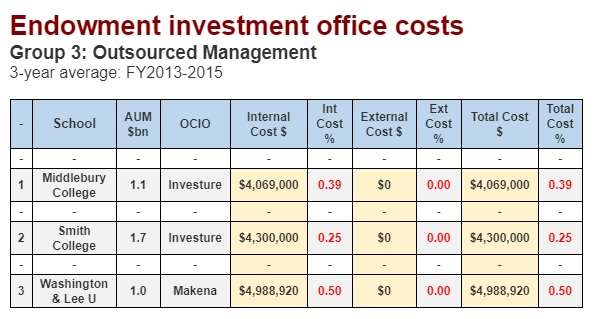

The Three Outsourcers

Our 15 responding letters include three from outsourcers: Middlebury (Investure), Smith (Investure), and Washington & Lee (Makena):

By using an OCIO, they are one step further removed from their external money managers and, not surprisingly, none of them choose to disclose external management fees apart from what they pay their OCIO vendors. Implicitly, they regard those costs as netted out and don't seem to capture them in their accounting system.

But we do see that the fees to their OCIOs on a BPS basis are significantly higher than the average "internal" cost reported by the non-outsourcers: 38 BPS vs. just 25 BPS. And that includes outlier Harvard.

That difference suggests that the outsourcing schools may be paying those vendors a bit of a premium over and above what they save by eliminating their internal offices. But it's a small sample including only two outsourcers, and may not warrant drawing any such broad conclusion.

Those three schools also appear in our latest compensation report, along with 7 other outsourcing schools. The data is for a different period and from a different source, but the costs are very similar. See Pay and Chief Investment Officers

An update on Fiscal 2017 endowment returns

Although we officially disdain endowment returns for periods under five years, we keep track of 1-year returns just like everybody else.

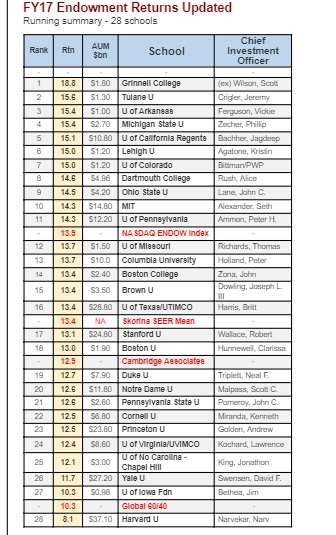

Last month we had heard from only 10 major schools. Now, as we go to press in mid-October, we're up to 28. Here they are:

Interestingly, the top and bottom schools in our ranking are unchanged from last month. Little Grinnell College still leads with an excellent 18.8 percent, while Harvard still brings up the rear with 8.1 percent. The mean return in our list is now 13.5 percent.

Tulane is in second place with 15.6, while Michigan State and University of Arkansas Foundation are tied for third with 15.4. Phil Zecher, MSU's new CIO will be pleased with that ranking, and so will be Vickie Ferguson, veteran investment manager at Arkansas, who has finally shepherded her fund into the over-$1 billion AUM club.

These are schools we don't usually see high in the return rankings and we can attribute this (mostly) to the surging stock market and the Trump Trade.

Arkansas, for example, has a full 50 percent allocation to global equity, far higher than the Ivies. With the S&P 500 up 17.9 percent in this period, and the Dow up a blistering 22.1, stocks were a good place to be. Princeton and Yale, with their heavy alternative allocations, put up respectable numbers on an absolute basis, but were in the bottom half of the pack.

Benchmarks on our chart include the NASDAQ Endowment Index, a non-investable index listed as ENDOW. It's a basket of 19 ETFs which are tradeable, but the mix is not disclosed. In theory, an investor (with some help from the indexing firm ETF Model Solutions LLC) can create a low-cost portfolio tracking a "typical" well-diversified endowment. Indeed, they seem to have beaten most of the Ivys this year. Of course, neither we nor they make any representations about future performance.

We'll chronicle longer term returns and offer more in-depth discussion as usual when we update our SEER report in a few months.

Charles Skorina works with leaders of endowments, foundations, and institutional asset managers to recruit Board Members, Executives Officers, Chief Investment Officers and Fund Managers. Mr. Skorina also publishes The Skorina Letter, a widely read professional publication providing news, research and analysis on institutional asset managers and tax-exempt funds. Prior to founding CASCo, Mr. Skorina worked for JP MorganChase in New York City and Chicago and for Ernst & Young in Washington, D.C.