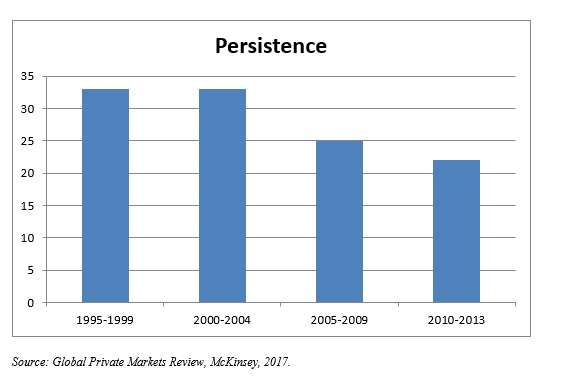

The data and analysis provider eVestment has issued a new white paper on “enhancing private equity manager selection with deeper data.” PE funds below the top quartile have not materially outperformed the public markets as a matter of history. So for an institutional investor, earning alpha is in large measure a matter of selecting the manager who is in and will stay in the top quartile. And to justify the fees involved, the PE allocation really must outperform the public markets. Such simple observations account for the need for a more skillful due diligence process in the selection of managers. Neither luck nor preferential access to the best managers can be counted upon. More to the point of this white paper, the “headline numbers” unearthed by not-so-deep data can’t be counted upon, either. Internal rate of return in particular can’t be looked at in isolation. Investors, as eVestment puts it, “need to look … into a variety of metrics and performance statistics across a manager’s track record” to understand how it creates value, what the skill set on offer is and how that skill set interacts with the strategy of the fund. The authors of this study cite a recent paper by Daniel R. Cavagnaro, Bart Sensoy, Yingdi Wang, and Michael Weisbach. Cavagnaro et al found (in the eVestment paraphrase) that “an investor’s skill level in fund selection is a more important driver of their returns, than luck or access to managers,” and that indeed an increase in skill of one standard deviation accounts for a 3% increase in the annual IRR. If Success were only Persistent…. Persistence is one name for one of the problems that a duly-diligent data dive must solve. Life would be easier for investors if those fund managers that had scored in the top quartile in the recent past could be counted on to do so for at least the near range future. But excellence does not persist. Investors “should consider putting as much scrutiny on a re-investment with this manager [one with a successful recent past] as when considering a GP in the second or third quartile with their latest fund.” With reference specifically to buy-out funds, eVestment says that only 19% of the funds that (a) have raised money subsequent to 2001, and (b) were a successor to a top quartile performer (by the same GP) have then repeated that top quartile performance. Not only is persistence low, it has been decreasing over time. Working from McKinsey research, eVestment offers the graph below.  Source: Global Private Markets Review, McKinsey, 2017. The height of each column represents the percentage of private equity funds raising money during the specified period that were in the same quartile as their immediate predecessor (as Asia Buyout Partners IV was a successor to Asia Buyout Partners III). The numbers for these four periods are: 33%, 33%, 25%, and 22%. Focusing more specifically on persistence within the top quartile, the numbers drop more dramatically. They are then: 31%, 28%, 13%, and 12%. Value Creation Analysis The eVestments paper also offers a primer in value creation analysis techniques: how one might go about taking the necessary deep dive into the data. Three key techniques are: valuation bridges; sensitivity analysis; and public market equivalent analysis. Valuation bridges “attempt to quantify the drivers of value and attribute them to certain key areas.” The analysis may produce a chart that looks somewhat bridge-like, with three pylons, representing from right to left “entry equity,” “gross equity,” and “exit equity.” Between the first and the second pylons one sees rectangles representing accretions: revenue growth, EBITDA margin, and debt reduction, that get one to the gross equity figure. Then beyond gross equity there are rectangles indicating subtractions, such as foreign exchange impact, which bring the overall curve down to the “exit equity” pylon. Sensitivity analysis looks at the deals that have driven the performance of a manager and how sensitive the level of fund performance is to deal specifics (which of course by definition don’t persist.) Finally, public market equivalent analysis “helps identify whether the manager has benefitted from a general uptick in markets or has truly outperformed through skill in deal selection and/or operational improvements.”

Source: Global Private Markets Review, McKinsey, 2017. The height of each column represents the percentage of private equity funds raising money during the specified period that were in the same quartile as their immediate predecessor (as Asia Buyout Partners IV was a successor to Asia Buyout Partners III). The numbers for these four periods are: 33%, 33%, 25%, and 22%. Focusing more specifically on persistence within the top quartile, the numbers drop more dramatically. They are then: 31%, 28%, 13%, and 12%. Value Creation Analysis The eVestments paper also offers a primer in value creation analysis techniques: how one might go about taking the necessary deep dive into the data. Three key techniques are: valuation bridges; sensitivity analysis; and public market equivalent analysis. Valuation bridges “attempt to quantify the drivers of value and attribute them to certain key areas.” The analysis may produce a chart that looks somewhat bridge-like, with three pylons, representing from right to left “entry equity,” “gross equity,” and “exit equity.” Between the first and the second pylons one sees rectangles representing accretions: revenue growth, EBITDA margin, and debt reduction, that get one to the gross equity figure. Then beyond gross equity there are rectangles indicating subtractions, such as foreign exchange impact, which bring the overall curve down to the “exit equity” pylon. Sensitivity analysis looks at the deals that have driven the performance of a manager and how sensitive the level of fund performance is to deal specifics (which of course by definition don’t persist.) Finally, public market equivalent analysis “helps identify whether the manager has benefitted from a general uptick in markets or has truly outperformed through skill in deal selection and/or operational improvements.”