By Guest Contributor Aaron Filbeck, CFA, CAIA, CIPM, Associate Director, Content Development

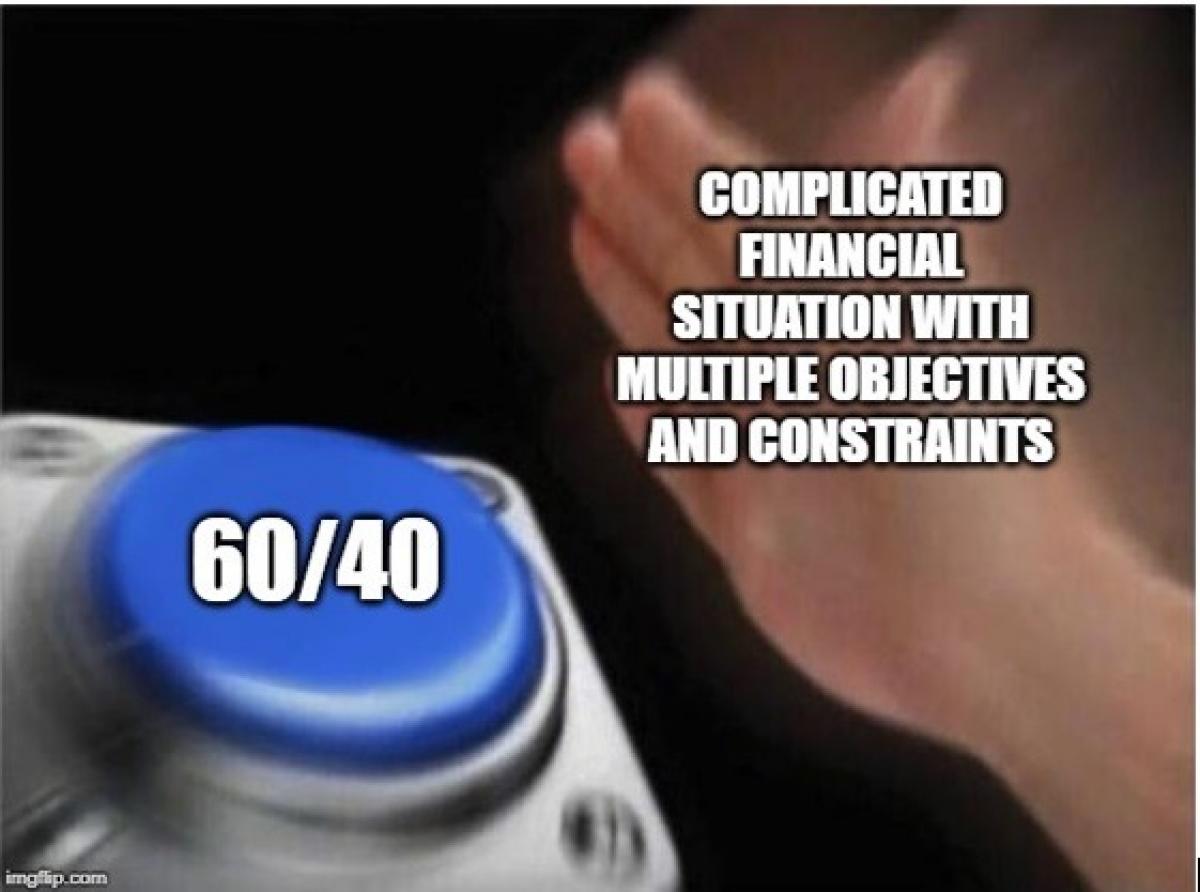

The death of the 60/40 may be a welcome change for multi-asset investors who understand that exposure to risk premia is perhaps a far better long-term investment strategy. Diversification remains an important facet of asset allocation, but we must change the conversation from meaningless allocation numbers (“I’m a 60 what?”) to just what it means to the end investor.

Much of the active management discussion over the past 10 years has been at the security selection level, with strong opinions on both sides. It feels only right to begin a needed dialogue of active management at the allocation level as we enter a time when global stock markets have done so well that large banks are now suggesting putting your portfolio in 100% stocks!

When we talk about active management, whether it’s security selection or asset allocation, we can’t help but talk about alpha. Does this manager provide alpha, or not? Is the manager justifying their fee? In simple terms, it’s just math: justification = yes when alpha > 0. Yes, fees are important, but are there better ways to measure the success of active management?

This must be a discussion about the end investor, and the value proposition this industry makes when trying to win that investor’s business. Right now, there is a lot of focus on alpha, and rightly so, but very little of that focus is on goals and objectives. What is the investor really trying to achieve? In other words: alpha is important, but it should be achieved in the context of an objective-based framework.

In an environment where the public market’s future returns look fairly dire and dry powder seems to be perpetually growing in the funds within private markets, we must step back and ask “why” we are making the allocation decisions we’re making. More importantly, we must stop ourselves (and our clients) from chasing performance at a time when those very markets may be opening their doors to many more people. Not every client’s objective is, nor should be, to outperform a capitalization-weighted index. Not only have we seen the studies that show how difficult it is to beat an index in most public markets, but we’ve also seen that investors simply aren’t good at investing in the funds that do it.

Instead, let’s get back to basics. What is your benchmark? Often, it’s an individual experience: public pensions have retiree distribution checks to cut, university endowments have operating budgets to support, and retail clients are often fending for themselves to not only save for retirement but also to invest their portfolios correctly. No amount of alpha will help if the foundations are weak--pun intended.

Our profession desperately needs to change the way we frame investment concepts to trustees, institutional investors, and retail clients. It’s all well and good to create an efficient portfolio, but it’s even better to create a portfolio which clients understand and feel a sense of ownership over. We spend our time “always saying sorry” for diversification, when we should be spending time proclaiming its benefits, and aligning it with purpose. Still, that can only happen if we, as investment professionals, internalize those benefits ourselves.

Aaron Filbeck, CFA, CAIA, CIPM is Associate Director, Content Development at CAIA Association. You can follow him on Twitter and LinkedIn.