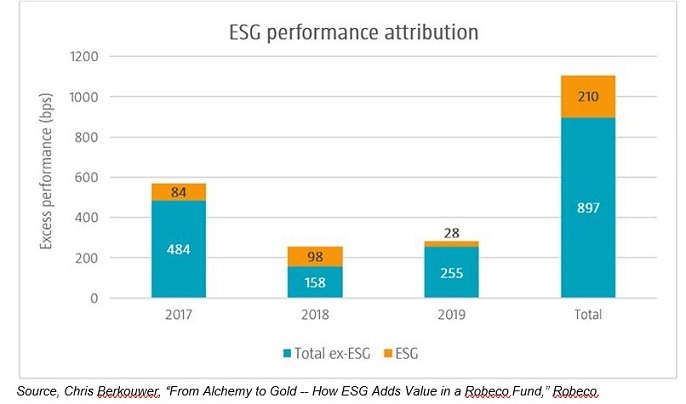

Sustainability-sensitive investing has a net positive impact on performance, according to a paper released by Robeco. According to the paper written by Chris Berkouwer, a Robeco equity analyst, ESG was responsible for 20% of the outperformance of a Robeco fund over a period of three years.

His findings are presented in the bar graph below. The fund in question was Robeco’s Sustainable Global Stars Equities and the time period studied in 2017-2019.

Berkouwer tells us that the most important fact about this fund’s strategy for the purposes of this paper is its bottom-up integration of ESG concerns into portfolio management. Robeco makes several valuation adjustments based on ESG factors: price target, sales growth, profit margin, and weighted average cost of capital.

The strategy of Sustainable Global Stars also follows an ESG-inspired exclusion policy, which excludes all companies in the tobacco sector and most of the aerospace and defense industries.

Furthermore, there is an activist component. Managers of the fund engage with corporate managers “to improve their sustainability strategy,” considering that more effective than a simple binary choice of exclude/include.

The Sugar in the Tea

Last year, Berkouwer says Robeco made a first attempt at quantifying the impact of ESG on portfolio performance in an article called “Separating the Sugar from the Tea.” In that headline’s metaphor, the “tea” was the underlying performance that a portfolio would have gotten without ESG. The “sugar” was the presumed addition that ESG brings.

That paper discussed a “distillation” or “sieving” approach to taking the sugar back out of the tea, to see whether the effect of the former is negative or positive and, if it is positive, to get a sense of how large it is. This year’s follow-up presents the results of the methodology developed there and then, the “full three-year track record of our ESG performance.”

In illustrating the positive effects of ESG, Berkouwer first looks at Linde plc, the Ireland-domiciled chemical company with a focus on industrial gas. Linde is the result of a combination between the old German company Linde AC and the US concern Praxair. Robeco looked with interest on this company because it is a crucial player in a transition of the industrialized world to a low-carbon energy system.

On the basis of its ESG analysis, Robeco lifted its price target in Linde from Euro 155 to 185. Arithmetically, this means that after the adjustment, the ESG component of the value of Linde to Robeco was 16%.

The performance contribution of Linde to the portfolio in the three-year period under study was 69 basis points. Sixteen percent of 69 basis points is 9 basis points of excess performance attributed to ESG.

Berkouwer writes that this straightforward computation is a “scientific, research-based attempt to proxy the importance of ESG factors to investment performance.” It separates the sugar from the tea.

Renewable Diesel

One inference is that ESG is to a degree counter-cyclical. 2018 was a difficult year for world stock markets. In that context, Robeco finds, ESG acted as a cushion, explaining 38% of excess performance. Global markets roared back in 2019, though, in what the Robeco report calls a “spectacular” rally. The ESG contribution to the fund’s excess return remained positive but fell to 10%. Several of the companies that contributed markedly to the 2019 return had only a small positive ESG adjustment, e.g. Charter Communications and Zebra Technologies.

On the other side, some stocks that did have a significant ESG adjustment did not perform as well as one might have hoped in the bullish environment of 2019. Biogen and Neste Oyj received negative ESG attribution. Neste Oyj is an oil refining company headquartered in Finland. In 2018 it was the largest producer of renewable diesel in the world. Its stock price was headed solidly upward through the first quarter of 2019, then suddenly plateaued in April.

Berkouwer attributes the success of Robeco’s ESG approach to its focus on opportunities rather than exclusion. Indeed, he notes that the exclusion of aerospace and defense has had an opportunity cost. Nonetheless, the focus on ROIC and free cash flow explains the positive impact that ESG has made to the performance of Robeco’s investment strategy.