By Aaron Filbeck, CFA, CAIA, CIPM, Associate Director, Content Development at CAIA Association Building the Burger I love when our industry uses analogies to describe investment concepts, so I must applaud one of the introductory pieces to JPMorgan’s 2020 Global Alternatives Outlook. In their introduction to the report, the authors claim that investing in alternative investments is like constructing the perfect burger (vegetarian or otherwise):

- The Patty: A core foundation of alternatives such as core real assets and private credit, designed to provide stable income with lower volatility;

- The Bun: Core complements such as hedge funds, which can provide diversification and uncorrelated alpha; and

- The Toppings: Return enhancers like special situations and private equity seeking opportunistic returns.

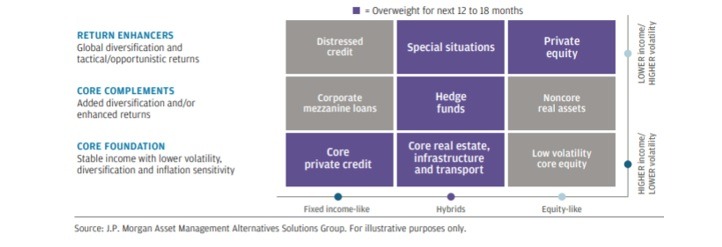

Food analogies aside, investors are at a crossroads. Public equities and fixed income have performed exceptionally well over the past decade but, looking forward, investors are now faced with high valuations and low interest rates. As a result, they are turning to alternative investments for differentiated sources of return. How Should Investors Think About Alternatives? The Framework How should investors think about allocating to alternative investments? The authors propose an Alternatives Framework, pictured below. In this framework, it’s important for investors to focus on what alternative investments do, not what they are. In other words, investors should move beyond naming conventions and instead focus on how introducing alternatives will benefit the entire portfolio. In their framework, you’ll notice the y-axis contains the “burger” components mentioned above, while the x-axis plots the risk-return profile from fixed income-like to equity-like. Using this schema as a starting point, it’s interesting to note that not all alternative investments are equally attractive to JPMorgan over the next 12 to 18 months. However, what is attractive depends on the objective of the portfolio. In the graphic, the purple boxes represent the categories they believe to be the most attractive places to allocate capital.  2020 Themes The rest of the Outlook takes an in-depth look into multiple alternative investment asset classes. Each of these asset classes contain multiple themes that are likely to impact risk and returns in the future. Rather than summarize each, I’ve pulled out some of the common themes across multiple asset classes that I believe will be relevant for allocators. Sustainability: There Is No Escape Sustainability is a topic on every investor’s mind, but it’s interesting to note how differently it will impact different asset classes. Hedge funds seems to indicate the largest mismatch of priorities regarding sustainability. In fact, 65% of LPs believe ESG will become more important in the next five years, while only 37% of GPs share the same view. Not only are both percentages the lowest relative to other asset classes, they also represent the widest dispersion between LPs and GPs opinions. Additionally, renewable energy has gone mainstream in infrastructure equity and debt investments, driven by government initiatives and increased economies of scale. As a result, investors are likely to see a large portion of infrastructure projects with a focus on renewables. Go Small to Go Big Whether it’s equity or debt in private markets, smaller companies are likely to offer better return opportunities than larger. As investors have allocated more capital to private markets, larger funds have been forced to allocate to larger companies. This has likely placed a premium valuation on many of these companies that is disconnected with fundamentals. Therefore, patient and discerning investors have a chance to find opportunity in smaller and middle-market deals. Technological Advancements Technology’s impact on financial services has only just begun but similar to sustainability, its impact differs by asset class. For hedge fund managers, the impact is internal: artificial intelligence, machine learning, and cloud computing should all produce a meaningful positive impact for hedge fund strategies that properly use them. Better risk management processes and an ability to take advantage of short-term and/or real time information can have a material impact on a hedge fund’s investment process. In private equity, the impact is external and exists in the companies themselves. E-commerce, cyber security, and software as a service (SaaS) are industries that are likely to generate attractive returns for investors who identify them early. Final Thoughts Alternative investments are complex. While including them in a portfolio can enhance returns or mitigate total risk, introducing them should be done with eyes wide open with a focus on risk. Dry powder continues to rise in private markets and manager dispersion must be considered when making allocation decisions. Using the burger analogy, make sure you know the ingredients in your burger, and ensure that it’s well done. Aaron Filbeck, CFA, CAIA, CIPM is Associate Director, Content Development at CAIA Association. You can follow him on Twitter and LinkedIn.

2020 Themes The rest of the Outlook takes an in-depth look into multiple alternative investment asset classes. Each of these asset classes contain multiple themes that are likely to impact risk and returns in the future. Rather than summarize each, I’ve pulled out some of the common themes across multiple asset classes that I believe will be relevant for allocators. Sustainability: There Is No Escape Sustainability is a topic on every investor’s mind, but it’s interesting to note how differently it will impact different asset classes. Hedge funds seems to indicate the largest mismatch of priorities regarding sustainability. In fact, 65% of LPs believe ESG will become more important in the next five years, while only 37% of GPs share the same view. Not only are both percentages the lowest relative to other asset classes, they also represent the widest dispersion between LPs and GPs opinions. Additionally, renewable energy has gone mainstream in infrastructure equity and debt investments, driven by government initiatives and increased economies of scale. As a result, investors are likely to see a large portion of infrastructure projects with a focus on renewables. Go Small to Go Big Whether it’s equity or debt in private markets, smaller companies are likely to offer better return opportunities than larger. As investors have allocated more capital to private markets, larger funds have been forced to allocate to larger companies. This has likely placed a premium valuation on many of these companies that is disconnected with fundamentals. Therefore, patient and discerning investors have a chance to find opportunity in smaller and middle-market deals. Technological Advancements Technology’s impact on financial services has only just begun but similar to sustainability, its impact differs by asset class. For hedge fund managers, the impact is internal: artificial intelligence, machine learning, and cloud computing should all produce a meaningful positive impact for hedge fund strategies that properly use them. Better risk management processes and an ability to take advantage of short-term and/or real time information can have a material impact on a hedge fund’s investment process. In private equity, the impact is external and exists in the companies themselves. E-commerce, cyber security, and software as a service (SaaS) are industries that are likely to generate attractive returns for investors who identify them early. Final Thoughts Alternative investments are complex. While including them in a portfolio can enhance returns or mitigate total risk, introducing them should be done with eyes wide open with a focus on risk. Dry powder continues to rise in private markets and manager dispersion must be considered when making allocation decisions. Using the burger analogy, make sure you know the ingredients in your burger, and ensure that it’s well done. Aaron Filbeck, CFA, CAIA, CIPM is Associate Director, Content Development at CAIA Association. You can follow him on Twitter and LinkedIn.