John Bowman, CFA, Senior Managing Director at CAIA Association

“If the devil can quote Scripture, in his spare time he might be working on private capital return methodology.”

So uttered Bill Elfers in 1995, founder of Greylock Capital and arguably modern venture capital itself. Eleven years later in 2006, Howard Marks wrote his most famous investment letter to Oaktree clients entitled “You can’t eat IRR.” In it, he outlined the flaws and risks inherent in relying solely on this yardstick.

The replicability assumptions underlying IRR returns and the ability to engineer the number based on capital call timing and use of subscription credit facilities has been written about extensively. For a brief tutorial, I’d recommend reading my friend and Fiduciary Wealth Partners’ CIO Preston McSwain’s takes here and here. All agree that a sophisticated investor needs to evaluate a mosaic of return methodologies to properly assess the performance of private idiosyncratic investments.

For this post, however, I’d like to leave that aside, zooming out to what I believe is a more fundamental issue: access to private capital beta.

Accounting for various approaches to calculating performance mentioned above, consensus seems to be that the illiquidity premium for private capital rests somewhere between 100 and 300 basis points above public equity per year after fees. More importantly, holding a basket of alternative assets within a diversified portfolio lowers volatility and draw-down risk. This ultimately leads to a combination of uncorrelated return and cash flow streams that allow investors to better achieve their long-term outcomes. This is the heart of diversification: reducing risk through limiting aggregate exposure to any single asset class. A serious investment professional is tasked with preserving capital through appropriate beta exposures over several economic cycles versus the impossible task of market timing or manufacturing new sources of elusive alpha each year.

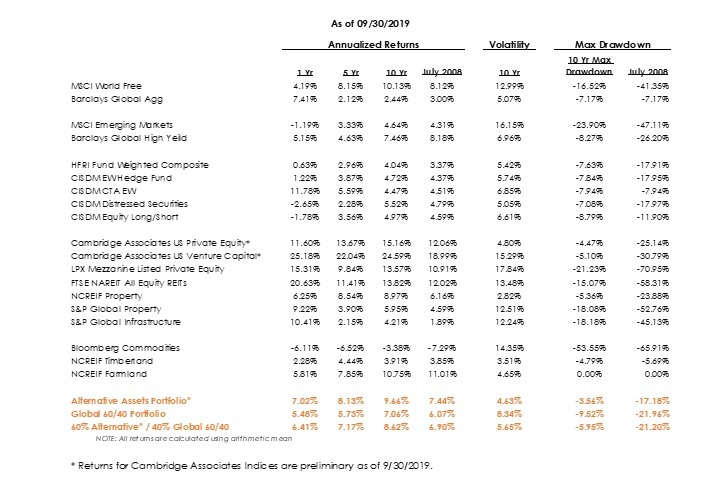

For many years, CAIA Association has prepared a quarterly performance representation, called the Global Invested Alternative Asset Portfolio, that aims to illustrate how a typical “endowment model” constructed portfolio with a heavy dose of alternatives would perform versus a plain vanilla “60/40” of global public equities and fixed income. Over the past ten years, the data shows that a portfolio with 60% alternatives (Private Equity, Real Assets, Hedge Funds) and 40% global publicly traded 60/40 portfolio outperforms a global publicly traded 60/40 portfolio by approximately 1.5% per year (8.6% vs. 7.1%). This outperformance is achieved with 32% less volatility and 38% less maximum drawdown risk underscoring the power of diversification.

Source: CAIA Association

I’m confident this tells an important story and is thematically correct. However, even we have called into question the veracity of these numbers, as there is no way to invest in the Cambridge Private Equity indices, S&P Global Property Index or the HFRI Hedge Fund Composite. These are simply mash ups, albeit rigorous, of aggregate asset class performance and not “investable.” In other words, you couldn’t passively replicate these indices through a strategy of owning the underlying funds or assets.

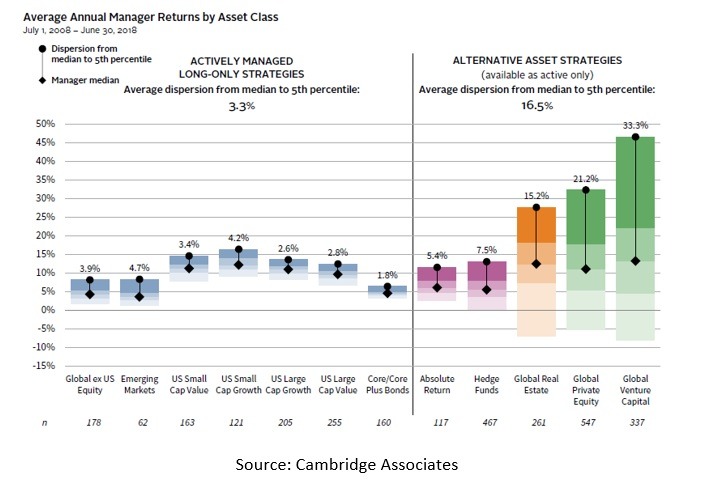

To exacerbate this challenge, it has been well documented that private capital dispersion between quartiles is alarmingly wide. According to a recent study from Cambridge Associates[1] the average difference between median manager and 5th percentile for traditional asset classes over the last ten years has been 3.3%, relative to 16.5% for alternative asset classes

In other words, top-tier and median performance for traditional asset managers are clustered very tightly, suggesting manager selection offers little incremental value to arbitrarily throwing darts. As we’d expect, the disparity between median and 5th percentile managers widens as you move from core/core plus fixed income (1.8%) to equities–US large-cap growth has the lowest level of dispersion (2.6%) while emerging markets has the highest (4.7%). Strikingly, however, dispersion levels balloon as you move into illiquid assets such as global real estate (15.2%), global private equity (21.2%) and global venture capital (33.3%). The dramatic differences in performance challenge whether these strategies can even be defined as a homogenous asset class and underscores the overwhelming importance of having access to the most competent and experienced GPs.

Anecdotally, in our conversations with allocators around the world, we often hear of the vast differences in responsiveness that the more prominent GPs provide to the large public pensions, SWF’s and Ivy league endowments whereas the smaller institutional capital pools that often won’t receive a returned phone call. Those anecdotes seem to be reinforced through a study conducted in 2018 by Binfare, Brown, Harris, and Lundblad that found that larger endowments (>$1B) significantly outperform their smaller brethren by an annualized rate of almost 3% across a 15-year period. Those returns were also superior on a risk adjusted basis with a Sharpe Ratio of 0.8 vs. 0.61.[2] Interestingly, trailing 10-year NACUBO performance data comparing similar endowment categories show a still existent but tighter spread of 1.3% per year.[3] Considering this data, by definition, excludes the GFC correction and recovery, it raises further concerns that this inequity phenomenon is even more acute in times of extreme market stress and volatility.

At face value, all of this seems to add up to a very rigged narrative where the size of your checkbook and historical relationship capital gets you access to the best performing GPs whereas all the rest of us are forced to settle on an average or poorly performing manager. Asked more candidly, is the entire illiquidity premium a self-fulfilling machination reserved only for the elite LPs?

Brown, Hu, and Kahn recently ran a study to attempt to answer this question by controlling for manager selection and discovering what a “realistic” return assumption might be for a diversified portfolio that includes a 20% allocation to private funds. Using detailed Burgiss data across more than 30 years and consisting of over 2,500 funds and $2.3 trillion of capital, the research found that both a “naïve,” random selection of private capital funds, or a dynamic rebalancing that allowed for oscillating vintages, ramp-up periods, and asset class allocations would still outperform a public 60/40 portfolio. Once again, the study also resulted in lower standard deviations and higher Sharpe Ratios in each simulation.[4] There is no doubt that a sophisticated GP selector would have garnered even better performance, but the research does suggest that even unskilled or lucky investors would almost always be better off with an allocation to private capital over the long term.

As I conclude, I want to circle back to the issue of access and equity as a necessary ingredient to a profession. George Bernard Shaw famously described professions as conspiracies against the laity. Humor aside, I vehemently disagree with the witty Irish playwright and prefer Sir John Templeton’s world view where he likened investment management to ministry, as both embody sacrificial care. A person of vulnerability puts his or her confidence, good faith and trust in another – whose help, advice and protection is sought in a financial manner. As investment professionals, whether overseeing billions of collective beneficiary pension receipts or just thousands of an individual’s hard-earned savings, we are stewards of a future and a dignified retirement. It is a public service that is virtuous, serves the greater good, and is owed to anyone that desires fiduciary care. While I value my special benefits through United, there is no room for premier or elite status in a true profession.

All investors deserve the benefit of superior risk adjusted returns through a diversified portfolio. As we recently wrote to the SEC during their comment period on revising the accredited investor rule, we must couple the forthcoming regulatory liberalization with appropriate safeguards and reform. As a profession, we need to remove any barriers, bias, opaqueness and favoritism that plagues the private capital space to ensure that all client’s interests are treated fairly and with priority. And we must simplify the packaging of these vehicles so that access to low-cost private capital beta, and the long-term benefits outlined above, become a reality to Main St. as well.

Keep in touch with John Bowman, CFA, Senior Managing Director at CAIA Association on LinkedIn, Twitter, or via email.

[1] “Private Investing for Private Investors: Life Can Be Better After 40(%).” 2019.

[2] “How do Financial Expertise and Networks Affect Investing? Evidence from the Governance of University Endowments,” 2018, Binfare, Brown, Harris, Lundblad.

[3] 2019 NACUBO-TIAA Study of Endowments. 2020.

[4]“Why Defined Contribution Plans Need Private Investments.” 2019. Brown, Hu, and Kahn.