By Aaron Filbeck, CAIA, CFA, CIPM | Associate Director, Content Development at CAIA Association

Depending on the day this blogpost is published, equity markets could be up 10% or down 10%. I guess timing blogposts is just as hard as timing the market these days.

We often refer to diversification as “the only free lunch.” You know what’s better than a “free lunch?” A free three-course meal. That may be difficult for those of us in self-quarantine right now (I’m not a good cook), so instead let’s explore this example vicariously through the art of portfolio construction.

Like chefs, capital allocators have a lot of ingredients to juggle at once. Typically, these investors are focused on building portfolios to withstand extreme market events, weather the proverbial storms, and make sure their portfolios are achieving their goals.

Allocators can’t control the directions of asset classes, but they can manage the multiple levels of risk and exposures in a portfolio. Rob Croce, PhD, of Mellon, articulates this concept in his paper “The Three Pillars of Better Strategic Portfolios.” In short, diversification is more than putting together multiple asset classes, just like a three-course meal is more than throwing a bunch of ingredients together and hoping for the best.

Setting the Menu: Diversification Across Asset Classes

Creating a menu lets the customer know they have options to choose from across multiple courses. Similarly, by exposing a portfolio to multiple economic drivers, an allocator can avoid extreme drawdowns, volatility, and the boom-bust cycles associated with investing in a single asset class. This concept is well accepted and known to professional investors already.

A Well-Balanced Plate: Diversification Within Asset Classes

Protein, vegetables, and starches should be well represented on your plate for a well-balanced meal, and the same can be said for representation within pockets of a portfolio.

Performance dispersion is common within asset classes, from individual securities within an index to indexes within a global market. How does an investor decide which equity markets to buy? Should they try to rotate between markets? What if they owned multiple markets at once? Does that level of diversification improve their portfolio?

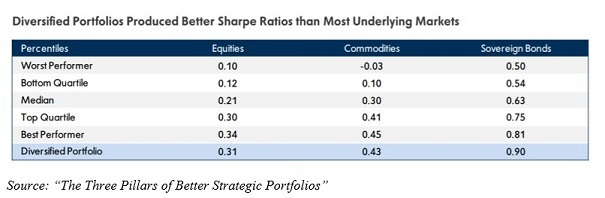

To answer the last two questions, Croce measures the dispersion of risk-adjusted performance (using Sharpe ratios) of popular indexes within equities, commodities, and sovereign bonds from 2000 to 2019, and compares them to an equally-weighted “diversified portfolio” that owns them all. The results of this exercise are below:

Notice the material spread between the Worst Performer and Best Performer within each asset class. There’s a lot of risk that an investor could select the Worst Performer, significantly lagging the Best Performer. That investor would have to strong foresight into the direction of each index. What’s more interesting, however, is that the Diversified Portfolio generates a Sharpe Ratio very similar to that of the Best Performer within each asset class. In other words, an investor opting for diversification within the asset class, instead of trying to predict the best market to own, generated very comparable risk-adjusted returns relative to a “perfect foresight” portfolio.

Setting the Pace: Diversification Across Time

About 10 years ago, my wife and I went out to dinner and ordered soup, an appetizer, and our entrée all at once. We didn’t think anything of it until all three appeared at our table simultaneously. Talk about lumpy!

For individuals and institutions, return sequence becomes an important part of the portfolio management process. Returns are often lumpy, driven by periods of extreme optimism and extreme pessimism. Mitigating the lumpiness of volatility is known as time diversification.

For investors with static allocations (“buy-and-hold” investors), sharp or prolonged equity declines can have an enormous influence on the trajectory of their portfolio. Focusing on long-term outcomes, but actively rebalancing a portfolio can dampen extreme market events and maintain a similar risk profile over shorter time periods. In other words, investors can prevent single asset classes or markets from dominating the trajectory of the portfolio over the short-term. Dynamic rebalancing strategies, volatility targeting, and short-term risk exposure analysis can mitigate this risk.

Putting It All Together

It’s worth noting that Croce’s paper examines these pillars through the lens of building a risk-parity portfolio. A risk parity portfolio seeks to balance risks across asset classes, not necessarily allocations to various assets classes. Additionally, risk parity strategies use leverage to achieve certain return objectives. Therefore, maximizing Sharpe ratios can often take priority over maximizing raw returns.

Still, regardless of the strategy, the paper brings forth some useful applications for asset allocators trying to weather markets that are ever changing. Diversification across asset classes is a well-accepted first step, but there are multiple levels to building a properly diversified portfolio. Make sure your portfolio has plenty of sustenance.

You can read the full piece here.

Aaron Filbeck, CFA, CAIA, CIPM is Associate Director, Content Development at CAIA Association. You can follow him on Twitter and LinkedIn.