By Aaron Filbeck, CAIA, CFA, CIPM, Associate Director, Content Development at CAIA Association

During CAIA Association’s most recent Virtual Chapter event, Keith and I (virtually) sat down with Chris Tidmore, CFA, CPA at The Vanguard Group to discuss Vanguard’s recent whitepaper, “The Wrapper Matters: Comparing Liquid Alternatives to Hedge Funds”

In the paper, Tidmore and his co-author, Daniel B. Berkowitz, CFA, sought to understand how hedge funds and liquid alternatives differed in terms of performance, portfolio construction, and their ultimate value proposition in a diversified portfolio. Some of the categories discussed in the virtual chapter event included equity long/short, equity market neutral, long/short credit, managed futures, multicurrency, and multi-strategy.

Performance: An Apples to Apples Comparison

Over the 15-year period, median performance for private hedge funds was meaningfully higher than their liquid alternative counterparts. Hedge funds also outperformed liquid alternatives on a risk-adjusted basis, using the Sharpe Ratio as a proxy.

However, higher median hedge fund performance came with higher levels of dispersion. In fact, for some hedge fund strategies, like long/short credit and event-driven, the spread between the 5th and 95th percentile hedge fund manager was more than double than that of the liquid alternative category. In other words, private hedge funds provided a higher level of manager selection risk.

What could help explain hedge funds apparent superiority over liquid alternatives? There are three potential explanations:

- Manager Skill—Skillful managers tend to prefer to operate in the private markets rather than the public markets.

- The “LIDS”—Liquid alternatives tend to be more restrictive than private hedge fund structures, either due to regulations, daily redemptions, or regular reporting of holdings. These restrictions could be summarized as the “LIDS”: Leverage, Illiquid Securities, Derivatives, and Shorting.

- Hedge Fund Database Bias—Since hedge fund databases are self-reported, they are filled with biases. Survivorship and backfill bias are two of many. In fact, over the 15-year period, the average lifespan of a hedge fund was five years, while a liquid alternative fund was four years.

Differences in Portfolio Construction

Not surprisingly, both private hedge funds and liquid alternatives underperformed global equities. However, as Tidmore emphasized and we at CAIA have often said, they’re not necessarily supposed to outperform... “this isn’t the 1980s or 1990s anymore.” However, it’s worth noting that hedge funds displayed lower and more dynamic correlations to global equities and fixed-income markets than liquid alternatives than their liquid alternative counterparts.

As a result, liquid alternatives tend to have more consistent factor exposures than hedge funds. To display this, Tidmore and Berkowitz ran three different factor models when regressing gross excess returns:

- The capital asset pricing model (CAPM): a single “market” factor model;

- A seven-factor model: market, value, size, momentum, term, credit, and high-yield; and

- A custom regression model: the seven-factor model plus liquidity, low volatility, quality, and trend following.

After running these three factors across the multiple hedge fund/liquid alternatives categories, they discovered the following: hedge funds outperform liquid alternatives after accounting for asset-pricing factors; most of the hedge funds strategies produced statistically significant alphas at the 5% significance level; R-squares were much higher for liquid alternatives than their hedge fund counterparts; and a unique combination of risk factors drove individual strategy returns.

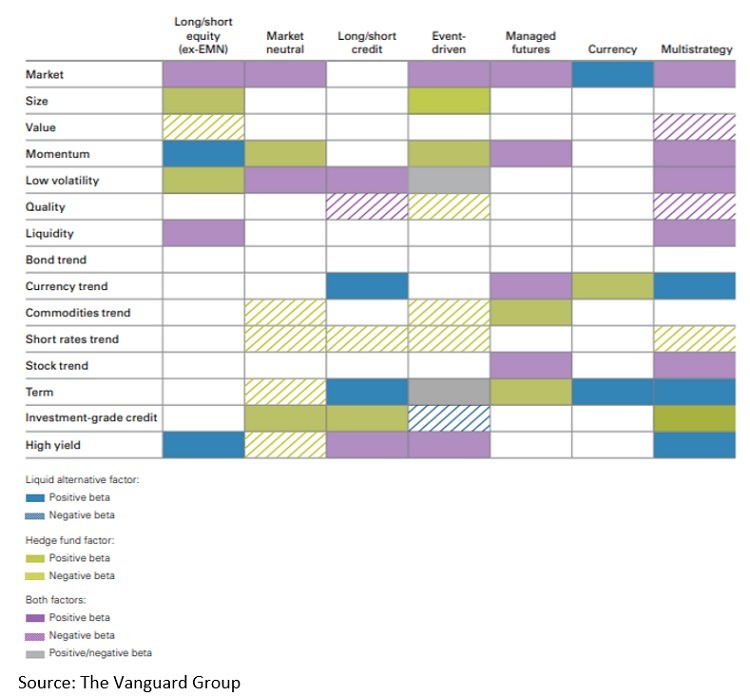

The last discovery was most interesting to the group. The schematic below shows the factor exposures for each strategy, and even differentiates these exposures by wrapper. As shown, some hedge fund and liquid alternatives have very different factor exposures within the same strategy.

An Allocator’s Guide

While this information is great, but how should allocators think about allocating to hedge funds and/or liquid alternatives?

First, hedge funds and liquid alternatives provide diversification. Regardless of the wrapper, these strategies have correlations less than 1.0 to traditional public markets. Their correlations and betas are also dynamic, meaning their diversification benefits can increase during certain market environments. An additional diversification benefit is that many of these strategies have low correlations to one another, with managed futures and macro strategies having the lowest.

Second, while correlations are less than 1.0, they aren’t negative. As a result, investors can’t expect most liquid alternatives and hedge funds to generate positive returns during public equity and fixed-income drawdowns. However, they tend to have shallower drawdowns than equities on average.

Third, hedge funds and liquid alternatives do add something unique to a portfolio and can improve the efficient frontier of a traditional global stock and bond portfolio. However, a significant allocation of the total portfolio might be needed for those benefits to be realized. Also, investors cannot own the average hedge fund manager, which means the improvement in the efficient frontier can heavily depend on the manager selected.

Putting It All Together

Over the last decade, liquid alternatives (mutual funds and UCITs) have seen a higher share of the growth within the hedge fund industry. For an allocator, there are two decisions to be made in the portfolio—the beta and the alpha.

For an investor wishing to allocate to hedge fund beta, they have the choice of investing in liquid alternatives that tend to have more stable factor beta exposure, or investing in private hedge funds that may have more dynamic correlation and beta exposure (potential factor timing).

For an investor wishing to allocate to hedge fund alpha, the decision becomes much more complex. Factor betas tend to explain the returns of liquid alternative returns, while alphas tend to be less pervasive. Hedge funds, on average, do produce alpha gross of returns, but manager dispersion is much higher, and betas are more dynamic. Neither of these are necessarily bad, as hedge fund beta can benefit a portfolio, but allocators should still perform proper due diligence and ensure they are paying a fair fee for what they get.

Watch the replay of the Virtual Chapter Event here. Read the full report here.

Interested in submitting content? Email us at content@caia.org.

Aaron Filbeck, CFA, CAIA, CIPM is Associate Director, Content Development at CAIA Association. You can follow him on Twitter and LinkedIn.