A recent literature review conveys the state of scholarly understanding of ESG alpha.It also discusses how machine learning may help alternatives managers to track, and at the right time to pounce upon, a critical tipping point.

Joachim Erhardt, a managing director at Landesbank Baden-Württemberg (LBBW) and an independent scholar, starts with a number. The total assets under management of ESG investing is more than $22.8 trillion.

Does ESG investing create alpha? With that kind of money at stake, the question is of some importance. Milton Friedman, in 1970, famously criticized views that we would today put under the ESG umbrella. Friedman maintained that the managers of a corporation (and, by natural extension, the managers of a fund) have an obligation to their equity holders to increase profitability, and that they have no broader social obligations, beyond obedience to the law, that trump that one.

Studies and Meta-Studies

A natural response to Friedman’s argument, offered then and through the decades since, is that ESG does benefit the equity holders, so that there is no such either/or choice as he imagined.

Does it, though? Fifty years later, with a lot of scholarly water under the bridge, what can we say about this?

There are several studies that treat the matter directly by comparing the relative performance of ESG asset managers to unrestricted asset managers or to relevant market benchmarks. There are enough studies that do this, with different time frames, different benchmarks, different ESG criteria, etc., that there is a market for meta-studies and meta-analyses, such as that of Revelli and Viviani in a paper in Management International (2013).

Erhardt passes along the Revelli and Viviani judgment that there is “no apparent link between [ESG] and financial performance.” Whether a study finds positive or negative impact “clearly depends on the methodological choices.”

The conclusion then is that one can draw no conclusion on whether ESG generates alpha or (as Friedman presumed) harms alpha.

Toward a Tipping Point

Beyond that, (and this was another of the common and early replies to Friedman’s provocative article) we ought to acknowledge the presence of a lot of stakeholders in operating corporations in the portfolio companies of investment funds. The equity shareholders possess only one of the sorts of stakes. Employees possess another, consumers of the products and services another … and people who are, for example, residing downwind of an industrial plant that is emitting pollutants into the air represent still another.

Related to this: ESG alpha will become self-evident to fund managers and their investors when the other stakeholders have enough clout to make it self-evident. For example, in a near-future world one can envision that customers will be sufficiently happy to buy green products as to give those marketing such products a clear competitive edge, in this way rewarding those who invested in those companies. Likewise, for leveraged companies, creditors may be more forgiving when a higher moral purpose adds to subsequent credit and investment decisions. Such an attitude by ESG lenders for the benefit of ESG lenders could even out the ups and downs of the business cycle. Empirical studies aren’t showing a clear ESG alpha because they are inherently backward-looking (and meta-studies more so). The alpha is yet to come.

This leads Erhardt to two further questions. What will do the tipping? And, how can interested parties best predict and track such a tipping when it comes? The tipping itself, he answers, will be brought about by a combination of market innovation and regulatory pressure. Further, he sees this not as a distant horizon, but as a near-term development.

An ESG Preference Model

This brings Erhardt to the matter of machine learning. He develops what he calls an “ESG Preference Model” through which managers can monitor the increasing market impact of the integration of ESG’s into decision making.

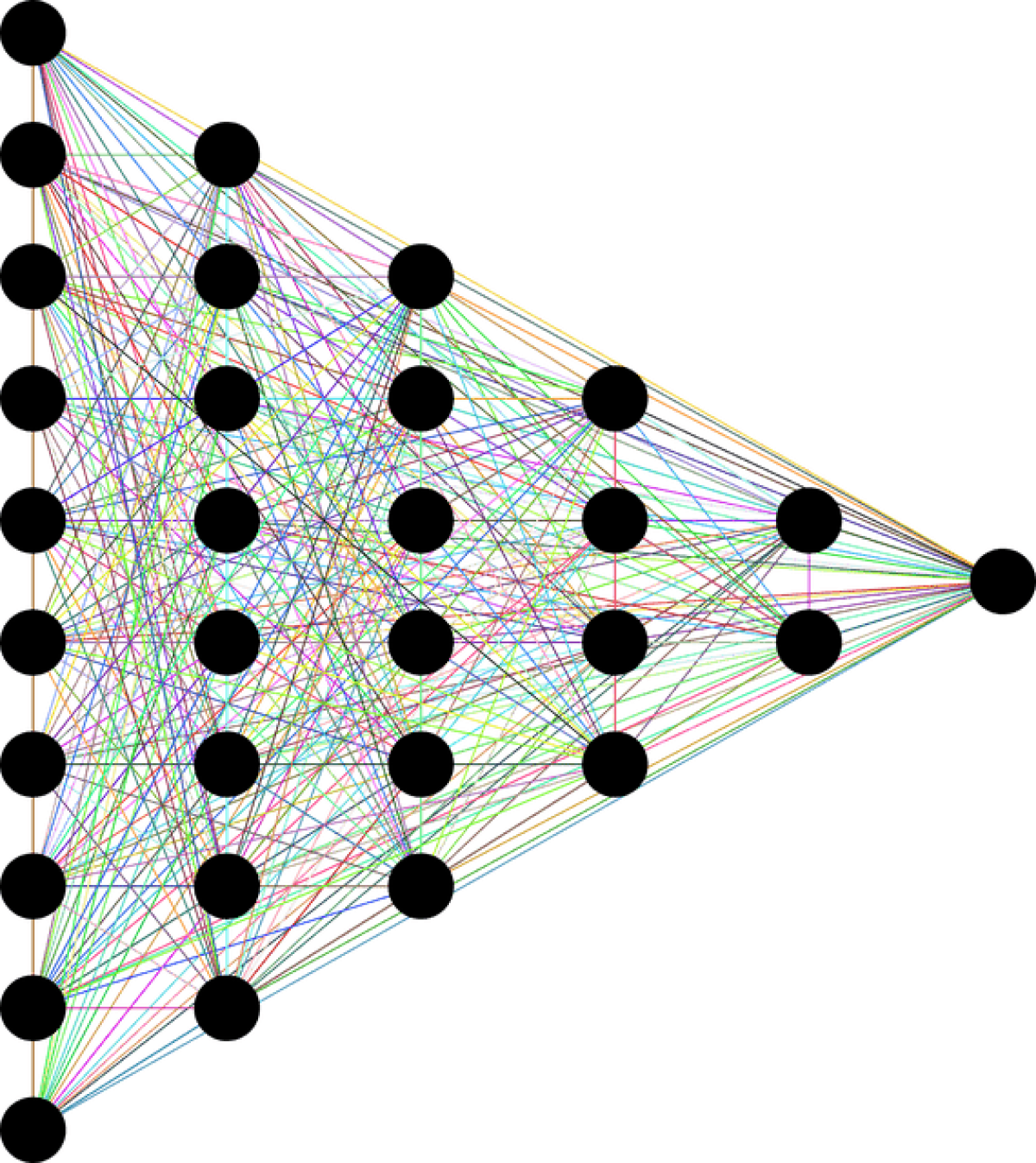

The model involves a fitting process that arranges market features and splitting points to reduce the weighted average miscalculation (WAM) of the initial (training) data. The process creates trees, a combination of features and splitting points, and systematically calculates the WAM for each tree. At each point in its learning, it chooses the tree with the lowest WAM, and the weightings used become the input for the next forest, the next collection of trees, producing a new choice, etc.

All this teaching and learning is “to monitor for an ESG tipping point” Erhardt tells us. The resulting “models need to be run in real-time, utilising ‘walk forward validation’ ending in the present day.”