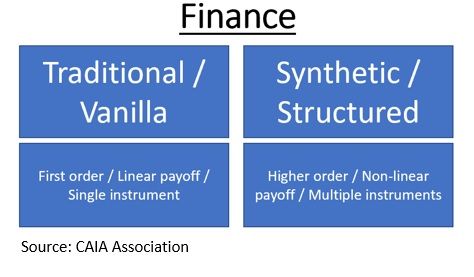

By Shreekant Daga, CAIA, CFA, FRM What is structured finance? Finance has several theoretical traditional and modern frameworks in practice. Needless to say, often the frameworks have conflicting assumptions. The sub-prime mortgage crisis is a modern classic example. Data-reliant credit rating agencies (CRAs) had not seen such a large drawdown in real estate prices in recent history, and lending institutions, making similar assumptions, essentially provided a put option to real estate buyers factoring in projected increases. When an investment call goes wrong the derivatives segment is affected to a greater extent in comparison to the cash segment. The crisis is often blamed upon mortgage-backed securities (MBS) but, zeroing down to fundamentals, it likely comes from the flaws in the modelling assumptions. Structured finance is often a route to challenge the status quo in finance and explores opportunity in the face of constraints by simply using first-order products. Structured finance transactions often rely on providing tailor made covenants to facilitate deal making. In very simple terms, structured finance is a form of negotiation to create a customized product to better serve the participants of the transaction.  How does structured finance compare to leverage finance? Finance has several specialized fields. Leverage finance extracts its being from a simple formula.

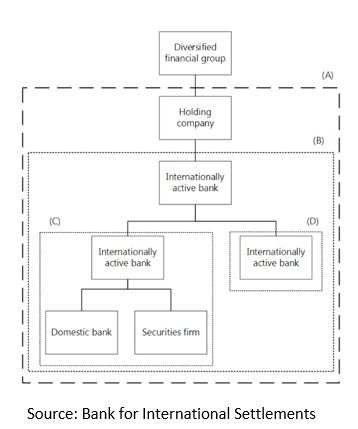

How does structured finance compare to leverage finance? Finance has several specialized fields. Leverage finance extracts its being from a simple formula.  To generate the maximum return for equity, an investor should theoretically continue taking as much leverage to the point where the cost of additional debt is greater than the additional return generated. Often times, the requirement for capital is finite rather than perpetual . Example: USD 100 million required to setup a plant. The capital for the plant is some optimal mix of equity or debt. The same formula would help optimize the return for equity. On the other hand, structured finance is a negotiation tool for the deal. A peculiar feature of structured finance is ring fencing. Ring fencing, in simple words, is the act of isolating an asset such that claims to it or to its cashflows are exclusively meant for the participant’s intended transaction. Example: An institution may carry out operations in several fields but a lender might not be keen to lend on the overall book. Structured finance by the creation of SPVs will isolate the exposure to the select parts of the book. This lender would hence have exposure to changes in the selected asset value rather than the whole book. Structuring can happen at two levels:

To generate the maximum return for equity, an investor should theoretically continue taking as much leverage to the point where the cost of additional debt is greater than the additional return generated. Often times, the requirement for capital is finite rather than perpetual . Example: USD 100 million required to setup a plant. The capital for the plant is some optimal mix of equity or debt. The same formula would help optimize the return for equity. On the other hand, structured finance is a negotiation tool for the deal. A peculiar feature of structured finance is ring fencing. Ring fencing, in simple words, is the act of isolating an asset such that claims to it or to its cashflows are exclusively meant for the participant’s intended transaction. Example: An institution may carry out operations in several fields but a lender might not be keen to lend on the overall book. Structured finance by the creation of SPVs will isolate the exposure to the select parts of the book. This lender would hence have exposure to changes in the selected asset value rather than the whole book. Structuring can happen at two levels:

- Product level

- Organisation structure/ Company / SPE level

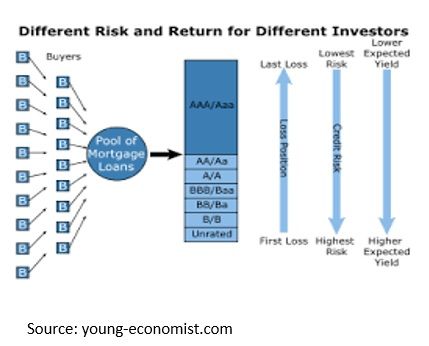

Product level The first is predominantly for tranching of various types of risks to meet the specific requirements of investors. This is not limited to the more commonly used tranching of seniority of claims (credit risk) but includes tranching of other types of risk, such as interest rate risk Example: Converting the return of a fixed income variable return instrument to two tranches of fixed income fixed return instrument and fixed income variable return instrument for two different classes of investors. Organization level The second form of structuring which happens at the organization structure level may be for one of the following reasons (not limited):

- To segregate the various businesses

- To segregate the investors based on their preferences

- To create selective availability of information at various levels

- For tax planning in case of transfer pricing

- To hold control over entities with lower capital allocation

- To operate (certain closed economies allow only domestic companies to operate)

- For better valuations/fund raising (individual parts collectively have often times proven to be valued better than all of the parts together)

- Efficient capital structure support at group level

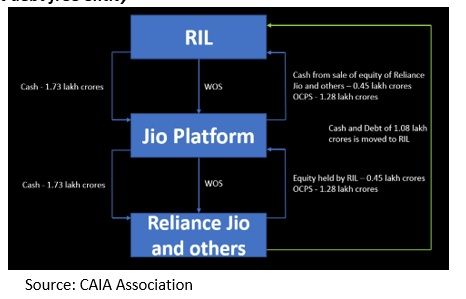

Structured Finance is not the same as Structured Credit Financing sources can be broadly split into equity and debt. The scope of structured finance runs through the ends of the capital structure, while structured credit is a subset of structured finance and deals with only the debt side. Structured Finance – Case in view: Reliance Industries Limited An Indian company, named Reliance Industries Limited (RIL) recently raised funds from domestic and foreign markets predominantly using a structured finance framework. This is a very special transaction in many ways. Most structured finance transactions are a single transaction signed between parties with varied covenants across products and at various levels of the company at a single point in time. In order to achieve the fund raising, RIL entered into several transactions with multiple parties (institutional and retail) with constant and/or varied covenants spread across a time frame involving huge sums of money. If the goal of RIL fund raising is to be looked up as an objective and the manner and complexity with which they accomplished it over time is unheard of. Precursor The fund-raising story of RIL (for most of us) begins on August 19, 2019. The target of making RIL net debt-free was outlined by Chairman and Managing Director, Mukesh Ambani at RIL's 42nd Annual General Meeting on August 12, 2019.  RIL, in its October 2019 analyst call, had highlighted that, specifically, technology companies receive the best valuation when they are net debt zero. The digital business had undergone huge expansions as Jio, a wholly owned subsidiary of RIL, established itself as one of the market leaders in the segment. Jio also grew inorganically by acquisitions which were debt fuelled, leading to a debt overhang post-expansion. On the analyst call, RIL floated an idea of accumulating the digital platform for the first time. Organization level structuring – creating platform value from existing business units To bring all of this under a single ambit, the holding company Jio Platforms was formed on November 15, 2019 as per Ministry of Corporate Affairs filings. Jio Platforms was a wholly owned subsidiary of RIL. This was the first brick of organizational level structuring. For foreign investments to pour into the company it was important to establish Jio Platforms since the platform company receives better valuations. Furthermore, a platform company facilitates larger investments. This was evident with the valuations (and size) of global digital companies such as Alibaba, Tencent or Amazon. Product level structuring – creating a net debt free entity

RIL, in its October 2019 analyst call, had highlighted that, specifically, technology companies receive the best valuation when they are net debt zero. The digital business had undergone huge expansions as Jio, a wholly owned subsidiary of RIL, established itself as one of the market leaders in the segment. Jio also grew inorganically by acquisitions which were debt fuelled, leading to a debt overhang post-expansion. On the analyst call, RIL floated an idea of accumulating the digital platform for the first time. Organization level structuring – creating platform value from existing business units To bring all of this under a single ambit, the holding company Jio Platforms was formed on November 15, 2019 as per Ministry of Corporate Affairs filings. Jio Platforms was a wholly owned subsidiary of RIL. This was the first brick of organizational level structuring. For foreign investments to pour into the company it was important to establish Jio Platforms since the platform company receives better valuations. Furthermore, a platform company facilitates larger investments. This was evident with the valuations (and size) of global digital companies such as Alibaba, Tencent or Amazon. Product level structuring – creating a net debt free entity  This was followed by a perceived quiet period since RIL transacted within the group. Jio platforms was capitalized with 1.73 lakh crore (USD 23 billion). 1.08 lakh crore (USD 14 billion) worth of Optionally Convertible Preference Shares (OCPS) were issued by Reliance Jio and others wherein Jio Platform acted as a conduit. This cash was returned to RIL along with takeover of debt of the same amount. The remaining 0.65 lakh crores (USD 9 billion) in the Jio Platform were used by Jio Platform to purchase the equity by RIL in Reliance Jio and others (0.45 lakh crores) alongside infusion (0.2 lakh crore) against the OCPS. This financial juggling moved debt from Reliance Jio onto RIL and left 0.2 lakh crore (USD 3 billion) on Reliance Jio’s balance sheet. The holding company for Reliance Jio and others was now Jio Platform. This move had no impact on the consolidated debt level for RIL. Likewise, the reorganization had no impact for shareholder on pre or post basis. The underlings of RIL in the structure were debt free as debt moved to RIL. Organization-level structuring – selling new shares

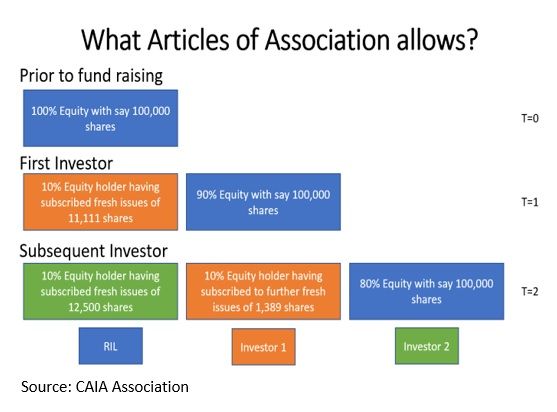

This was followed by a perceived quiet period since RIL transacted within the group. Jio platforms was capitalized with 1.73 lakh crore (USD 23 billion). 1.08 lakh crore (USD 14 billion) worth of Optionally Convertible Preference Shares (OCPS) were issued by Reliance Jio and others wherein Jio Platform acted as a conduit. This cash was returned to RIL along with takeover of debt of the same amount. The remaining 0.65 lakh crores (USD 9 billion) in the Jio Platform were used by Jio Platform to purchase the equity by RIL in Reliance Jio and others (0.45 lakh crores) alongside infusion (0.2 lakh crore) against the OCPS. This financial juggling moved debt from Reliance Jio onto RIL and left 0.2 lakh crore (USD 3 billion) on Reliance Jio’s balance sheet. The holding company for Reliance Jio and others was now Jio Platform. This move had no impact on the consolidated debt level for RIL. Likewise, the reorganization had no impact for shareholder on pre or post basis. The underlings of RIL in the structure were debt free as debt moved to RIL. Organization-level structuring – selling new shares  Beginning late April to mid-July, Jio platforms received commitments of investment aggregating 1.52 lakh crore (USD 20 billion) from financial and strategic investors. It is important to note that these investments are governed by an investment agreement and the money may be received in a series of flows. A peculiar feature of the articles of association of Jio Platforms was that in case of stake sale there would be no dilution for any shareholder other than RIL or any of its permitted transferees. This feature ensured that investors entered at various points in time held their respective stake by rebalancing the additional issue of shares. This also meant that RIL never transferred any of its units which would have brought about short-term tax implications. Tax implications can arise only if there is stake sale, stake dilution tantamount to stake sale through fresh issuance is not considered taxable. Corporate taxes on stake sale is ballpark 30% which has a huge cash drain. Product level structuring – raising cash from RIL rights issue Given that the investments on the Jio platform are signed but the sum of money may be received in a staggered manner which is governed by the investment agreement it was very important that RIL went ahead with rights issue. RIL’s planned the largest rights issue size by an Indian company with issue size of 0.53 lakh crores. Rights shares were offered at 1,257 with the cut-off date for eligibility being May 14th when the shares closed at 1,436. Subscription to the rights issue was under the caveat of staggered payment of 1,257. The in-the-money nature of the rights issue along with the staggered payment option ensured that it was successful. Since the movement of debt from Jio Platform to RIL had no impact on a consolidated basis, RIL could continue with the rights issue which was for a separate class of existing investors. Case sum-up: RIL raised combined commitments close to 2.05 lakh crores (USD 27 billion) over late April to mid-July. The combined capital raised is unprecedented in Indian corporate history. It is also remarkable that it was achieved amidst a global lockdown caused by Covid-19 - a period when cash is king. RIL could achieve unprecedented fundraising by Indian company standards because it used a mix of instruments from a mix of investors over a period of time, untapping high valuations with the help of accounting entries that maintained the status quo at the consolidated level. This is also possible with strong promoter support as has underwritten the entire rights issue, pledging to buy shares that are unsubscribed. Could this had been achieved without reorganizing the organizational structure which unleased value? Maybe not. Could this had been achieved without the use of multiple instruments, amended articles of association, and an array of domestic and foreign investors? Again, perhaps not. Could RIL have solely relied on investment agreements and have avoided the rights issue, which brought immediate cash along with capital call commitments over a year? Maybe not. Could the oil business have generated the funds required at group level? Would the bulk of foreign investors be interested in an oil refinery and marketing company? Maybe not. Rich use of structured finance on both product and organizational level ensured fund raising success for RIL. Conclusion Deeper understanding of structured finance helps to fill gaps in an investment mandate. It provides both parties with exactly what they require. Structured finance helps eliminate the risks which the investing side does not wish to entail and facilitates to reward only for the risks underwritten or taken in isolation. It helps transact in situations which would otherwise be blocked by the investment philosophy. Structured finance is the custom fit stream of finance, as vanilla finance acts more as the readymade!

Beginning late April to mid-July, Jio platforms received commitments of investment aggregating 1.52 lakh crore (USD 20 billion) from financial and strategic investors. It is important to note that these investments are governed by an investment agreement and the money may be received in a series of flows. A peculiar feature of the articles of association of Jio Platforms was that in case of stake sale there would be no dilution for any shareholder other than RIL or any of its permitted transferees. This feature ensured that investors entered at various points in time held their respective stake by rebalancing the additional issue of shares. This also meant that RIL never transferred any of its units which would have brought about short-term tax implications. Tax implications can arise only if there is stake sale, stake dilution tantamount to stake sale through fresh issuance is not considered taxable. Corporate taxes on stake sale is ballpark 30% which has a huge cash drain. Product level structuring – raising cash from RIL rights issue Given that the investments on the Jio platform are signed but the sum of money may be received in a staggered manner which is governed by the investment agreement it was very important that RIL went ahead with rights issue. RIL’s planned the largest rights issue size by an Indian company with issue size of 0.53 lakh crores. Rights shares were offered at 1,257 with the cut-off date for eligibility being May 14th when the shares closed at 1,436. Subscription to the rights issue was under the caveat of staggered payment of 1,257. The in-the-money nature of the rights issue along with the staggered payment option ensured that it was successful. Since the movement of debt from Jio Platform to RIL had no impact on a consolidated basis, RIL could continue with the rights issue which was for a separate class of existing investors. Case sum-up: RIL raised combined commitments close to 2.05 lakh crores (USD 27 billion) over late April to mid-July. The combined capital raised is unprecedented in Indian corporate history. It is also remarkable that it was achieved amidst a global lockdown caused by Covid-19 - a period when cash is king. RIL could achieve unprecedented fundraising by Indian company standards because it used a mix of instruments from a mix of investors over a period of time, untapping high valuations with the help of accounting entries that maintained the status quo at the consolidated level. This is also possible with strong promoter support as has underwritten the entire rights issue, pledging to buy shares that are unsubscribed. Could this had been achieved without reorganizing the organizational structure which unleased value? Maybe not. Could this had been achieved without the use of multiple instruments, amended articles of association, and an array of domestic and foreign investors? Again, perhaps not. Could RIL have solely relied on investment agreements and have avoided the rights issue, which brought immediate cash along with capital call commitments over a year? Maybe not. Could the oil business have generated the funds required at group level? Would the bulk of foreign investors be interested in an oil refinery and marketing company? Maybe not. Rich use of structured finance on both product and organizational level ensured fund raising success for RIL. Conclusion Deeper understanding of structured finance helps to fill gaps in an investment mandate. It provides both parties with exactly what they require. Structured finance helps eliminate the risks which the investing side does not wish to entail and facilitates to reward only for the risks underwritten or taken in isolation. It helps transact in situations which would otherwise be blocked by the investment philosophy. Structured finance is the custom fit stream of finance, as vanilla finance acts more as the readymade!

Interested in contributing to Portfolio for the Future? Drop us a line at content@caia.org