By Daniel Fang, CFA, CAIA, Lead Portfolio Manager at Emotomy, and Sabrina Bailey, CEO at Emotomy

Interest Rates to Stay Lower for Longer

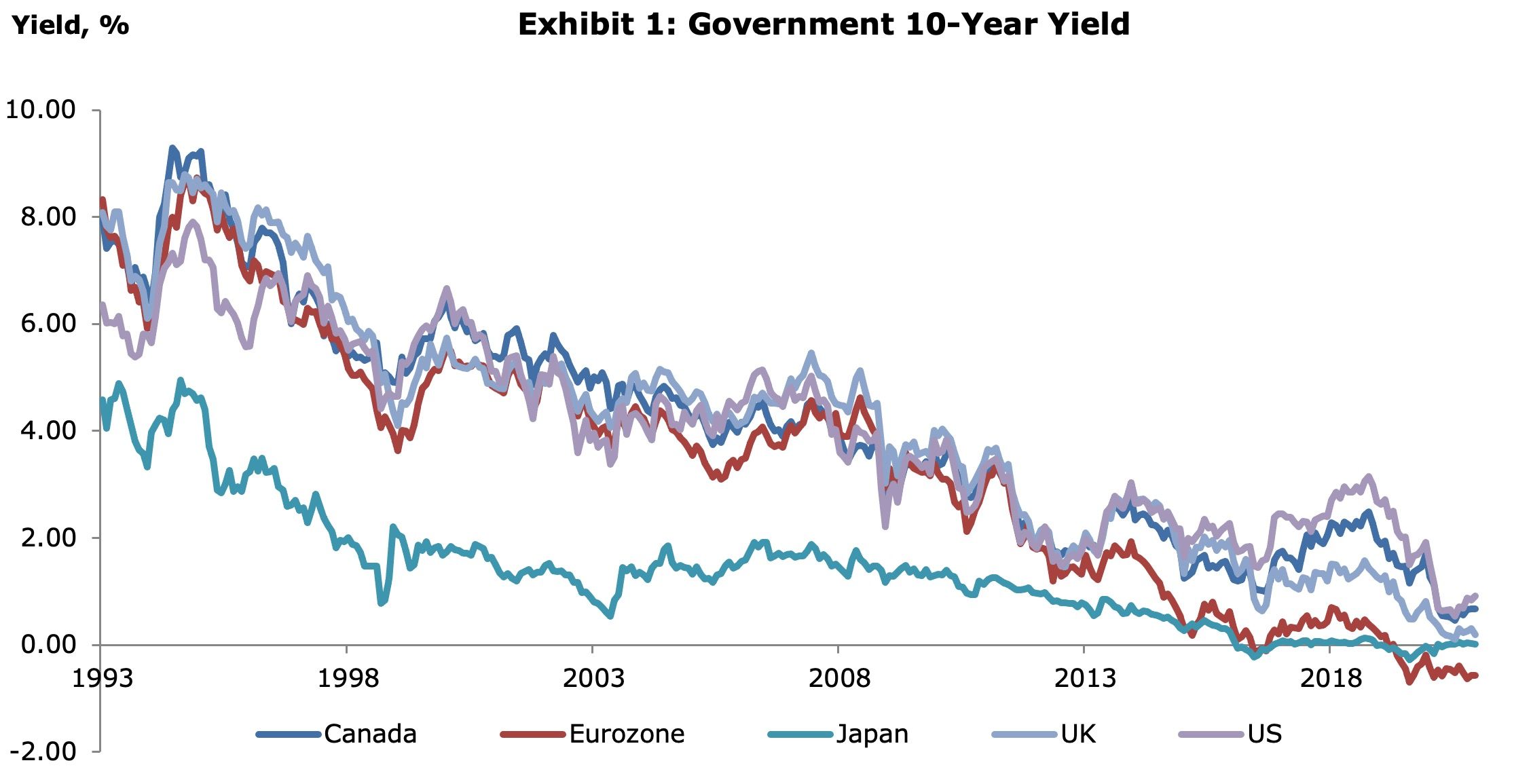

Since the Great Financial Crisis, central banks across all major economies have kept interest rates low to stimulate economic growth (See Exhibit 1). This trajectory took a new course after the COVID-19 pandemic hit the globe in the early part of 2020. The Federal Reserve cut interest rates to zero and vowed to keep interest rates low for the foreseeable future. The lower-for-longer interest rate outlook negatively impacts investors’ ability to generate income.

(Source: Bloomberg)

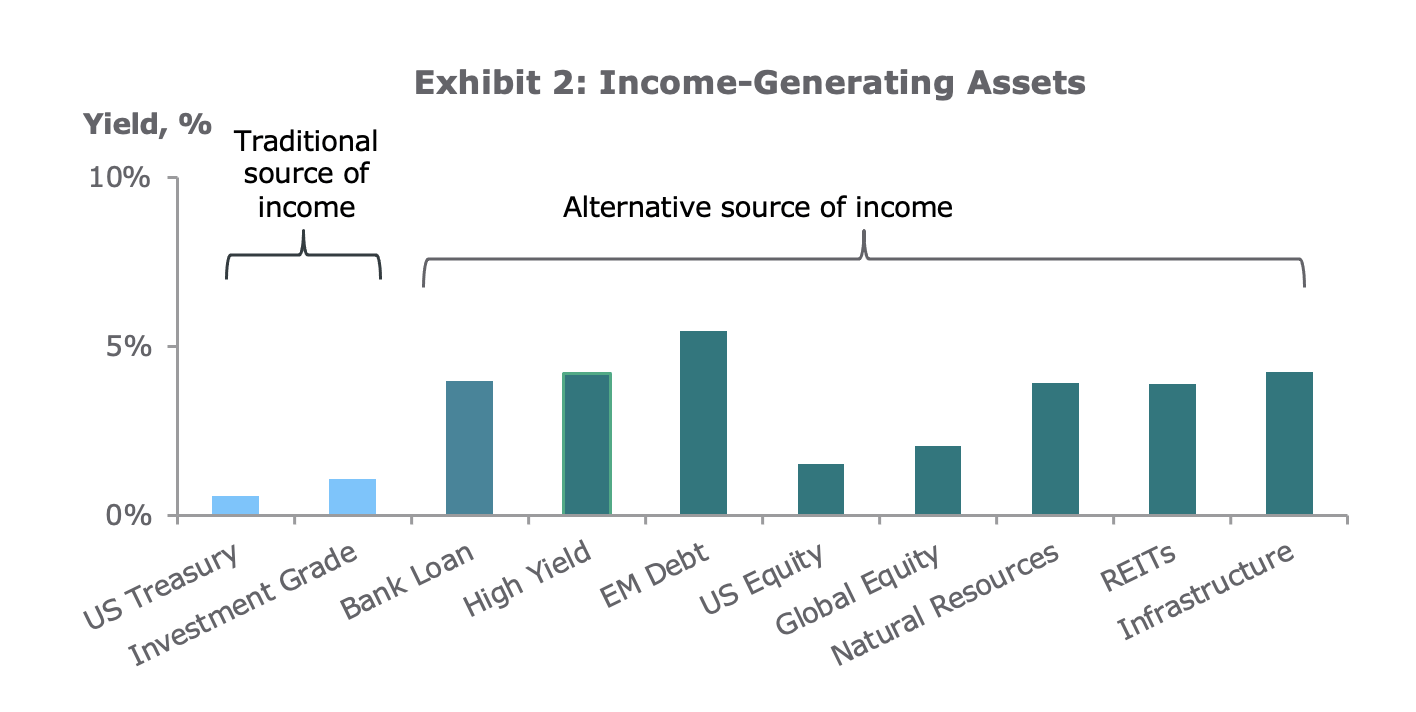

Decades ago, income investors could get a healthy yield of 5% to 7% by holding U.S. Treasury bonds. They could also take on slightly more risk for extra yield by investing in corporate investment-grade bonds. Today, these are no longer viable options. With the U.S. Treasury 10-year note only paying 1.0%, and investment-grade spreads hovering around 90 basis points, income investors have no choice but to look for yield in riskier assets, including high-yield bonds, emerging market debt, stocks, real assets, and so on. These alternative sources of income can offer higher yields but come with significantly more risk.

(Source: Bloomberg)

Building Risk Efficient Income Portfolios

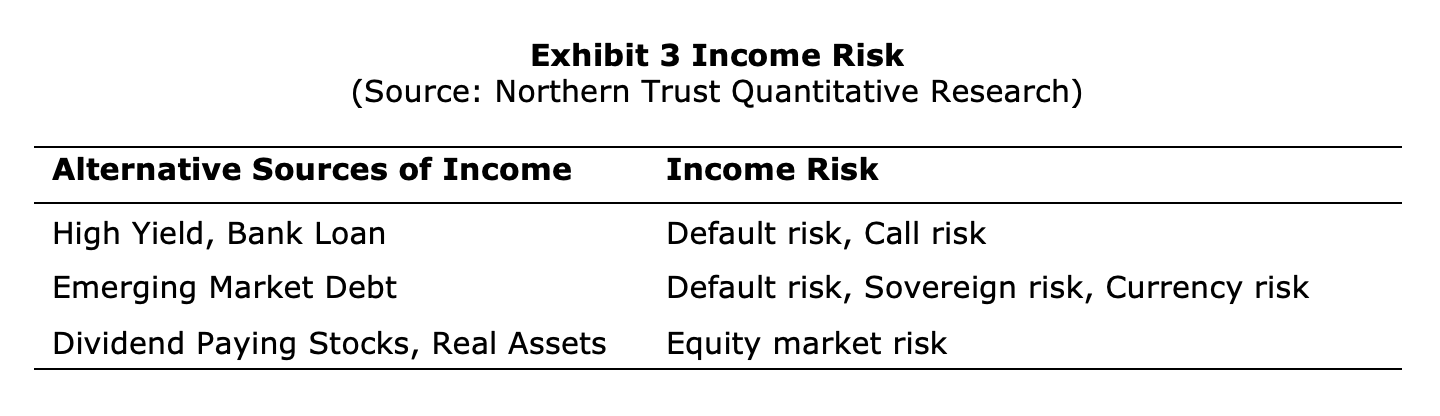

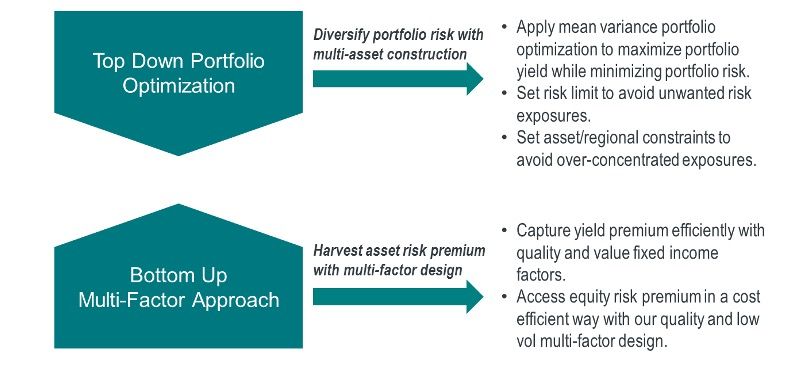

The income risk means uncertainty of income cash flow and potential capital losses. For income investors, a stable and predictable income stream is a top priority. To mitigate income risk, we approach the income portfolio design from both top-down and bottom-up perspectives. The chart below illustrates the general framework for our income portfolio design. This framework delivers risk-efficient income portfolio construction for investors.

Exhibit 4: Portfolio Construction

Top-Down Portfolio Optimization

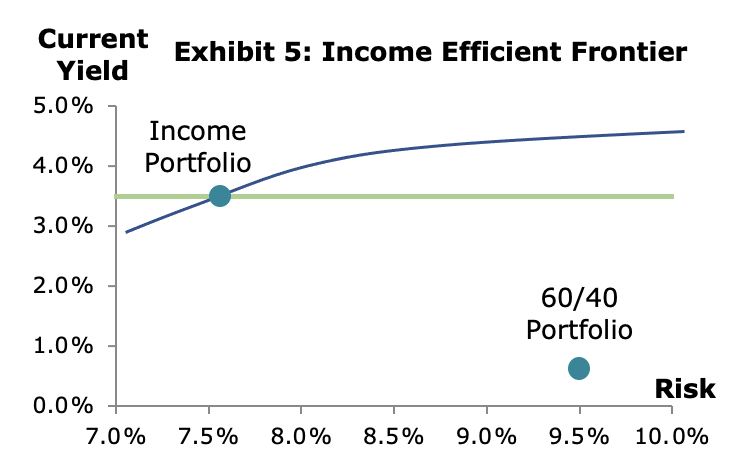

A diversified multi-asset portfolio construction is the most effective way to create a risk-efficient portfolio by taking advantage of low and negative correlations among yield, credit spread, and equities. Modern Portfolio Theory (MPT) established an industry standard for portfolio construction and design. However, most of the MPT applications focus on maximizing total return, which may not lead to the most efficient income portfolio. We adopted and adapted the MPT framework to maximize portfolio yield and construct the portfolio yield efficient frontier (See Exhibit 5). Each portfolio on the efficient frontier represents an optimal income portfolio given a level of portfolio risk. Maximizing yield may not result in an undesirable total return because:

- asset yield is the best predictor of future total return, and

- risk limits and asset bounds ensure the portfolio allocation remains within the desirable range.

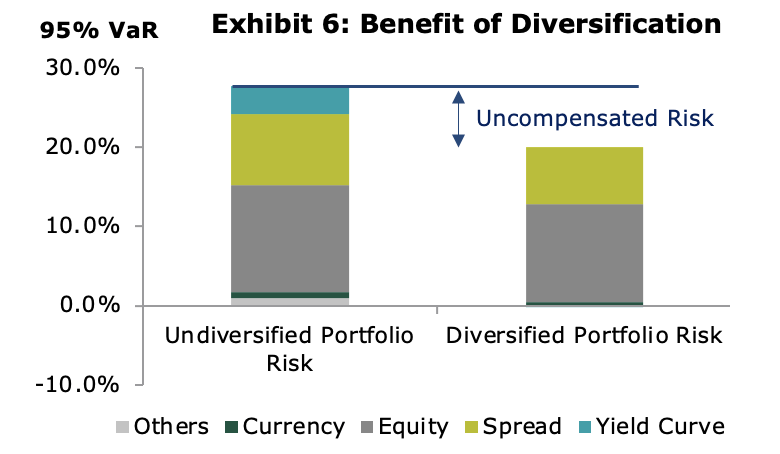

The income efficient frontier shows a superior risk-adjusted yield profile compared to a traditional 60% stock/40% bond (60/40) portfolio. The sample income portfolio yields 3.5%, 1.3% higher than the 60/40 portfolio with 2% less total risk. The diversification benefit from the multi-asset approach is notable as shown in Exhibit 6. More than 25% of uncompensated asset risks can be diversified away.

(Source: Northern Trust Quantitative Research)

(Source: Northern Trust Quantitative Research)

Bottom-Up Multi-Factor Design

The multi-factor design can best be described with a car analogy: top-down portfolio construction is like engineering the best car design while bottom-up implementation can be likened to picking quality parts. Multi-factor strategies are the best “parts” for the multi-asset income portfolios.

The sections below detail how factors such as Quality, Value, and Low Volatility can greatly enhance the multi-asset income portfolio.

Enhance Yields with Fixed Income Factors

Corporate credit, especially corporate high yield, is an essential part of the income portfolio due to its attractive yields. As of December 31, 2020, Bloomberg Barclays High Yield Bond Index had a market yield of 4.2%, which was 3.2% higher than the U.S. Treasury 10-year yield, and higher than most dividend-paying stocks. However, such a high yield payout comes with significant credit risk, also known as default risk.

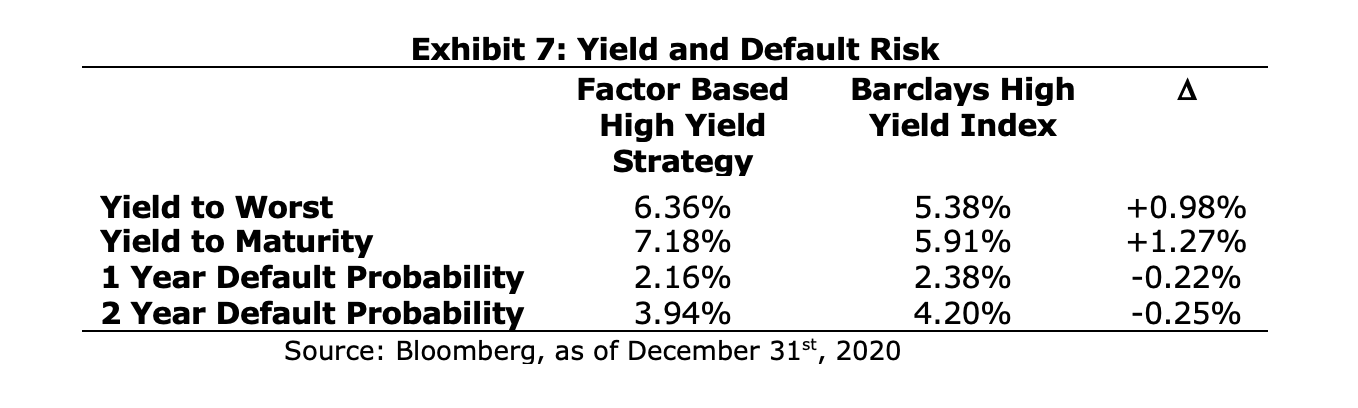

Many income strategies focus too much on “cheap” bonds, all but ignoring credit default risk. Credit defaults lead to principal losses and eat away most of the gains enjoyed by the investor from coupon payments. This risk can be mitigated by focusing on fixed-income factors. Fixed-income factors provide a way to select quality bonds that offer attractive yields on a default adjusted basis. Exhibit 7 provides an example of a factor-based high yield strategy that generates higher yield than the index while taking on less credit default risk.

Mitigating Income Shortfall with Low Volatility Factors

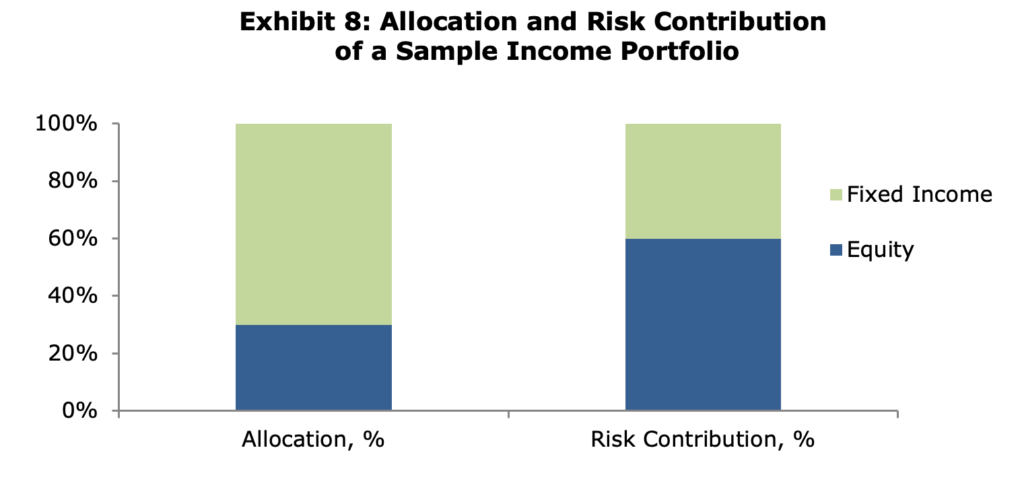

Income and growth are two sides of the same coin. Income cash flow is a function of portfolio yield and portfolio capital base. Without growth of the capital base, income cash flow will not be able to keep up with the rate of inflation. Equities play an important role in driving portfolio income growth. However, taking on higher risk is often the tradeoff required to achieve higher growth. For instance, in the sample income portfolio below, equities represent 30% of the total allocation, but more than 60% of the total risk.

(Source: Northern Trust Quantitative Research)

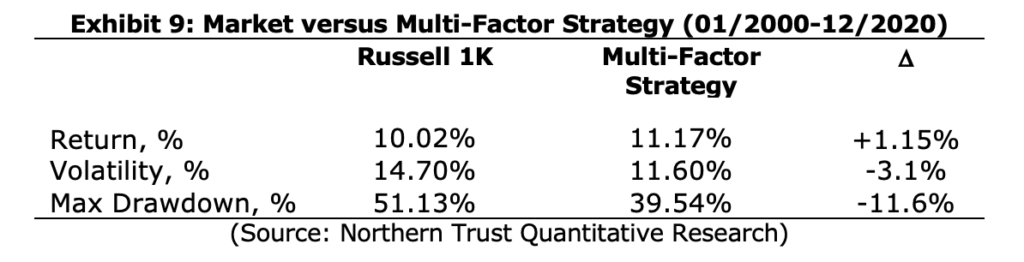

Large equity risk exposures may result in significant capital loss during market downturns, causing irreparable damage to the income portfolio and reducing its ability to meet its income objective. A defensive equity strategy, such as a multi-factor strategy with Quality and Low Volatility, can greatly mitigate equity downside risk without giving up upside potential (See Exhibit 9).

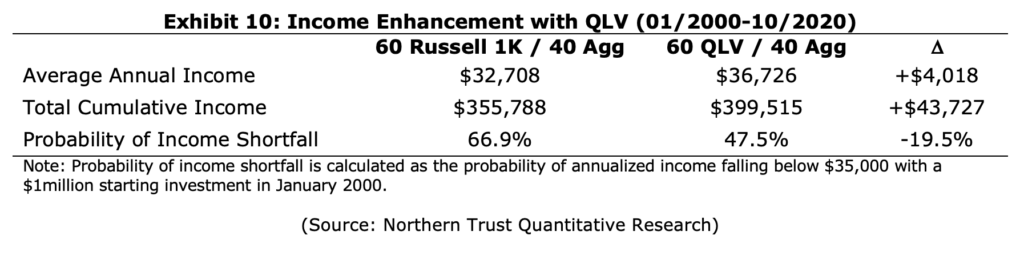

Low Volatility implementation can also lead to a higher income payout stream and reduce the probability of an income short fall. Our study shows that by replacing passive implementation with a Quality Low Volatility strategy in a 60/40 portfolio, the probability of an income shortfall may be reduced by approximately 20%.

Conclusion

A well-designed income portfolio incorporates:

- Portfolio optimization to maximize risk-adjusted yield

- Multi-asset implementation to minimize uncompensated risks, and

- Multi-factor design to enhance portfolio yield and minimize credit risk.

Specifically, as it relates to factors, fixed-income factors such as Quality and Value can increase yield without adding additional credit risk, and equity factors such as Quality and Low Volatility can mitigate a portfolio’s downside risk and reduce the probability of income shortfall. Robust income portfolio design helps investors achieve income without taking on excess risk to better weather this lower-for-longer yield environment.

IMPORTANT INFORMATION

The information contained herein is intended for use with current or prospective client of Northern Trust Investments, INC. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. Northern Trust and its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, and its accuracy and completeness are not guaranteed. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Opinions and forecasts discussed are those of the author, do not necessarily reflect the views of Northern Trust and are subject to change without notice.

This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

All investments are subject to risk, which should be considered prior to making and investment decisions. While certain companies may have consistently paid dividends in the past, there can be no assurance or guarantee that they will be able to continue paying dividends in the future. International investments involve additional risks you should be aware of, which include differences in financial accounting standards, currency fluctuations, political instability, foreign taxes and regulations, news that can trigger volatile conditions, and the potential for illiquid markets. Small cap companies in these markets may react with greater volatility in reaction to activities in those markets.

Past performance shown is back-tested and does not indicate future performance.

Belvedere Advisors LLC, is a California limited liability company that is a registered investment advisor and is a wholly owned subsidiary of Northern Trust Investments, Inc. Emotomy is a digital investment advice platform and is a registered trademark of Belvedere Advisors LLC.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc. Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K, NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Belvedere Advisors LLC and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

© 2021 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A.