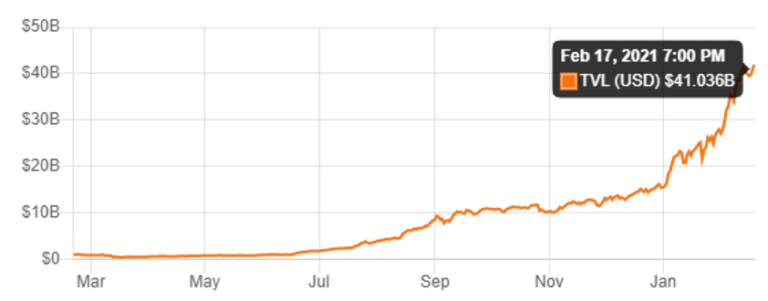

By Keith Black, PhD, CFA, CAIA, FDP, Managing Director, Content Strategy, CAIA Association With junk bonds yielding less than 4% and sovereign debt ranging in yields from negative to 2%, investors have been settling for meager yields in bank deposits and the bond market. The revolution in decentralized finance (DeFi) offers some tempting yields and a completely new way to invest. Having crossed just $1 billion in value in June 2020, the DeFi space exploded to over $41 billion by February 2021. Nearly $18 billion is invested in lending platforms such as Maker, Aave, and Compound, while over $12 billion is invested in decentralized exchanges (DEXes), such as Curve, Uniswap, and Sushi Swap. Total Value (USD) Locked in DeFi  Source: DeFiPulse.com It isn’t just cryptocurrencies driving borrowing, lending, and trading businesses that can earn yields. Recently, the Gemini exchange announced Gemini Earn, which pays yields of 3.05% for assets held in Bitcoin (BTC) and Ethereum (ETH). The Dai stablecoin currently yields 4.61%, while other digital assets on the Gemini Earn platform earn between 1.8% and 7.4%. Platforms such as Gemini Earn are democratizing access to yields on cryptocurrencies, making investing in and earning yields on digital assets as easy as accessing a brokerage account. [To learn more about stablecoins and algorithmic, fiat, and crypto pegging methods, read a recent post by guest contributor Andrew Keenan, CAIA, CFA, CBP, Assistant Vice President at Credit Suisse.] Coinmarketcap.com tracks the minute-by-minute value of over 8,500 cryptocurrencies. The cryptocurrency market has a total capitalization of over $1.5 trillion, with BTC dominance of over 60% or $960 billion. ETH is second, with a value of over $220 billion. The other 8,500+ projects have a combined value of approximately less than $400 billion. Of course, just last year, the entire market was valued at less than $600 billion. There are a number of reasons why borrowers may seek a loan collateralized by their digital asset holdings. First, many investors have large gains in their digital asset portfolio given the recent market rise from $600 billion to over $1.5 trillion. In most countries, gains on digital assets are taxable. Rather than selling their digital assets, some investors will take a loan against their value. This can defer taxes and allow investors to participate in further upside gains. Second, some investors may be borrowing against their crypto holdings to reinvest in other digital assets, thereby building leveraged positions. Of course, there are complications. Many digital assets have annual price volatility exceeding 100%, and leveraged trading multiplies the degree of both upside opportunity and downside risk. These stated yields are paid-in-kind, where you are earning yield in the form of extra units of the token or currency and not USD or EUR directly. There may also be some risk to software errors and custody, but large exchanges and top projects such as BTC and ETH have been well vetted by this point. DeFi is seeking to build a decentralized financial system that includes borrowing, lending, derivatives, and exchanges. The traditional world of banks and exchanges should be watching carefully to see the success of this newly digital world. With the previously stated yields, it is likely that the rate of asset growth continues as investors search for yield. As user interfaces improve and security protocols are proven, the DeFi industry could take substantial market share from the traditional financial world. Many of the digital assets, tokens, and cryptocurrencies function as publicly traded venture capital, providing assets and liquidity used to build these businesses. To the extent that these platforms grow into substantial businesses, projects that provide investors with equity, governance, and/or a share of fees can turn out to be lucrative investments. Is one of these DeFi platforms today the equivalent of Amazon, Google, or Priceline in 1999? There are numerous risks in the cryptocurrency space. Given the venture capital model, many of today’s cryptocurrencies will be as worthless as most dotcom stocks were in 2001 after the inevitable shakeout of undercapitalized and ill-fated projects. Technology risk looms large, not only for the potential for hacking, theft, and errors in smart contract code but also for innovations that may make newly launched coins superior to today’s offerings. Complexity risk may also be a factor, as today’s crypto-backed collateralized debt obligations may be eerily similar to the CDO-squareds and other structured products that posted significant losses during the GFC. Investors may also be concerned about regulatory risk, but there has recently been good news on this front. In July 2020, the Office of the Comptroller of the Currency (OCC), a key regulator of US banks, announced that national banks and federal savings institutions are allowed to provide custody for customer holdings of cryptocurrencies. In January 2021, the OCC noted that those same banks are now able to use stablecoins to store and transfer value through blockchains. These bullish developments from the OCC are at odds with the recent comments by the US Treasury Secretary Janet Yellen, who expressed concern about Bitcoin’s environmental impact as well as its inefficient use in real-world transactions. There are concerns that some nations, such as Nigeria and India, may move to restrict the use of digital assets by their citizens, or at least their ability to interface between fiat currency, local banks, and the world of digital assets. Another key risk factor is the rise of the Central Bank Digital Currency, where countries like China may wish to control the cryptocurrency market by experimenting with a digital yuan while constraining private market fintech solutions like those offered by Ant Group. In February 2021, the Federal Reserve Bank of St. Louis released this highly readable paper by Fabian Schär on Decentralized Finance. The following discussion benefits from the St. Louis Fed publication but also includes this author’s commentary: While Bitcoin is a store of value and can be used as a payment mechanism, the BTC blockchain can’t support any decentralized applications (dApps). The ability of the Ethereum blockchain to support smart contracts, however, is the basis for the decentralized finance movement. Borrowing and lending through banks or trading through traditional futures and options exchanges imposes centralization and personnel/middleman costs on financial market participants. When moving into the DeFi world, borrowing, lending, and trading can be automated through smart contracts, cutting out the traditional financial market intermediaries and enhancing efficiencies. This also brings democratization to the financial world, as smart contracts only see the financial credentials or assets shared by the borrower or lender. Real-world data like location or race is not considered in the smart contracts, which can bring financial services to a broader world without borders or racial discrimination. Schär discusses the DeFi stack, where up to five layers of applications are combined to build and distribute financial products. Nearly 86% of DeFi market cap is built using ETH as the first, or settlement, layer. The second asset layer uses fungible tokens built according to Ethereum’s ERC-20 standard. Protocols are built as a third layer, while applications and aggregators form the fourth and fifth layers, respectively. It is important to note that DeFi has to be built on trust, where transactions are secure and code reliable. Each layer of the software stack must be tested for trust and reliability before being deployed. Before investing in DeFi, participants are encouraged to review published audits verifying the reliability of the project. Much of the borrowing and lending in DeFi is collateralized, which builds trust in borrowers or lenders without divulging personal information. Dai is built on top of the ETH blockchain using on-chain collateral backing the value of the stablecoin at 1 USD through a minimum overcollateralization rate of 150%. USDT and USDC are stablecoins built off-chain, relying on a real-world counterparty to back the value at 1 USD. Off-chain assets may be subject to counterparty risk and should be transparent and auditable. While many investors first access cryptocurrency through centralized exchanges like Binance, Gemini, or Coinbase, a certain level of trust is required when assets are deposited and a single point of failure is created. The rise of DeFi has also been marked by the creation of decentralized exchanges (DEXes). On DEXes, investors can exchange one asset for another while keeping custody of their assets. That is, no counterparty risk is created as funds are not deposited. DEXes built on smart contracts include UniSwap, Curve, Bancor, and Balancer. Investors can stake their assets into liquidity pools on these smart contract exchanges to earn fees as liquidity providers. Lending protocols include platforms like Aave, Compound, and dYdX. These platforms facilitate loans collateralized by cryptocurrencies locked into smart contracts. Interest rates on these loans vary by the amount of crypto offered for loans and demand for borrowing. Schär notes that almost 75% of these loans are backed by the Dai stablecoin. Decentralized derivatives exchanges are also available. While Hegic provides trading of call and put options on the largest digital assets, Synthetix seeks to trade derivatives not only on digital assets but on real-world assets such as oil or equity markets. Binance is also entering the DeFi world through their Smart Chain project. Binance is using their position as the largest centralized exchange to build a new ecosystem that may initially have lower costs and less congestion than DeFi transactions on the Ethereum network. The ability for Binance exchange clients to participate in DeFi without leaving the familiar exchange interface may allow Binance a quick path to grow DeFi assets. Innumerable other applications exist, such as event prediction markets, collateralized debt obligations, as well as investments in centralized and decentralized exchanges. Schär lists the benefits to DeFi of transparency, efficiency, accessibility, and composability, or the ability of DeFi projects to fit together like Lego pieces. There are real risks to the crypto space as well, including the risk of software malfunctions, failure of a central counterparty, illicit activity, scalability, and reliance on external data. As the value locked rises, user interfaces improve, and the risks are addressed, the world of digital assets, and DeFi in particular, may continue to take share and value away from the traditional finance sector. We can make an analogy of DeFi in 2020 to dotcom stocks in 1997. While most of the projects ended up without economic significance, the surviving companies like Google, Amazon, and Priceline changed the way the world does business. Today, those three companies have a combined equity market capitalization of $3.2 trillion, while today the value of the entire digital asset market is $1.5 trillion.

Source: DeFiPulse.com It isn’t just cryptocurrencies driving borrowing, lending, and trading businesses that can earn yields. Recently, the Gemini exchange announced Gemini Earn, which pays yields of 3.05% for assets held in Bitcoin (BTC) and Ethereum (ETH). The Dai stablecoin currently yields 4.61%, while other digital assets on the Gemini Earn platform earn between 1.8% and 7.4%. Platforms such as Gemini Earn are democratizing access to yields on cryptocurrencies, making investing in and earning yields on digital assets as easy as accessing a brokerage account. [To learn more about stablecoins and algorithmic, fiat, and crypto pegging methods, read a recent post by guest contributor Andrew Keenan, CAIA, CFA, CBP, Assistant Vice President at Credit Suisse.] Coinmarketcap.com tracks the minute-by-minute value of over 8,500 cryptocurrencies. The cryptocurrency market has a total capitalization of over $1.5 trillion, with BTC dominance of over 60% or $960 billion. ETH is second, with a value of over $220 billion. The other 8,500+ projects have a combined value of approximately less than $400 billion. Of course, just last year, the entire market was valued at less than $600 billion. There are a number of reasons why borrowers may seek a loan collateralized by their digital asset holdings. First, many investors have large gains in their digital asset portfolio given the recent market rise from $600 billion to over $1.5 trillion. In most countries, gains on digital assets are taxable. Rather than selling their digital assets, some investors will take a loan against their value. This can defer taxes and allow investors to participate in further upside gains. Second, some investors may be borrowing against their crypto holdings to reinvest in other digital assets, thereby building leveraged positions. Of course, there are complications. Many digital assets have annual price volatility exceeding 100%, and leveraged trading multiplies the degree of both upside opportunity and downside risk. These stated yields are paid-in-kind, where you are earning yield in the form of extra units of the token or currency and not USD or EUR directly. There may also be some risk to software errors and custody, but large exchanges and top projects such as BTC and ETH have been well vetted by this point. DeFi is seeking to build a decentralized financial system that includes borrowing, lending, derivatives, and exchanges. The traditional world of banks and exchanges should be watching carefully to see the success of this newly digital world. With the previously stated yields, it is likely that the rate of asset growth continues as investors search for yield. As user interfaces improve and security protocols are proven, the DeFi industry could take substantial market share from the traditional financial world. Many of the digital assets, tokens, and cryptocurrencies function as publicly traded venture capital, providing assets and liquidity used to build these businesses. To the extent that these platforms grow into substantial businesses, projects that provide investors with equity, governance, and/or a share of fees can turn out to be lucrative investments. Is one of these DeFi platforms today the equivalent of Amazon, Google, or Priceline in 1999? There are numerous risks in the cryptocurrency space. Given the venture capital model, many of today’s cryptocurrencies will be as worthless as most dotcom stocks were in 2001 after the inevitable shakeout of undercapitalized and ill-fated projects. Technology risk looms large, not only for the potential for hacking, theft, and errors in smart contract code but also for innovations that may make newly launched coins superior to today’s offerings. Complexity risk may also be a factor, as today’s crypto-backed collateralized debt obligations may be eerily similar to the CDO-squareds and other structured products that posted significant losses during the GFC. Investors may also be concerned about regulatory risk, but there has recently been good news on this front. In July 2020, the Office of the Comptroller of the Currency (OCC), a key regulator of US banks, announced that national banks and federal savings institutions are allowed to provide custody for customer holdings of cryptocurrencies. In January 2021, the OCC noted that those same banks are now able to use stablecoins to store and transfer value through blockchains. These bullish developments from the OCC are at odds with the recent comments by the US Treasury Secretary Janet Yellen, who expressed concern about Bitcoin’s environmental impact as well as its inefficient use in real-world transactions. There are concerns that some nations, such as Nigeria and India, may move to restrict the use of digital assets by their citizens, or at least their ability to interface between fiat currency, local banks, and the world of digital assets. Another key risk factor is the rise of the Central Bank Digital Currency, where countries like China may wish to control the cryptocurrency market by experimenting with a digital yuan while constraining private market fintech solutions like those offered by Ant Group. In February 2021, the Federal Reserve Bank of St. Louis released this highly readable paper by Fabian Schär on Decentralized Finance. The following discussion benefits from the St. Louis Fed publication but also includes this author’s commentary: While Bitcoin is a store of value and can be used as a payment mechanism, the BTC blockchain can’t support any decentralized applications (dApps). The ability of the Ethereum blockchain to support smart contracts, however, is the basis for the decentralized finance movement. Borrowing and lending through banks or trading through traditional futures and options exchanges imposes centralization and personnel/middleman costs on financial market participants. When moving into the DeFi world, borrowing, lending, and trading can be automated through smart contracts, cutting out the traditional financial market intermediaries and enhancing efficiencies. This also brings democratization to the financial world, as smart contracts only see the financial credentials or assets shared by the borrower or lender. Real-world data like location or race is not considered in the smart contracts, which can bring financial services to a broader world without borders or racial discrimination. Schär discusses the DeFi stack, where up to five layers of applications are combined to build and distribute financial products. Nearly 86% of DeFi market cap is built using ETH as the first, or settlement, layer. The second asset layer uses fungible tokens built according to Ethereum’s ERC-20 standard. Protocols are built as a third layer, while applications and aggregators form the fourth and fifth layers, respectively. It is important to note that DeFi has to be built on trust, where transactions are secure and code reliable. Each layer of the software stack must be tested for trust and reliability before being deployed. Before investing in DeFi, participants are encouraged to review published audits verifying the reliability of the project. Much of the borrowing and lending in DeFi is collateralized, which builds trust in borrowers or lenders without divulging personal information. Dai is built on top of the ETH blockchain using on-chain collateral backing the value of the stablecoin at 1 USD through a minimum overcollateralization rate of 150%. USDT and USDC are stablecoins built off-chain, relying on a real-world counterparty to back the value at 1 USD. Off-chain assets may be subject to counterparty risk and should be transparent and auditable. While many investors first access cryptocurrency through centralized exchanges like Binance, Gemini, or Coinbase, a certain level of trust is required when assets are deposited and a single point of failure is created. The rise of DeFi has also been marked by the creation of decentralized exchanges (DEXes). On DEXes, investors can exchange one asset for another while keeping custody of their assets. That is, no counterparty risk is created as funds are not deposited. DEXes built on smart contracts include UniSwap, Curve, Bancor, and Balancer. Investors can stake their assets into liquidity pools on these smart contract exchanges to earn fees as liquidity providers. Lending protocols include platforms like Aave, Compound, and dYdX. These platforms facilitate loans collateralized by cryptocurrencies locked into smart contracts. Interest rates on these loans vary by the amount of crypto offered for loans and demand for borrowing. Schär notes that almost 75% of these loans are backed by the Dai stablecoin. Decentralized derivatives exchanges are also available. While Hegic provides trading of call and put options on the largest digital assets, Synthetix seeks to trade derivatives not only on digital assets but on real-world assets such as oil or equity markets. Binance is also entering the DeFi world through their Smart Chain project. Binance is using their position as the largest centralized exchange to build a new ecosystem that may initially have lower costs and less congestion than DeFi transactions on the Ethereum network. The ability for Binance exchange clients to participate in DeFi without leaving the familiar exchange interface may allow Binance a quick path to grow DeFi assets. Innumerable other applications exist, such as event prediction markets, collateralized debt obligations, as well as investments in centralized and decentralized exchanges. Schär lists the benefits to DeFi of transparency, efficiency, accessibility, and composability, or the ability of DeFi projects to fit together like Lego pieces. There are real risks to the crypto space as well, including the risk of software malfunctions, failure of a central counterparty, illicit activity, scalability, and reliance on external data. As the value locked rises, user interfaces improve, and the risks are addressed, the world of digital assets, and DeFi in particular, may continue to take share and value away from the traditional finance sector. We can make an analogy of DeFi in 2020 to dotcom stocks in 1997. While most of the projects ended up without economic significance, the surviving companies like Google, Amazon, and Priceline changed the way the world does business. Today, those three companies have a combined equity market capitalization of $3.2 trillion, while today the value of the entire digital asset market is $1.5 trillion.