By Jana Bour, LL.M., EU Policy Manager at the European Public Real Estate Association (EPRA) With the 'European Green Deal’ (EGD), as with every growth-oriented policy strategy, come challenges but also opportunities. The European Commission aims to transform our continent to achieve net-zero emissions of greenhouse gases in 2050. While it may sound fairly easy to imagine, in reality, it will require deep social and economic transformation. Buildings are responsible for around 40% of energy consumption in Europe. There is a significant annual investment gap estimated at around €177 billion, totalling €1.77 trillion between 2021 and 2030, out of which the biggest gap relates to investment in energy efficiency in buildings (74%)[1]. In this context, the Commission’s commitment to promote a shift towards more sustainable investments may lead to a transformation of the real estate sector we see today, including listed real estate. The below presents a brief summary of the few challenges as well as opportunities for listed property companies and Real Estate Investment Trusts (REITs), as presented during the recent CAIA/EPRA (European Public Real Estate Association) webinar on the European Green Deal. SETTING THE SCENE: A STRONG HIGH-LEVEL POLITICAL AMBITION Building on the detailed introduction of the European Green Deal, and more specifically the Renovation Wave strategy, by Christos Angelis, CAIA, Director at Masterdam (here)[2], two additional elements should be pointed out, which are increasing the already existing momentum placed on greening real estate investments.

- Recovery Plan for Europe: the package put forward by the European Union to help with post-pandemic recovery that has been tied to the climate objectives.

- EU Sustainable Finance: an initiative that was further reinforced by the EGD aiming to redirect the financial flows into more sustainable economic activities, including in real estate.

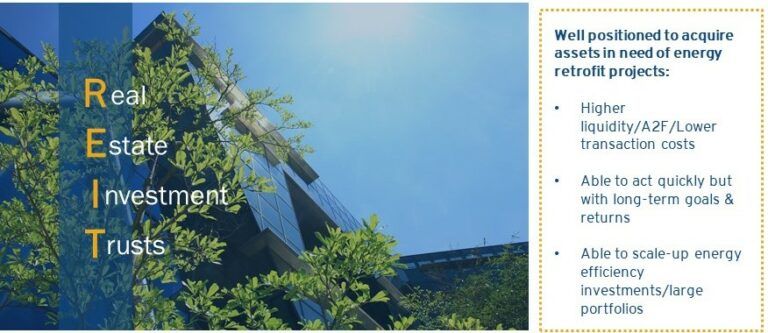

Cumulatively, the European Green Deal, the Renovation Wave, EU Sustainable Finance, and the post-pandemic recovery plan are creating a very strong political movement. We can therefore expect the year 2021 to be particularly fruitful regarding ESG-related regulations, laws, and policies in Europe. For the listed real estate sector, the focus will be on the EU taxonomy of sustainable investments and the review of non-financial (ESG) reporting by listed companies, which would of course include the listed property sector. REITs AND LISTED PROPERTY COMPANIES ARE THE ASSET OWNERS TO WATCH Christos Angelis in his blog (here)[3] points rightly to REITs as an interesting group of real estate investors in the context of EGD. REITs are indeed "well positioned to acquire assets in need of energy retrofit projects and maintain them for the long-term"[4]. Even more so in Europe—the continent where EPRA members predominantly invest and where 85% of building stock was built before 2001 and will remain in 2050[5]—the topic of renovation, energy efficiency, and sustainability will certainly be high on the agenda of the real estate industry. It is therefore our role to continue to explain, particularly to EU policymakers, that REITs are in the business of investing in the value of assets they own and maintaining that value for the long-term. The sector itself has been focused on the retrofit, and we see REITs whose entire business models are based on acquiring existing assets in need of retrofit.

Cumulatively, the European Green Deal, the Renovation Wave, EU Sustainable Finance, and the post-pandemic recovery plan are creating a very strong political movement. We can therefore expect the year 2021 to be particularly fruitful regarding ESG-related regulations, laws, and policies in Europe. For the listed real estate sector, the focus will be on the EU taxonomy of sustainable investments and the review of non-financial (ESG) reporting by listed companies, which would of course include the listed property sector. REITs AND LISTED PROPERTY COMPANIES ARE THE ASSET OWNERS TO WATCH Christos Angelis in his blog (here)[3] points rightly to REITs as an interesting group of real estate investors in the context of EGD. REITs are indeed "well positioned to acquire assets in need of energy retrofit projects and maintain them for the long-term"[4]. Even more so in Europe—the continent where EPRA members predominantly invest and where 85% of building stock was built before 2001 and will remain in 2050[5]—the topic of renovation, energy efficiency, and sustainability will certainly be high on the agenda of the real estate industry. It is therefore our role to continue to explain, particularly to EU policymakers, that REITs are in the business of investing in the value of assets they own and maintaining that value for the long-term. The sector itself has been focused on the retrofit, and we see REITs whose entire business models are based on acquiring existing assets in need of retrofit.  REITs’ access to public markets enables them to gain capital rather quickly to finance retrofits, which are heavy on upfront capital costs. They are equally able to sufficiently scale up their investments, including in energy efficiency. They would therefore be the most logical partner for discussions with policymakers on how to solve current barriers to the continent’s retrofitting efforts. WHEN REITS ARE OVERLOOKED BY POLICYMAKERS Yet, REITs’ ability to help with European retrofitting ambitions continues to be overlooked by European policymakers. As the sector grows, and with it the number of national REIT regimes in Europe, we continue to point out the obstacles hindering REITs’ ability to invest within the European market. Currently, only 14 European countries have a REIT regime[6]. And although those 14 countries represent 84% of the European GDP[7], there are still major disparities; these are 14 unique REIT regimes with no framework in place to facilitate their mutual recognition.

REITs’ access to public markets enables them to gain capital rather quickly to finance retrofits, which are heavy on upfront capital costs. They are equally able to sufficiently scale up their investments, including in energy efficiency. They would therefore be the most logical partner for discussions with policymakers on how to solve current barriers to the continent’s retrofitting efforts. WHEN REITS ARE OVERLOOKED BY POLICYMAKERS Yet, REITs’ ability to help with European retrofitting ambitions continues to be overlooked by European policymakers. As the sector grows, and with it the number of national REIT regimes in Europe, we continue to point out the obstacles hindering REITs’ ability to invest within the European market. Currently, only 14 European countries have a REIT regime[6]. And although those 14 countries represent 84% of the European GDP[7], there are still major disparities; these are 14 unique REIT regimes with no framework in place to facilitate their mutual recognition.  However, a successful REIT regime could be an excellent enabling framework to drive investments in the retrofit of existing buildings. If only a REIT’s status in, for example, Belgium or France would be recognised in other Member States, it would significantly facilitate their ability to further scale up investments within the European internal market[8]. If there were a European directive enabling a mutual recognition of REITs, subject to the right set of conditions, it would certainly help drive the investments toward more sustainable real estate. WHAT IS THE BIGGEST CHALLENGE FOR REITS? Ultimately, the biggest challenge for REITs, and any other real estate investor, is to invest in energy efficiency retrofit in a:

However, a successful REIT regime could be an excellent enabling framework to drive investments in the retrofit of existing buildings. If only a REIT’s status in, for example, Belgium or France would be recognised in other Member States, it would significantly facilitate their ability to further scale up investments within the European internal market[8]. If there were a European directive enabling a mutual recognition of REITs, subject to the right set of conditions, it would certainly help drive the investments toward more sustainable real estate. WHAT IS THE BIGGEST CHALLENGE FOR REITS? Ultimately, the biggest challenge for REITs, and any other real estate investor, is to invest in energy efficiency retrofit in a:

- Profitable way: it is still an investment, and there may be specific constraints with the rental gaps following the energy efficiency investments, particularly in the jurisdictions with rent control regulations.

- Impactful way: while ensuring that the actual performance of the building has indeed improved as a consequence of the investment.

- Affordable way: ensuring that after the investment, real estate remains affordable for tenants who pay rent.

These are the three factors that cumulatively impact the decision of real estate investors in whether they invest in renovation or whether they develop or acquire a new building. Supporting a new emerging business model, such as social housing in listed real estate[9], could also bring much-needed collaboration between governments, property companies, investors, and tenants while addressing the top priorities of the Renovation Wave, such as energy poverty and retrofitting the worst-performing buildings in the residential sector[10]. A lifecycle assessment of the buildings and acceleration of circular economy could also help improve the way we look at the value of the existing buildings. Helping the market see the value in existing assets prior to and after renovations is probably one of the most important ways policymakers could assist the industry. POTENTIAL OF THE EU TAXONOMY TO DRIVE THIS TRANSFORMATION The EU Taxonomy[11] that the European Regulation adopted last year does not obligate companies to change their business model or to conduct their business in a more sustainable way. Instead, it sets a common framework based on which the sector can determine (and then also communicate or report on) what underlying economic activities can be considered sustainable. Its ultimate ambition is to drive private capital towards more sustainable activities. Here is how:

- The listed property companies, including REITs, will determine if their activities are ‘eligible’ (or in other words covered by the EU Taxonomy) and thus can be considered environmentally sustainable.

- They will then ‘report’ on how and to what extent their activities are eligible. They will do so by informing on the proportion of their turnover, capex, and opex (where applicable) in their non-financial statements.

- This information will serve investors who will assess REITs or other property companies and their sustainable investments based on the reported turnover, capex, or opex. They would then adjust their own investment portfolios accordingly.

This is a significant opportunity for the listed real estate sector to attract new investors who are looking to invest in a more sustainable way. The potential the EU Taxonomy has in supporting REITs towards investing in renovations is real[12]. However, it can only be materialised provided that:

- REITs can tap into the renovation category as an economic activity, and their refurbishment capex and subsequent rental income is considered eligible.

- REITs are incentivised to acquire to renovate, so that the acquisition capex of existing buildings is added on.

Recently, the Commission requested that an expert group from the Platform on Sustainable Finance further advise on how to ensure that the EU Taxonomy can motivate transitional activities. In other words, the Commission is looking to drive investments not only in real estate that is already green, but more importantly in real estate that is to become green, in order to finance this ‘transition from brown to green.’ It is indeed great news for the EGD and its Renovation Wave; however, it remains to be seen to what extent the Commission will incentivise investment in renovations. About EPRA (if possible to add) EPRA, the European Public Real Estate Association, is the voice of the publicly traded European real estate sector. With more than 275 members, covering the whole spectrum of the listed real estate industry (companies, investors and their suppliers), EPRA represents over EUR 670 billion of real estate assets managed by European companies and 94% of the market capitalisation of the FTSE EPRA Nareit Europe Index. EPRA’s mission is to promote, develop, and represent the European public real estate sector. They achieve this through the provision of better information to investors and stakeholders, active involvement in the public and political debate, promotion of best practices, and the cohesion and strengthening of the industry. Find out more about EPRA’s activities on www.epra.com. [1] https://eur-lex.europa.eu/legal-content/EN/TXT/?qid=1596443911913&uri=CELEX:52019DC0640#document2 [2] https://www.allaboutalpha.com/blog/2020/08/20/eupopean-green-deal-towards-a-zero-carbon-urban-environment/ [3] https://www.allaboutalpha.com/blog/2020/10/08/european-green-deal-towards-a-zero-carbon-urban-environment/ [4] Ibid [5] As indicated in the EU Renovation Wave strategy published in October 2020. See the strategy here [6] EPRA Manifesto 2019, at page 4 [7] EPRA Total Markets Table - Q4-2020 [8] Read also here [9] EPRA Residential Sector report, November 2020 [10] See the strategy here [11] EU Taxonomy Regulation [12] EPRA letter to the European Commissioners on the EU Taxonomy - December 2020