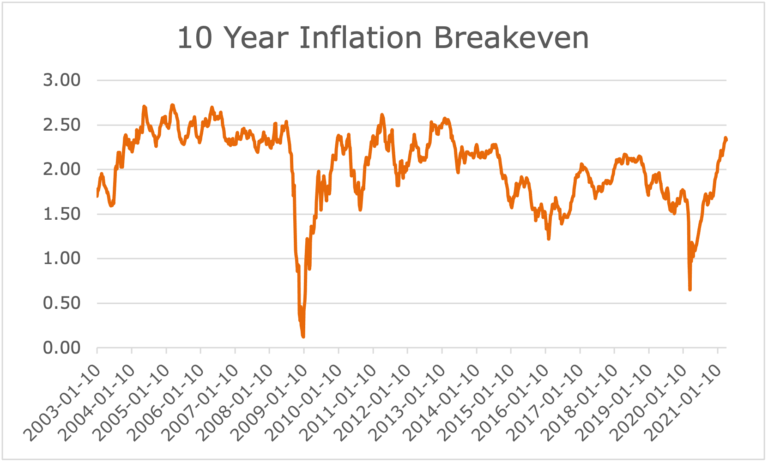

By Keith Black, PhD, CFA, CAIA, FDP, Managing Director, Content Strategy, CAIA Association Last July, we discussed Socially Distanced Inflation with the idea that COVID would have a negative effect on employment and output, which would lead to increased business failures. A record amount of monetary and fiscal stimulus combined with constrained output driven by social distancing measures in food processing and service businesses could lead to a substantial increase in inflation. That is, too much money chasing too few goods. The breakeven inflation rate, the difference between the yield on nominal 10-year Treasury notes and 10-year Treasury Inflation Protection Securities (TIPS), was 1.5% last July. At that time, this blog recommended that the breakeven inflation rate was understated and that inflation would accelerate in the coming year. Since then, fiscal stimulus increased by an additional $1.9 trillion, inflation accelerated to 2.6%, and breakeven inflation rates are now at 2.33%. While real TIPS yields moved from -0.8% to -0.7% since last July, the 10-year Treasury has increased in yield from 0.7% to 1.6%. The 2.33% breakeven on April 9, 2021 was the highest observation since the September 2012 to May 2013 period when breakeven yields ranged from 2.3% to 2.5%. Today’s inflation expectation, then, is in the 75th percentile of weekly observations since 2013.  Source: Federal Reserve Bank of St Louis What are investors to do during times of rising inflation? The data points to increasing allocation to commodities and real assets. Remember that CPI inflation is calculated based on the cost of items in a basket of goods and services purchased by consumers. Recently, that basket was comprised of over 41% in housing costs, 31% in food and transportation, 13% in medical and education costs, and about 15% in other goods and services. If over 70% of the inflation basket is based on real assets, it makes sense that an inflation hedge would rely primarily on real asset investments. Looking back over the last 30 years, we can sort equity, fixed income, and real asset returns based on the trailing four-quarter change in CPI inflation. As you can see in the tables below, the lowest returns to stocks and bonds were experienced during the 25% of quarterly periods with the greatest increase in inflation, while the highest returns to real assets came during the times when stock and bond returns are at their weakest. Not only do real asset returns diversify a stock and bond portfolio, but they also hedge against increases in inflation.

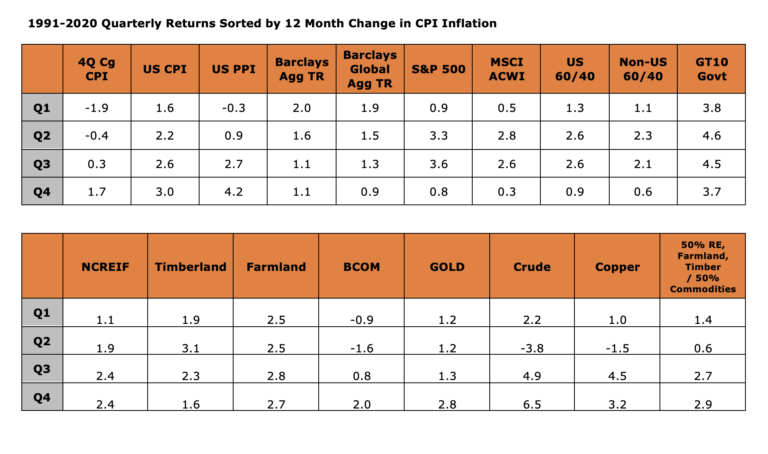

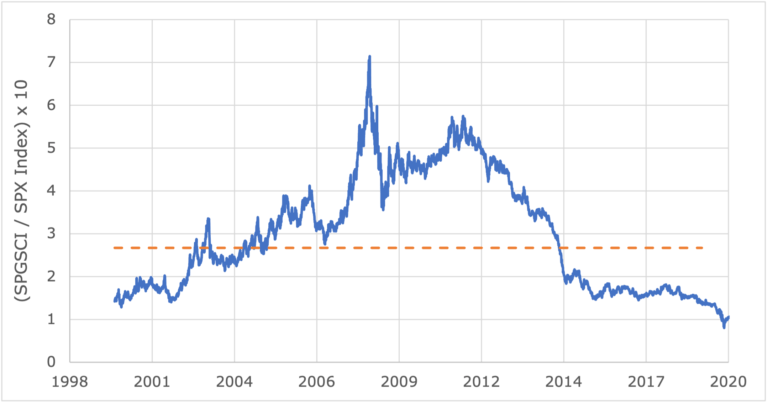

Source: Federal Reserve Bank of St Louis What are investors to do during times of rising inflation? The data points to increasing allocation to commodities and real assets. Remember that CPI inflation is calculated based on the cost of items in a basket of goods and services purchased by consumers. Recently, that basket was comprised of over 41% in housing costs, 31% in food and transportation, 13% in medical and education costs, and about 15% in other goods and services. If over 70% of the inflation basket is based on real assets, it makes sense that an inflation hedge would rely primarily on real asset investments. Looking back over the last 30 years, we can sort equity, fixed income, and real asset returns based on the trailing four-quarter change in CPI inflation. As you can see in the tables below, the lowest returns to stocks and bonds were experienced during the 25% of quarterly periods with the greatest increase in inflation, while the highest returns to real assets came during the times when stock and bond returns are at their weakest. Not only do real asset returns diversify a stock and bond portfolio, but they also hedge against increases in inflation.  Anecdotal evidence shows that most investors are underweighted in commodities, given their weak performance since 2008. Since the beginning of 2008, the Bloomberg Commodity Index has underperformed the S&P 500 by almost 14% per year! When analyzing the ratio of the GSCI Index to the S&P 500 index, we see substantial outperformance of commodities from 1998 to July of 2008. Commodities were exceptionally volatile in 2008 when compared to one-tenth of the value of the S&P 500, with a ratio of 4.3x S&P 500 in January 2008, rising to over 7x in July 2008, and falling back to 3.9x by the end of 2008. The ratio continued to fall with the GSCI Index trading below the S&P 500 from March to May of 2020 before rallying to 1.16 today. With commodities having trailed stocks since July 2008 and the tendency of commodities to outperform during times of rising inflation, investors can reduce inflation risk by rebalancing out of stocks and back into commodities. Most investors who are concerned about inflation target strategic portfolio allocations to the real assets space between 5% and 20%, with typical weights on commodities of less than 10%. Ratio of GSCI to S&P 500 Index, 1998-February 2021

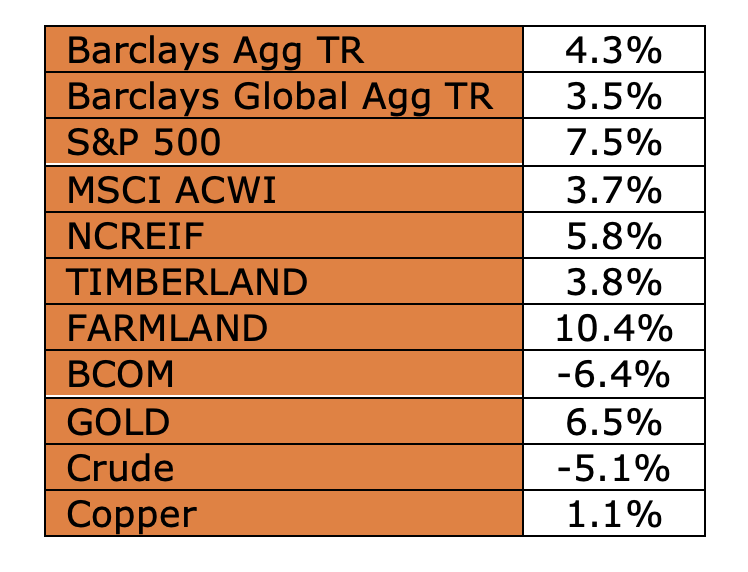

Anecdotal evidence shows that most investors are underweighted in commodities, given their weak performance since 2008. Since the beginning of 2008, the Bloomberg Commodity Index has underperformed the S&P 500 by almost 14% per year! When analyzing the ratio of the GSCI Index to the S&P 500 index, we see substantial outperformance of commodities from 1998 to July of 2008. Commodities were exceptionally volatile in 2008 when compared to one-tenth of the value of the S&P 500, with a ratio of 4.3x S&P 500 in January 2008, rising to over 7x in July 2008, and falling back to 3.9x by the end of 2008. The ratio continued to fall with the GSCI Index trading below the S&P 500 from March to May of 2020 before rallying to 1.16 today. With commodities having trailed stocks since July 2008 and the tendency of commodities to outperform during times of rising inflation, investors can reduce inflation risk by rebalancing out of stocks and back into commodities. Most investors who are concerned about inflation target strategic portfolio allocations to the real assets space between 5% and 20%, with typical weights on commodities of less than 10%. Ratio of GSCI to S&P 500 Index, 1998-February 2021  Total Return, 2008 to 2020: Commodities have trailed stock and bond returns since 2008

Total Return, 2008 to 2020: Commodities have trailed stock and bond returns since 2008  Source: CAIA Association In a current market example, let’s consider the lumber market, which has been highly impacted by COVID. Wood you believe that lumber futures prices have increased nearly 85% since the beginning of 2021 and over 200% since the beginning of February 2020? Increasing lumber prices are contributing to the strength of the housing market by adding over $16,000 to the cost of a new single-family home. While we see weakness in office and retail real estate as COVID-fueled shutdowns keep workers at home, the work-from-home trend has contributed to demand for home renovations and demand for larger homes better designed for a work-and-school-from-home environment. On the supply side, sawmills shut for some time during the pandemic, and when they returned to production, fewer workers were allowed due to social distancing measures. The larger the demand relative to supply, the higher prices move. If the demand continues at the higher prices, industries with constrained supply will grow their backlog of orders, leading to persistent price inflation over longer periods of time. Remember that the ability and willingness of consumers to spend on items such as meals at home and home renovations has significantly changed since the start of the pandemic due to both the record levels of monetary and fiscal policy stimulus as well as their reduced spending on areas such as entertainment and travel where availability of product is also constrained. Finally, we can consider interest rates. While the Fed has voiced that policy will continue to be accommodative as long as inflation remains below 2%, an acceleration of inflation is likely to trigger a tightening in monetary policy, which some market observers consider to be long past due. If stocks and bonds are valued using a discounted cash flow model of future cash flows, rising interest rates are likely to contribute to a sustained underperformance of stocks and bonds. Too much money chasing too few goods creates inflation. Higher inflation eventually leads to weaker real returns from stocks and bonds. The longer stimulus and COVID continue to increase consumer demand for expenditures on food and home improvement, the longer inflation will be with us. Remember inflation? Federal Reserve President Jerome Powell said in February that it will take until 2023 to reach an inflation rate of 2%. I’ll take the under.

Source: CAIA Association In a current market example, let’s consider the lumber market, which has been highly impacted by COVID. Wood you believe that lumber futures prices have increased nearly 85% since the beginning of 2021 and over 200% since the beginning of February 2020? Increasing lumber prices are contributing to the strength of the housing market by adding over $16,000 to the cost of a new single-family home. While we see weakness in office and retail real estate as COVID-fueled shutdowns keep workers at home, the work-from-home trend has contributed to demand for home renovations and demand for larger homes better designed for a work-and-school-from-home environment. On the supply side, sawmills shut for some time during the pandemic, and when they returned to production, fewer workers were allowed due to social distancing measures. The larger the demand relative to supply, the higher prices move. If the demand continues at the higher prices, industries with constrained supply will grow their backlog of orders, leading to persistent price inflation over longer periods of time. Remember that the ability and willingness of consumers to spend on items such as meals at home and home renovations has significantly changed since the start of the pandemic due to both the record levels of monetary and fiscal policy stimulus as well as their reduced spending on areas such as entertainment and travel where availability of product is also constrained. Finally, we can consider interest rates. While the Fed has voiced that policy will continue to be accommodative as long as inflation remains below 2%, an acceleration of inflation is likely to trigger a tightening in monetary policy, which some market observers consider to be long past due. If stocks and bonds are valued using a discounted cash flow model of future cash flows, rising interest rates are likely to contribute to a sustained underperformance of stocks and bonds. Too much money chasing too few goods creates inflation. Higher inflation eventually leads to weaker real returns from stocks and bonds. The longer stimulus and COVID continue to increase consumer demand for expenditures on food and home improvement, the longer inflation will be with us. Remember inflation? Federal Reserve President Jerome Powell said in February that it will take until 2023 to reach an inflation rate of 2%. I’ll take the under.